Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

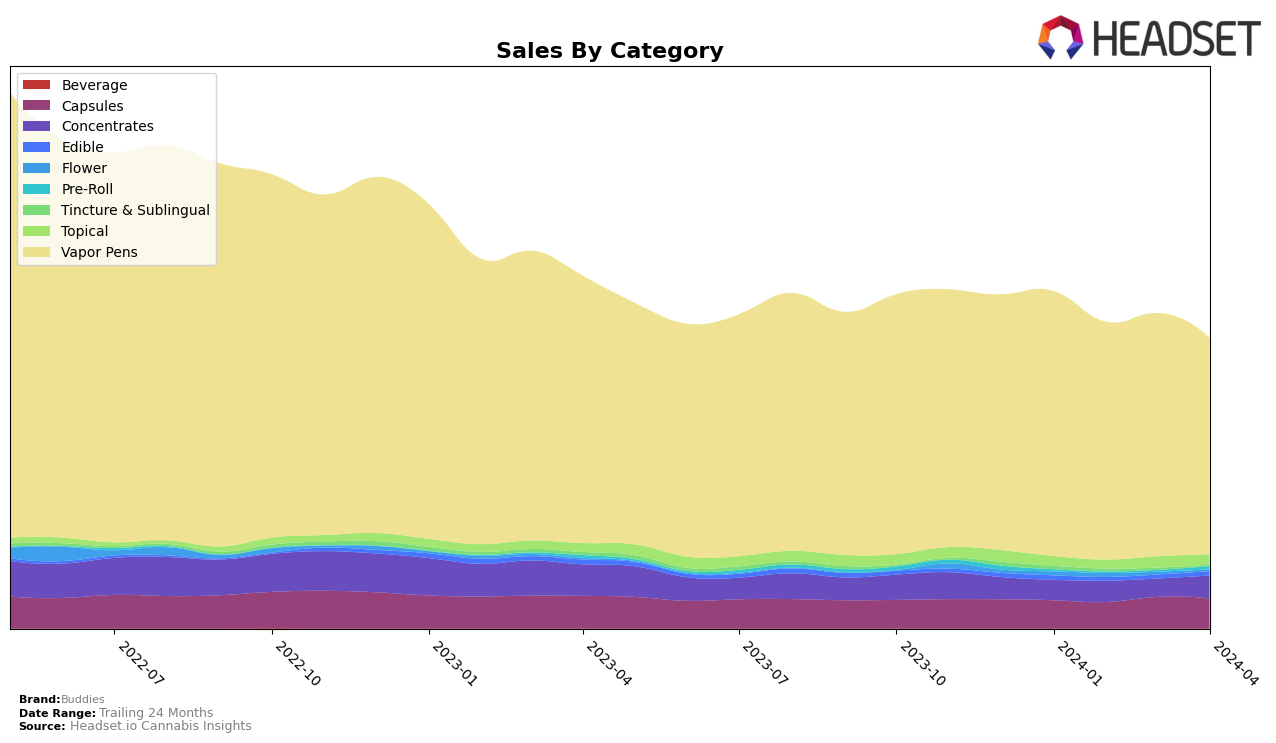

In California, Buddies has shown a consistent performance across several categories, with notable standings in Capsules, Topicals, and Vapor Pens. The brand maintained a steady rank within the top 6 for Capsules from January to April 2024, even improving to rank 5 in April, indicating a strong presence in this category. However, in the Concentrates category, they struggled to stay within the top 30, fluctuating from rank 33 in January to 44 in March, then slightly improving to rank 34 by April. This volatility suggests challenges in capturing a more significant market share within the Concentrates space. On the other hand, their Topicals category performance was impressive, consistently holding the 3rd rank over the four months, highlighting a solid market position. The Vapor Pens category saw a slight decline from rank 19 in January to rank 24 by April, which might raise concerns about increasing competition or changing consumer preferences in this segment.

Looking at Oregon and Washington, Buddies demonstrates a strong foothold, especially in the Vapor Pens category. In Oregon, Buddies led the Vapor Pens category, securing the 1st rank from January to March and slightly dropping to 2nd in April. This dominant position is a testament to the brand's strong consumer loyalty and product quality in the Oregon market. Meanwhile, in Washington, the brand's Vapor Pens category showed resilience, maintaining positions within the top 20 from January to April. The slight improvement from rank 17 in February to rank 15 in April suggests a positive trajectory amidst competitive pressures. The performance in Oregon's Concentrates category also reflects a competitive stance, with rankings improving significantly from 12th in January to 7th in February, though experiencing some fluctuation in the following months. This data underscores Buddies' varying degrees of market strength across different states and categories, with particular success in the Vapor Pens category across the board.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Oregon, Buddies has demonstrated a strong presence but has recently faced a notable shift. Initially leading the pack in January through March 2024, Buddies experienced a slight downturn in April, moving to the second rank behind Entourage Cannabis / CBDiscovery, which ascended to the top position. This change is significant, reflecting a shift in consumer preferences or possibly marketing strategies among the competing brands. While Buddies led in sales at the start of the year, a gradual decrease in sales figures was observed over the subsequent months. In contrast, Entourage Cannabis / CBDiscovery saw an increase in their sales, indicating a stronger performance and possibly a growing consumer base. Other notable competitors, such as NW Kind and White Label Extracts, have maintained steady ranks but with fluctuations in sales, suggesting a dynamic and competitive market environment. This trend highlights the importance for Buddies to innovate and adapt to maintain its market position and address the challenges posed by its competitors.

Notable Products

In April 2024, Buddies' top-performing product was the Raspberry Distillate Cartridge (1g) within the Vapor Pens category, holding its position at rank 1 from the previous month with sales figures peaking at 5542 units. Following closely was the Melon Gum Distillate Cartridge (1g), also in the Vapor Pens category, which moved up to rank 2 from its previous position at rank 3 in March. The Blueberry Distillate Cartridge (1g) made its appearance in the rankings for the first time in April, securing the 3rd position with notable sales. The Apple Jack Flavored Distillate Cartridge (1g) maintained its rank at 4, showing consistency in its performance. Meanwhile, the Lime Sorbet Flavored Distillate Cartridge (1g) experienced a slight drop to rank 5 from its previous higher rank of 2 in March, indicating a shift in consumer preferences within the Vapor Pens category.

Top Selling Cannabis Brands