Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

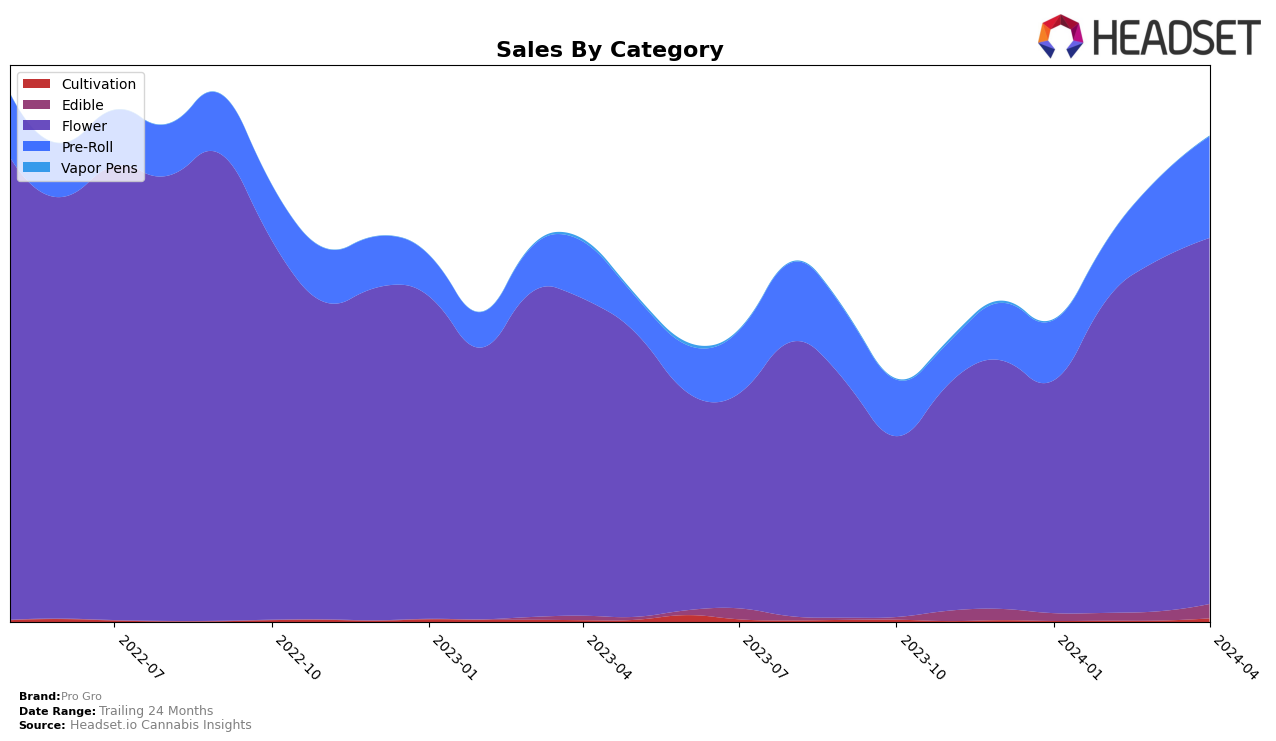

In Michigan, Pro Gro has shown a varied performance across different cannabis categories, illustrating the brand's diverse market presence. Notably, in the Flower category, Pro Gro has maintained a top position, ranking 1st in January and February 2024, and slightly dropping to 2nd in March and April, which still signifies a strong market presence. This slight drop could indicate emerging competition or shifts in consumer preferences but nonetheless, Pro Gro remains a dominant player in Michigan’s flower market. On the other hand, the Edible category tells a story of significant improvement, with Pro Gro not ranking in the top 30 for January and February but making a notable entrance at 43rd in March and climbing to 37th by April. This upward trajectory, especially in a category where they were previously unranked, highlights a potential area of growth for Pro Gro, supported by a considerable increase in sales from March to April 2024.

However, the performance in the Pre-Roll category showcases a different aspect of Pro Gro's market dynamics. Starting at 9th in January, experiencing a slight dip to 11th in February, and then oscillating back to 10th in March before improving to 8th in April, suggests a fluctuating but overall positive momentum in this category. This fluctuation might reflect changes in consumer buying patterns or possibly Pro Gro's adjustments in strategy to better cater to the pre-roll market. The sales figures, showing a steady increase from January to April, further support the notion that despite the rank fluctuations, Pro Gro is on an upward sales trajectory in the Pre-Roll category. This mixed performance across categories in Michigan underscores Pro Gro's multifaceted approach to the cannabis market, revealing both its strengths and areas for potential growth.

Competitive Landscape

In the competitive landscape of the cannabis flower category in Michigan, Pro Gro has demonstrated a strong market presence but has seen a recent shift in its dominance. Initially leading the pack in January and February of 2024, Pro Gro was overtaken by High Minded in March and April, moving Pro Gro down to second place. This shift is notable not just for the change in rank but also because High Minded's sales surged past Pro Gro's, indicating a significant preference shift among consumers. Meanwhile, Society C and Play Cannabis have been trailing behind, occupying the third and fourth positions respectively in April 2024. Society C has shown consistent performance, maintaining a spot in the top four, whereas Play Cannabis has seen a gradual climb, suggesting a growing consumer base. This dynamic indicates a highly competitive market where brand positioning can change rapidly, affecting sales and market share. Pro Gro's initial lead suggests strong brand loyalty and product quality, but the rise of High Minded underscores the importance of staying responsive to market trends and consumer preferences.

Notable Products

In April 2024, Pro Gro's top-performing product was Moonbow #112 Pre-Roll (1g) in the Pre-Roll category, securing the top rank with notable sales of 57,899 units. Following closely, Wedding Cake Pre-Roll (1g) and Don Mega Pre-Roll (1g) ranked second and third, respectively, showcasing a strong preference for Pre-Roll products among consumers. The Wedding Cake (3.5g) from the Flower category managed to secure the fourth position, indicating a diverse interest in product types. Notably, the Watermelon Zkittlez Pre-Roll (1g) rounded out the top five, underscoring the dominance of Pre-Rolls in Pro Gro's sales for the month. This month's rankings indicate a significant shift in consumer preferences, with Wedding Cake Pre-Roll (1g) making a notable jump to the second rank, having not been ranked in the previous months.

Top Selling Cannabis Brands