Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

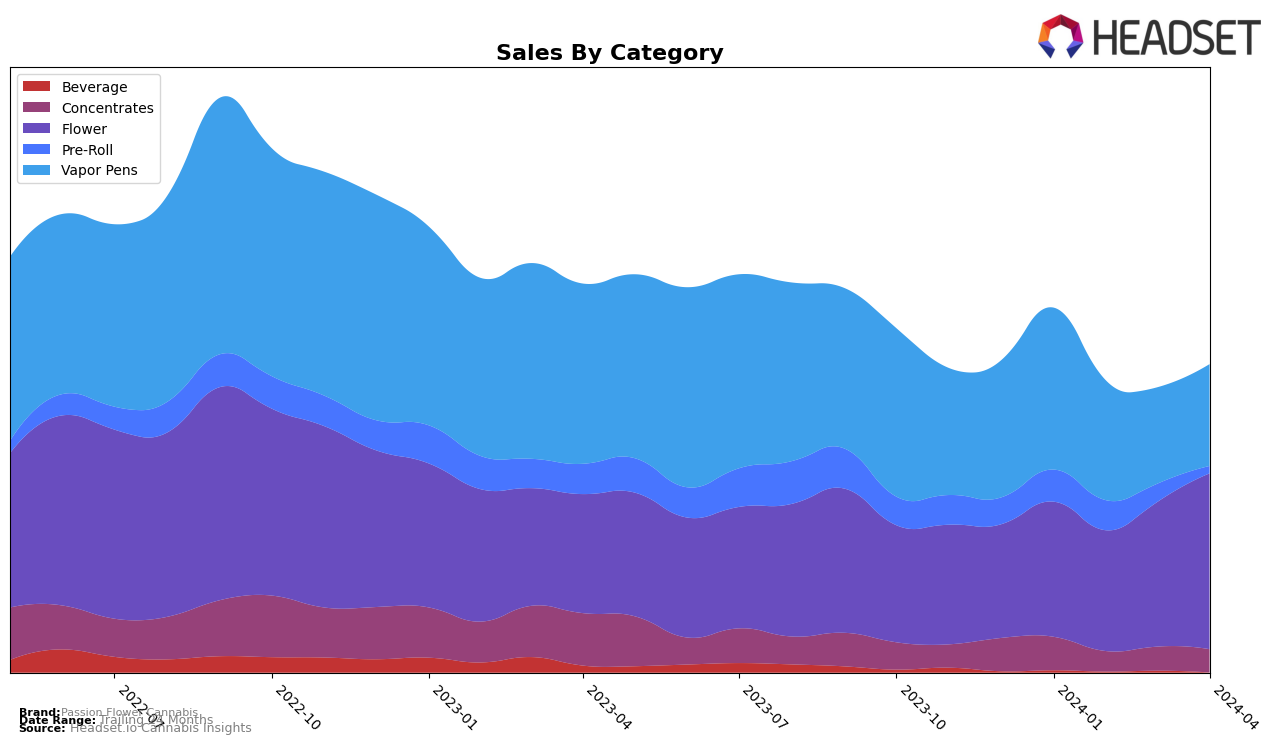

In the Washington market, Passion Flower Cannabis exhibits a diverse presence across multiple cannabis categories, indicating a broad product offering. Notably, their performance in the Vapor Pens category shows a significant presence, starting at rank 32 in January 2024 and experiencing a slight decline to rank 47 by April 2024. This downward trend in ranking, despite being within the top 50, suggests a competitive challenge within the category, possibly due to emerging brands or evolving consumer preferences. Conversely, their Flower category has shown remarkable upward movement, improving from rank 73 in January to rank 64 by April 2024. This positive trajectory, coupled with a substantial increase in sales from January's 148,765 to 191,413 by April, highlights a growing consumer preference for their flower products, potentially signaling a strengthening foothold within this category.

However, Passion Flower Cannabis's performance in the Concentrates and Pre-Roll categories tells a different story. In Concentrates, they remained outside the top 50 throughout the observed period, with rankings fluctuating slightly but showing a modest improvement from rank 63 in February to 54 in April. This improvement, albeit outside the top 30, indicates a potential for growth or at least a stabilization in their market position. The Pre-Roll category presents a challenge for the brand, as it was ranked 80th and 82nd in January and February 2024, respectively, with no ranking data available for March and April, suggesting they were not in the top 30 brands in Washington for those months. This absence from the rankings could be seen as a significant area of concern or an opportunity for strategic realignment, depending on the brand's focus and resource allocation towards this category.

Competitive Landscape

In the competitive landscape of the cannabis flower category in Washington, Passion Flower Cannabis has shown notable resilience and improvement in its market position from January to April 2024. Initially ranked 73rd in January, it climbed to 64th by April, showcasing a significant upward trend in both rank and sales, despite stiff competition. Notably, it outperformed The Happy Cannabis in April, which had a higher rank in March but fell behind Passion Flower Cannabis by April. However, Rochester Farms and Green Haven remained strong competitors, with Rochester Farms experiencing a slight decline in rank from March to April but still maintaining higher sales figures than Passion Flower Cannabis. Green Haven, despite a fluctuating rank, also showed a consistent increase in sales, indicating a robust competitive edge. Conversely, Washington Bud Company saw a decline in both rank and sales, positioning Passion Flower Cannabis more favorably against it. This analysis underscores Passion Flower Cannabis's positive trajectory in the Washington flower market, highlighting its growth potential amidst dynamic competitive movements.

Notable Products

In Apr-2024, Passion Flower Cannabis saw Lemon Meringue (3.5g) leading its product line with the highest sales, reaching 1402 units, maintaining its top position from previous months. Following closely was Koffee Breath (3.5g), which also kept its second position steadily, showcasing strong and consistent consumer preference. Slurricane (3.5g) held onto the third rank, indicating a stable demand despite fluctuating positions in earlier months. A new entry, Electric Watermelon (3.5g), made a notable debut at fourth place, suggesting a promising start for this product. Lastly, Koffee Breath (7g) secured the fifth rank, maintaining its position from the previous month and highlighting the brand's success across different product sizes.

Top Selling Cannabis Brands