Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

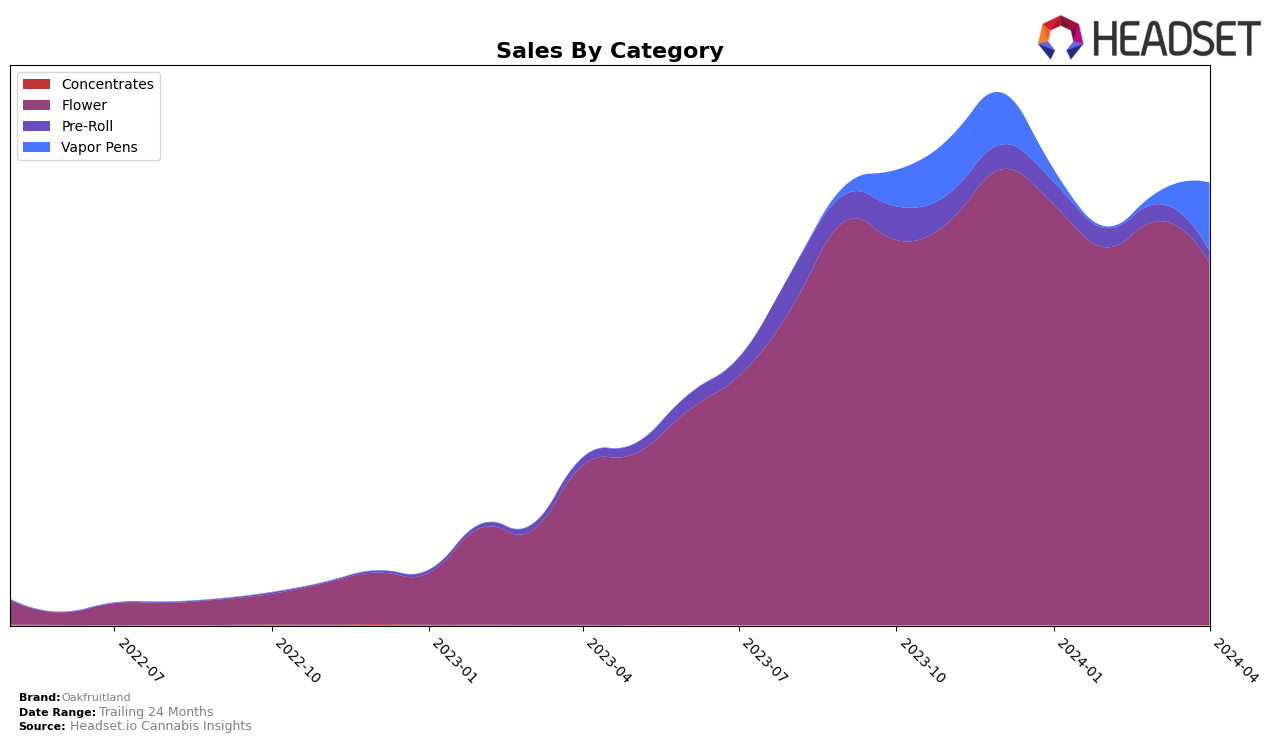

In the competitive California market, Oakfruitland has shown a consistent performance in the Flower category, maintaining a top 3 position from January to April 2024. The slight fluctuation between the 2nd and 3rd ranks over these months indicates a strong presence in this category, despite a noticeable decrease in sales from January's high of $3,127,581 to April's $2,693,730. This trend suggests a robust demand for Oakfruitland's flower products, though the declining sales figures could point to increasing competition or market saturation. On the other hand, their performance in the Pre-Roll category paints a different picture, with rankings slipping from 65th in January to 94th in April. This downward trajectory, coupled with a significant drop in sales, highlights challenges in maintaining their market share against competitors in this segment.

Furthermore, Oakfruitland's venture into the Vapor Pens category in California showcases an intriguing pattern of absence and re-entry. After being ranked 93rd in January with sales of $89,602, the brand did not make it into the top 30 in February and March, only to reappear in April at the 36th position with a remarkable increase in sales to $508,890. This dramatic re-entry and sales spike could indicate a successful product launch or marketing campaign that significantly boosted consumer interest and sales. However, the absence in the rankings for two consecutive months prior to April raises questions about the brand's consistency and strategy in the Vapor Pens market. This inconsistency could be a point of concern or a strategic move by Oakfruitland, but it undoubtedly makes their performance in this category one to watch closely.

Competitive Landscape

In the competitive landscape of the cannabis flower category in California, Oakfruitland has demonstrated a strong presence, maintaining a position within the top 3 ranks from January to April 2024. Initially ranked second in January, it slightly dipped to third by April, showcasing a resilient performance amidst fierce competition. Notably, CannaBiotix (CBX) consistently held the top rank during these months, indicating a dominant market position with sales figures peaking significantly higher than Oakfruitland's by April. Another notable competitor, Alien Labs, showed remarkable progress, moving from the ninth to the second position by April, surpassing Oakfruitland in rank and closing the gap in sales. Blem and Pacific Stone also remained significant players, with Pacific Stone making a notable jump from eleventh to fourth place. This competitive analysis highlights the dynamic shifts in rankings and sales within the market, underscoring the importance of strategic positioning and market responsiveness for Oakfruitland to maintain and enhance its market share.

Notable Products

In April 2024, Oakfruitland's top-performing product was the Oak-lato Cured Resin Disposable (1g) from the Vapor Pens category, with sales reaching 6507 units. Following closely was the Pandora's Box Cured Resin Disposable (1g), also in the Vapor Pens category, securing the second position with notable sales figures. The Pandora's Box (7g) from the Flower category, which was ranked second in March, dropped to the third position in April, indicating a shift in consumer preference towards vapor pens. Interestingly, the Pandora's Box (3.5g) from the Flower category, which had maintained the top spot in February and March, fell to the fourth position in April, showcasing a significant change in its sales trajectory. The V-Power Cured Resin Disposable (1g) rounded out the top five, highlighting the growing popularity of vapor pens in Oakfruitland's product lineup.

Top Selling Cannabis Brands