Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

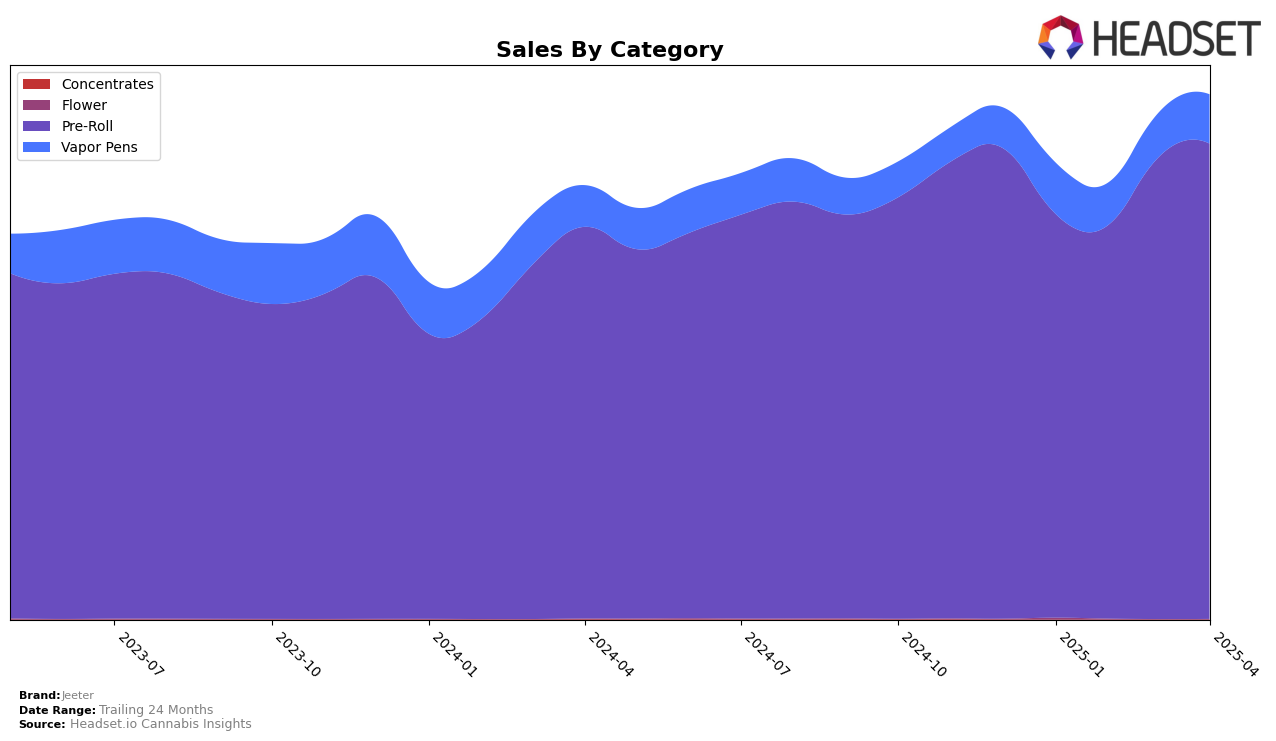

Jeeter has demonstrated impressive consistency in the Pre-Roll category across multiple states and provinces, maintaining the top rank in Arizona, California, Massachusetts, and Michigan from January to April 2025. Notably, in Ontario, Jeeter climbed back to the first position in April after a brief dip to the second position in February and March. This indicates a strong brand presence and consumer preference in these regions. In contrast, Jeeter's performance in the Vapor Pens category has been more varied, with rankings fluctuating between 7th and 8th in Arizona and hovering around the 12th position in California. The absence of a top 30 ranking in other states for this category might suggest a need for strategic focus or market adaptation.

In terms of sales trends, Jeeter's Pre-Roll category has shown robust growth, particularly in Michigan, where sales increased significantly from January to April. This positive momentum is mirrored in Massachusetts, highlighting a strong consumer demand for their products. Conversely, the Vapor Pens category, while maintaining a steady rank, shows some fluctuation in sales figures, suggesting potential volatility or market competition. The lack of presence in the top 30 for Vapor Pens in other regions could be seen as a gap in market penetration that Jeeter might need to address to enhance its overall market share. These insights provide a clear picture of Jeeter's current market stance, while also hinting at areas for potential growth and improvement.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll market, Jeeter has consistently maintained its top position from January to April 2025, demonstrating its strong brand presence and consumer loyalty. Despite the steady competition from Cali-Blaze, which has held the second rank throughout the same period, Jeeter's sales figures have shown a significant upward trend, indicating robust market demand. Meanwhile, Goodlyfe Farms remains in third place, with its sales figures considerably lower than Jeeter's, highlighting Jeeter's dominant market share. This consistent ranking and sales growth suggest that Jeeter's marketing strategies and product offerings are effectively resonating with consumers, keeping it ahead of its competitors in the Michigan pre-roll category.

Notable Products

In April 2025, the top-performing product for Jeeter was the Baby Jeeter - Multi-Pack Infused Pre-Roll 5-Pack (2.5g), which climbed to the first position with sales of 39,595. The Baby Jeeter - Bubba Gum Infused Pre-Roll 5-Pack (2.5g) dropped to second place, despite consistently holding the top rank in previous months. The Baby Jeeter - Strawberry Sour Diesel Liquid Diamond Infused Pre-Roll 5-Pack (2.5g) improved its standing to third place, indicating a positive trend in its sales performance. Meanwhile, the Baby Jeeter - Blue Zkittles Quad Infused Pre-Roll 5-Pack (2.5g) maintained a steady presence in the top four, albeit with a slight drop in rank. The Baby Jeeter - Blueberry Kush Infused Pre-Roll 5-Pack (2.5g) entered the rankings at fifth place, showing promising sales figures for its initial entry.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.