Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

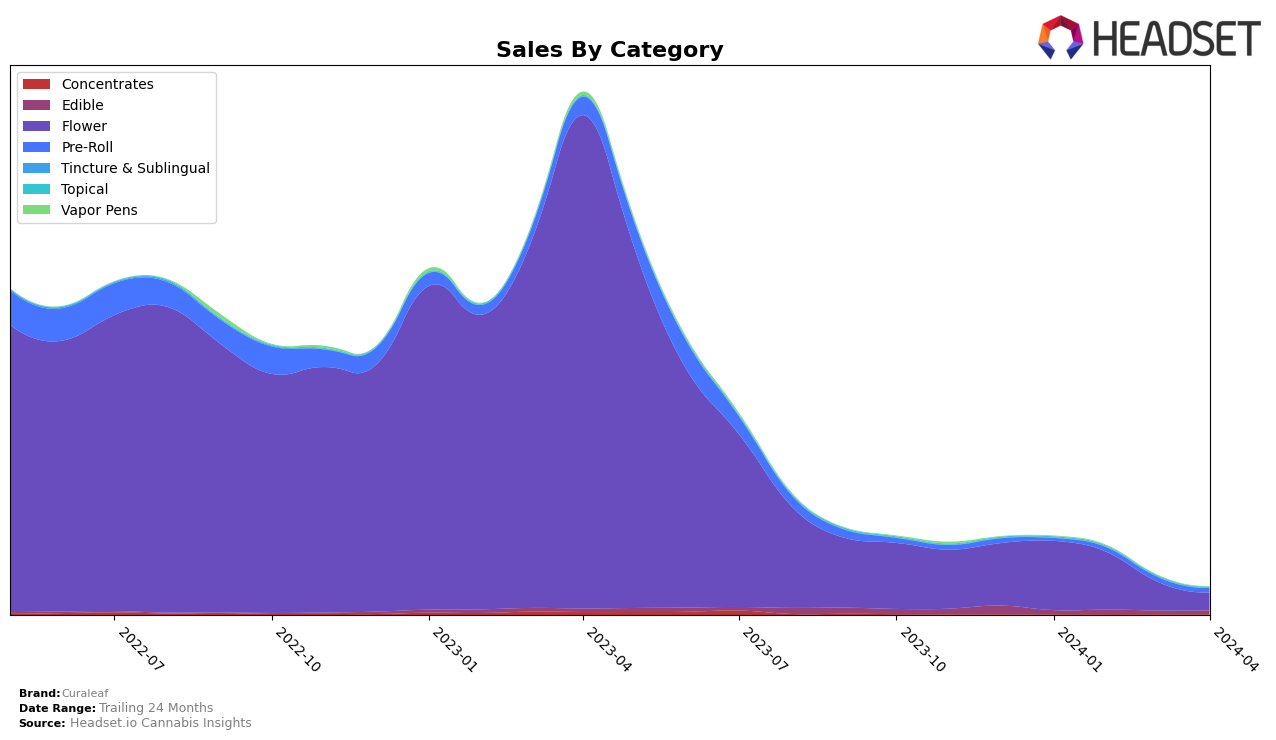

In the highly competitive cannabis market, Curaleaf has shown varied performance across different states and categories, indicating a dynamic presence in the U.S. For instance, in Nevada, Curaleaf's ranking in the Flower category experienced a significant drop from 10th in January and February 2024 to 47th by April, suggesting a dramatic shift in consumer preference or operational challenges. This decline is noteworthy, especially considering their Flower category sales plummeted from 654,417 in January to 140,642 by April. Conversely, in the Pre-Roll category within the same state, Curaleaf managed to improve its ranking slightly over the same period, moving from 49th to 41st, which indicates resilience and adaptability in part of their product lineup.

Elsewhere, in Maryland, Curaleaf has maintained a stable presence in the Edible category, with rankings fluctuating slightly between 26th and 32nd from January to April 2024. This stability, despite slight declines, suggests a consistent market share in Maryland's Edible sector. However, in Massachusetts, the brand faced challenges in the Flower category, not ranking in March and only marginally improving from 95th in January to 96th in April. This inconsistency in performance across states and categories highlights the complex landscape Curaleaf navigates, balancing successes in certain areas while facing setbacks in others. The absence from the top 30 brands in certain states and categories in some months points to the competitive nature of the cannabis market and the need for strategic adjustments to maintain or improve market position.

Competitive Landscape

In the competitive landscape of the Nevada flower market, Curaleaf has experienced notable fluctuations in its ranking and sales over the first four months of 2024. Starting the year strongly in the top 10, Curaleaf saw a significant drop to 28th in March and further down to 47th by April. This decline in rank is indicative of challenges faced by Curaleaf, possibly due to increasing competition or changes in consumer preferences within the state. Competitors such as Srene, TRENDI, and Pheno Exotic also experienced shifts in their rankings, though none as drastic as Curaleaf's. Notably, Cheech & Chong's saw an improvement in their position, moving up in the rankings despite starting from a lower base. This dynamic market suggests that Curaleaf must adapt to regain and maintain its competitive edge in Nevada's flower category, as both rank and sales trends point towards a need for strategic adjustments to address the evolving market landscape.

Notable Products

In April 2024, Curaleaf's top-performing product was Ice Cream Cake (3.5g) from the Flower category, securing the first rank with notable sales of 1147 units. Following closely, Gold - Donny Burger (3.5g), also within the Flower category, ranked second without previous monthly rankings, indicating a significant market entry with 1084 units sold. The third place was taken by Strawberry Pie Pre-Roll (1g) from the Pre-Roll category, improving from its fourth position in March to third in April, showcasing a strong consumer preference shift towards pre-rolled options. Garlic Budder Pre-Roll (1g) entered the rankings directly in the fourth position, emphasizing the increasing popularity of the Pre-Roll category among Curaleaf's offerings. Lastly, Scotty 2 Hotty (3.5g) from the Flower category made its debut in the top five, underscoring the dynamic nature of consumer preferences and the competitive landscape of cannabis products.

Top Selling Cannabis Brands