Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

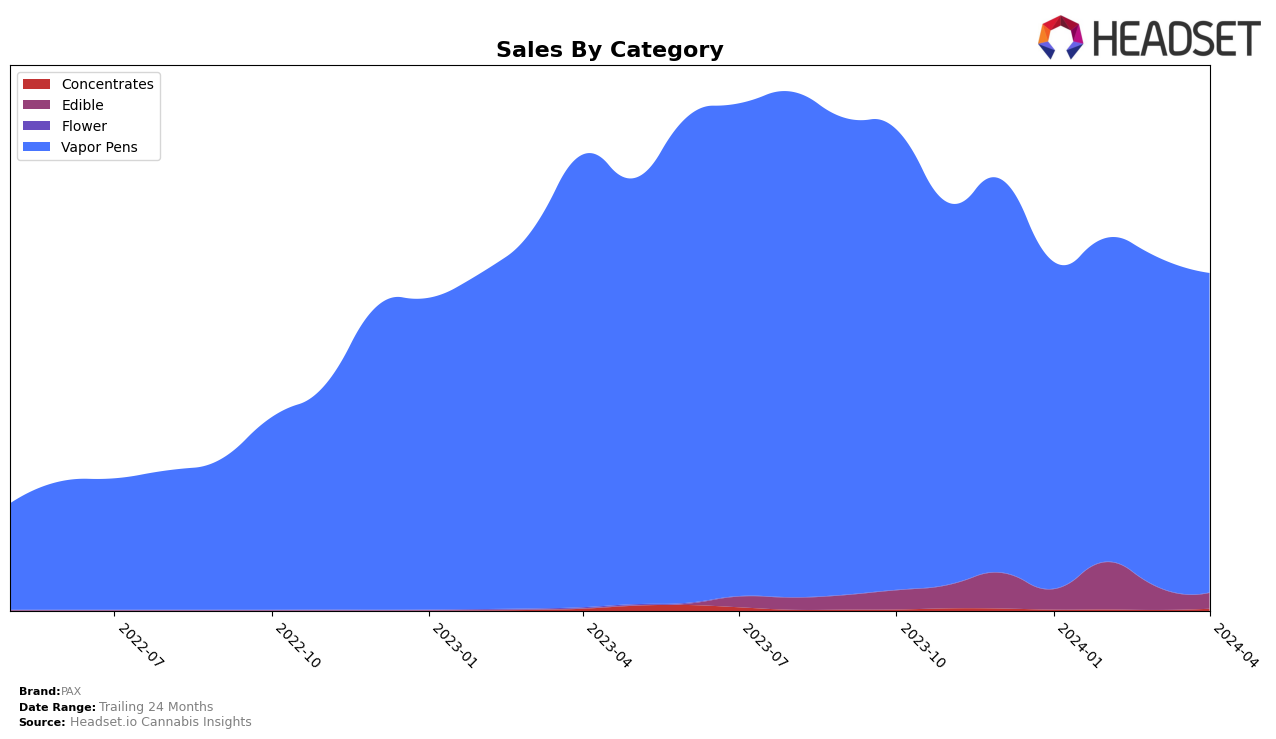

In the competitive cannabis market, PAX has shown a diverse performance across categories and states, with notable movements in both the Edibles and Vapor Pens categories. For instance, in California, PAX's ranking in the Edibles category improved from 45 in January 2024 to 38 in February, before slightly dipping to 40 in March, indicating a fluctuating yet improving position in this category. However, they were not present in the top 30 brands for April, which might suggest a need to reassess their market strategies in California for Edibles. Conversely, in the Vapor Pens category within the same state, their rankings remained relatively stable, moving from 28th position in January and February to 32nd in March, and slightly improving to 31st in April, showcasing a consistent performance amidst competitive market dynamics.

Looking at other states, PAX's performance in the Vapor Pens category demonstrates significant growth and resilience. In Colorado, the brand improved its ranking from 18th in January to 14th by April 2024, alongside an increase in sales, highlighting a strong upward trajectory in this market. Similarly, in Massachusetts, PAX maintained a top 15 position from January through April in the Vapor Pens category, despite a slight dip in sales over the same period. This consistency in ranking amidst a sales decline suggests a solid brand presence and customer loyalty. However, in Ontario, the brand saw a decline in the Vapor Pens category, dropping from 31st in January to 43rd by April, paired with a decrease in sales, indicating challenges in maintaining its market share in this region. These insights into PAX's performance across different states and categories highlight the brand's varied success and the competitive landscape of the cannabis industry.

Competitive Landscape

In the competitive landscape of the vapor pen category in Colorado, PAX has shown a notable upward trajectory in its rankings over the first four months of 2024, moving from 18th in January to 14th by April. This improvement in rank is indicative of a positive trend in sales and market penetration, despite fierce competition. Notably, Seed & Strain Cannabis Co. has consistently outperformed PAX, maintaining a higher rank and showcasing a stronger sales performance, peaking at 7th place in February. Conversely, AiroPro has experienced a slight decline, moving from 11th to 15th place, which could signal an opportunity for PAX to capture additional market share. The Clear has remained a close competitor, with its rank oscillating slightly but generally staying ahead of PAX. Interestingly, Natty Rems, despite not being in the top 20 in the earlier months, made a significant leap to 16th place by April, suggesting a rapidly changing competitive dynamic within the category. This data suggests that while PAX is improving its position, the market remains highly competitive, with shifts in consumer preference and brand performance affecting rankings and sales.

Notable Products

In April 2024, PAX's top product was the Blue Dream Fresh Press Live Rosin Pax Era Pod (1g) within the Vapor Pens category, maintaining its number one rank from the previous month with notable sales of 3863 units. Following in second place was the newly ranked Guava Gelato Live Rosin Pax Era Pod (1g), also in the Vapor Pens category. The Blueberry OG Fresh Pressed Live Rosin Pax Era Pod (1g) secured the third position, showing a return to the top products list without a specified rank in the previous months. Limoncello Haze High Purity Pax Era Pod (1g) and Jack Herer Live Rosin Pax Era Pod (1g) were ranked fourth and fifth, respectively, both marking their first appearance in the top rankings for 2024. This month saw significant shifts in product rankings, with new entries and re-entries highlighting changing consumer preferences within PAX's offerings.

Top Selling Cannabis Brands