Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

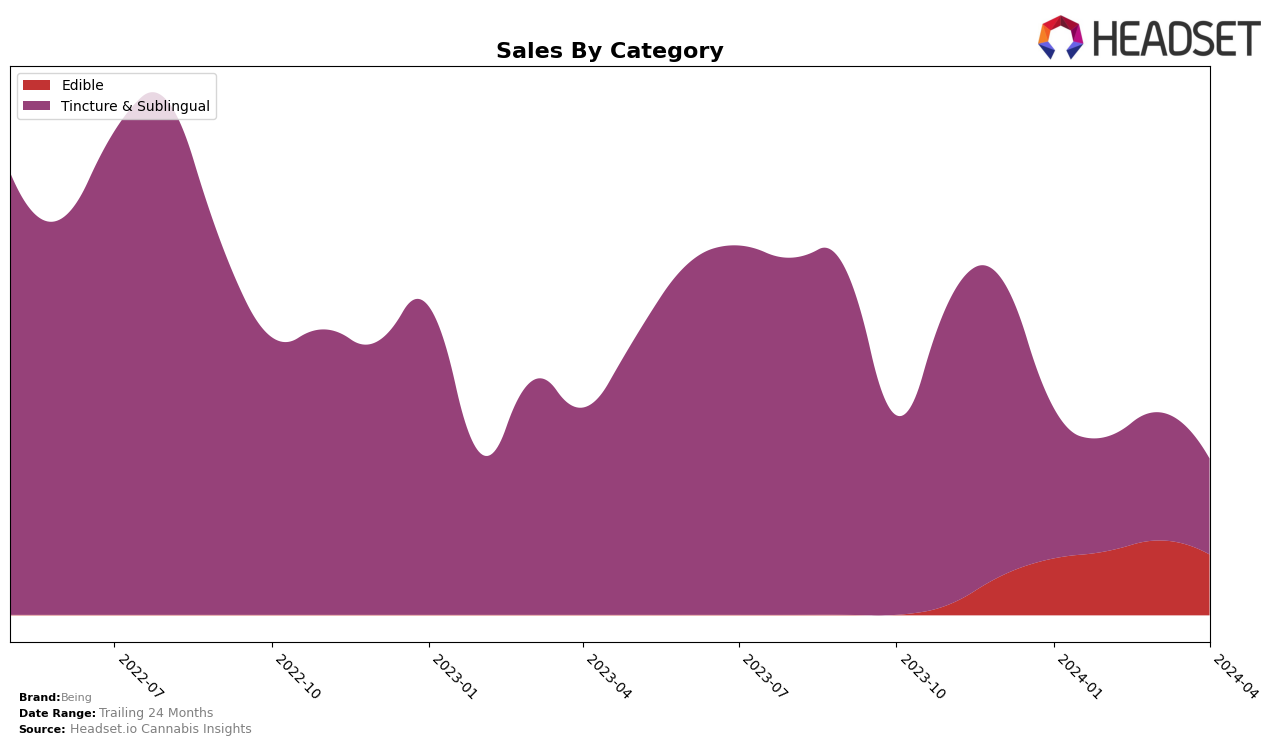

In the edible category within Alberta, Being has shown a fluctuating performance over the first four months of 2024. Starting at a rank of 25 in January, they managed to improve their position slightly to 22 in February, before slipping back to 23 in March and further down to 26 in April. This indicates a struggle to maintain or improve their market position in the highly competitive edibles market. The sales figures reflect a similar story, with a notable dip in February to 10,636, followed by a rebound in March to 13,908, before falling again in April to 10,641. This volatility suggests challenges in sustaining growth or consumer interest consistently over these months.

Conversely, Being's performance in the tincture & sublingual category within British Columbia tells a story of dominance and consistency. They have impressively maintained the number 1 rank from January through April 2024. Despite the sales figures showing a general downward trend from January's high of 34,305 to April's 21,757, holding the top position in such a competitive market is commendable. This starkly contrasts with their performance in the edibles category in Alberta, highlighting how Being's success varies significantly across different markets and product categories. The brand's ability to dominate in British Columbia's tincture & sublingual market may reflect a strong product-market fit or effective marketing strategies that resonate well with consumers in that region.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in British Columbia, Being has maintained a dominant position, consistently ranking 1st from January to April 2024. This consistent top-ranking indicates a strong market presence and consumer preference within the province. Notably, Being's sales have shown some fluctuation, with a peak in January, followed by a decrease in February, a slight recovery in March, and then a decrease again in April. This trend suggests a potential seasonality in consumer demand or the impact of market dynamics such as pricing strategies or promotional activities. Without direct competitors mentioned in the provided data, it's clear that Being's performance is a significant benchmark in the Tincture & Sublingual category. The absence of mentioned competitors further underlines Being's stronghold in the market, making it a pivotal brand for new entrants to analyze and for existing competitors to benchmark against. Future strategies for Being and its competitors should consider these sales trends and market positioning to navigate the competitive landscape effectively.

Notable Products

In April 2024, Being's top-performing product was CBG:THC 3:1 Red Raspberry Gummies 4-Pack (30mg CBG, 10mg THC) within the Edible category, maintaining its number one rank from previous months with sales reaching 1544 units. Following closely, the CBN:THC 3:1 Blue Raspberry Gummies 4-Pack (30mg CBN, 10mg THC), also in the Edible category, held its second position consistently, showing strong performance but with slightly lower sales figures. The THC Fast Acting Oral Quickstrip 10-Pack (100mg) in the Tincture & Sublingual category kept its third rank, indicating a stable demand among consumers for this product type. The CBD Fast Acting Oral Quickstrip 10-Pack (100mg CBD), another product in the Tincture & Sublingual category, remained in fourth place, showcasing a niche but steady market presence. These rankings underscore a consistent consumer preference for Being's edibles and tincture/sublingual products, with the top two edibles dominating sales in April 2024.

Top Selling Cannabis Brands