Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

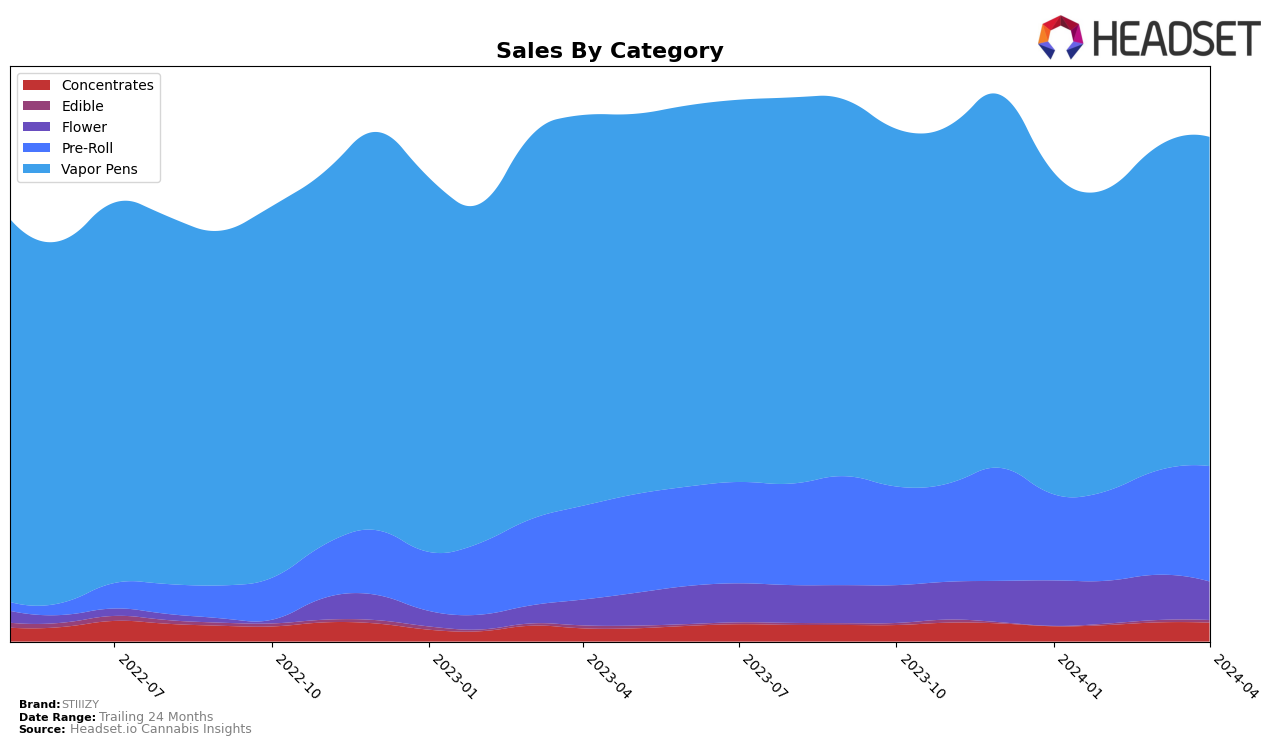

In the competitive cannabis market, STIIIZY's performance across various states and categories showcases both strengths and strategic areas for improvement. In California, STIIIZY maintains a dominant position in the Vapor Pens category, consistently holding the number 1 rank from January to April 2024, with sales peaking at over 20 million in January and maintaining strong performance throughout the following months. This indicates a solid foothold and a loyal customer base in the state's vapor pens market. However, in the Flower category within the same state, there's a noticeable decline from a rank of 3 in January to 11 in March and April, accompanied by a decrease in sales, suggesting a potential area for reevaluation and growth. Meanwhile, in Nevada, STIIIZY leads the Flower category, consistently ranking 1st and showing a significant sales increase in March, demonstrating the brand's strong appeal and market demand in this segment.

Looking at other states, STIIIZY's performance in the Pre-Roll category in Arizona and Michigan reveals interesting trends. In Arizona, despite missing data for February 2024, STIIIZY held the 2nd rank in January, March, and April, with sales growing each month, indicating increasing consumer interest and market penetration. Michigan shows a consistent presence in the top ranks for Pre-Rolls, though it experienced a slight drop to 6th place in April, suggesting a competitive challenge in maintaining its market position. The Vapor Pens category in Michigan also sees STIIIZY maintaining positions within the top 10, yet the slight fluctuations in rankings from 8th to 9th and back to 8th could signal the need for strategic adjustments to climb higher in this category. Overall, STIIIZY's performance across different states and categories highlights its strong market presence and areas where targeted efforts could drive further growth.

Competitive Landscape

In the competitive landscape of the vapor pens category in California, STIIIZY has maintained its leading position consistently from January to April 2024, outperforming its closest competitors in terms of sales and rank. Plug Play, holding the second rank throughout the same period, showed a notable increase in sales, yet it was still significantly lower than STIIIZY's, indicating STIIIZY's strong market hold. Similarly, Raw Garden remained in the third position, with its sales also increasing but not enough to challenge the top two brands. The data suggests that while STIIIZY's competitors are growing, STIIIZY continues to lead by a wide margin, highlighting its dominant position in the California vapor pens market. This trend underscores the importance for competing brands to innovate and strategize effectively if they wish to close the gap with STIIIZY.

Notable Products

In April 2024, STIIIZY's top-selling product was the 40's - Blue Dream Infused Pre-Roll 5-Pack (2.5g) within the Pre-Roll category, maintaining its number one position from March with sales figures reaching 32,696 units. Following closely was the Blue Dream Distillate STIIIZY Pod (1g) in the Vapor Pens category, which slipped from the top spot in March to second place in April, showcasing a sales increase to 29,382 units. The 40's - Strawberry Cough Infused Pre-Roll 5-Pack (2.5g) rose to the third rank in April, marking a significant comeback into the top rankings after being absent in March's data. The Blue Burst BDT Distillate STIIIZY Pod (1g) also made a noticeable entry at fourth place within the same category, despite not being ranked in the previous month. Lastly, the 40's - King Louis XIII Mini Infused Blunt 5-Pack (2.5g) debuted in the rankings at fifth place, indicating a diversifying interest among STIIIZY's product offerings.

Top Selling Cannabis Brands