Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

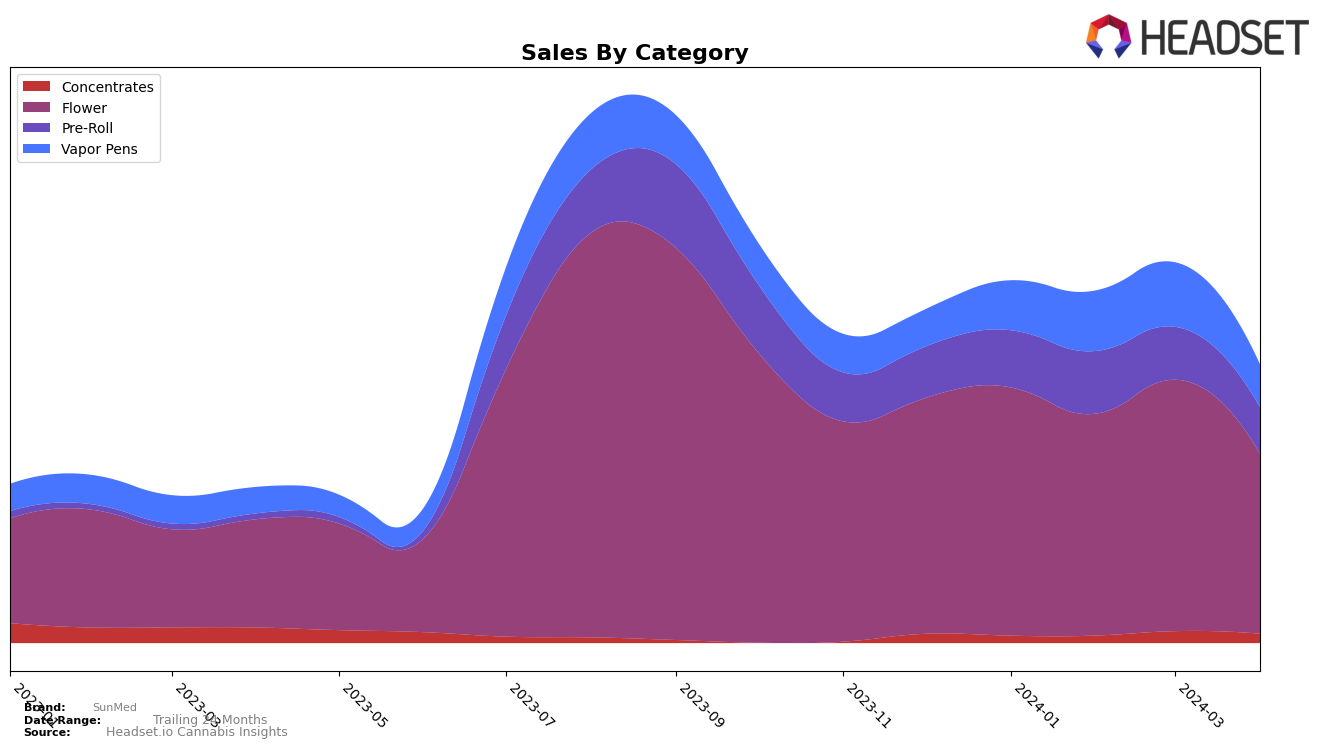

In Maryland, SunMed has demonstrated notable performance across various cannabis product categories, signaling a strong market presence. Particularly in the Pre-Roll category, SunMed has maintained a consistent top position from January to April 2024, indicating a solid consumer preference and loyalty towards their Pre-Roll products. This consistency is a positive sign, showcasing the brand's ability to hold onto the market lead amidst competition. On the other hand, the Vapor Pens category shows a fluctuation in rankings, with SunMed moving from the 7th position in January to the 4th in February, then slightly dipping and returning to the 7th position by April. This volatility suggests a competitive category where SunMed is fighting to maintain its market share but faces challenges in sustaining upward momentum.

Moreover, the Concentrates and Flower categories highlight SunMed's adaptability and strength in Maryland's market. Starting the year strong in Concentrates, SunMed improved its ranking from 2nd in January and February to 1st in March and April 2024, reflecting a growing consumer preference for their Concentrates offerings. This upward movement, coupled with a significant sales increase in March, underscores the brand's successful product strategies and market acceptance. However, the Flower category presents a slightly different narrative, with SunMed experiencing a slight decline from being the top brand in January to the 3rd position by April. Although still performing well, this shift might indicate increased competition or changing consumer preferences within the Flower market segment. These dynamics across categories provide a nuanced view of SunMed's performance, highlighting areas of strength and opportunities for growth within Maryland's cannabis market.

Competitive Landscape

In the competitive landscape of the Maryland flower cannabis market, SunMed has shown a notable performance, initially leading the pack in January 2024 but experiencing a slight decline in rank over the following months, settling at third place by April 2024. This shift in ranking is particularly interesting when considering the dynamics with its competitors. For instance, Fade Co. has consistently climbed, securing the top spot from February onwards, indicating a strong market presence and possibly impacting SunMed's sales and market share. Meanwhile, District Cannabis has shown significant growth, moving up to second place by April 2024, which could suggest a rising preference for their offerings among consumers. Other notable competitors like Rythm and Curio Wellness have also displayed resilience and competitiveness, with Rythm improving its position to fourth place by April. This competitive analysis underscores the fluidity of the Maryland flower cannabis market and highlights the importance for SunMed to innovate and adapt strategies to maintain and enhance its market position amidst vigorous competition.

Notable Products

In April 2024, SunMed's top-performing product was Snoop Dogg OG (3.5g) from the Flower category, maintaining its number one rank across the previous months with sales figures reaching 17,114 units. Following closely, Snoop Dogg OG Pre-Roll 2-Pack (1g) from the Pre-Roll category secured the second spot, consistently holding its position as well. The third place was claimed by Purple Punch Pre-Roll 2-Pack (1g), also in the Pre-Roll category, showing a stable performance by remaining in the third spot from February to April. New entries in the top products list include Peach Crescendo Pre-Roll (0.5g) and Lemon Slushie BDT Distillate Cartridge (0.5g) from the Pre-Roll and Vapor Pens categories, respectively, ranked fourth and fifth in April, indicating a diversification in consumer preferences. These rankings highlight a strong consumer preference for Pre-Roll products, with three out of the top five products belonging to this category.

Top Selling Cannabis Brands