A high-level overview of the Pennsylvania cannabis market

Introduction

Although Pennsylvania is not yet legalized for adult-use cannabis consumption, the market is uniquely positioned to be one of the largest on the East Coast. As a medical market, Pennsylvania can provide broader insight into the overall state of the industry and help us better understand changes and opportunities within cannabis. In this report, we explore PA's path to rapid growth. As the fifth most populated state, Pennsylvania doubled their year over year sales growth in March 2021. Read along to get a closer look at what's driving growth, as well as basket metrics, and category level trends. Ready to dig deeper? You can now get a full PA market read and analyze market trends down to the SKU-level with Insights Premium.

Executive Summary

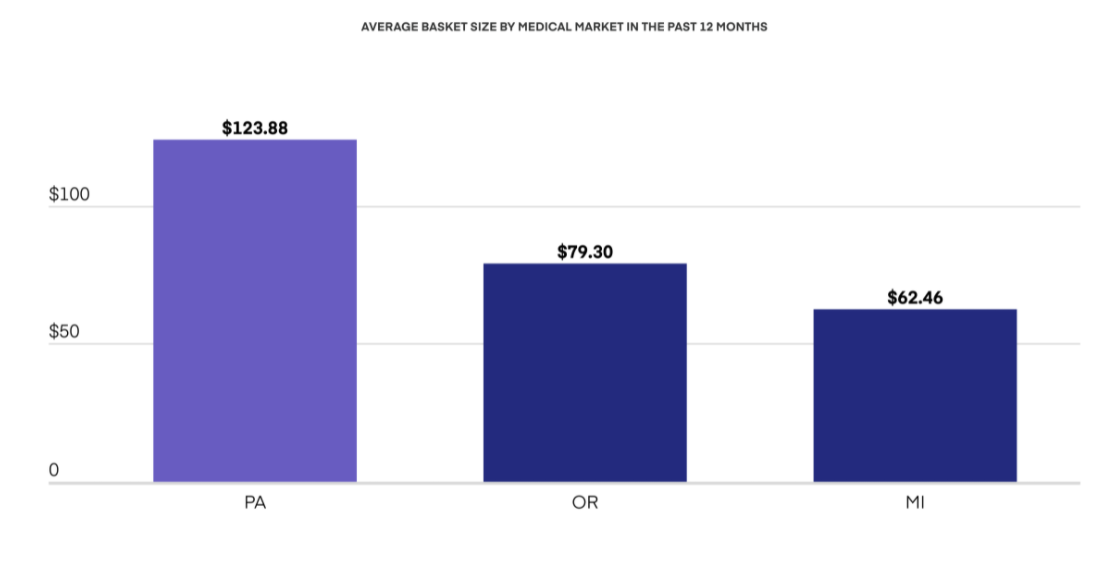

From April 2020 to March 2021, the Pennsylvania medical cannabis market came in at $909M in sales, and doubled in sales from March 2020 to March 2021. Because of nuances in the market, such as pricing and available products, the average basket size in PA is twice the size of the average basket in Michigan and 1.5 times the size of an average basket in Oregon. However, the average number of items per basket has been declining since Fall 2020. At the category level, Flower has been steadily gaining share going from 38% in March 2020 to 45% in March 2021. Vapor Pens, on the other hand, have seen their share decrease from 42% to 36% during the same time span.

Methodology

Data for this report was sourced from a licensed, market-wide dataset of retailer sales in Pennsylvania. This data was pre-anonymized before it was received.

Total cannabis sales in Pennsylvania

.png)

The Pennsylvania medical cannabis market is growing quickly! From April 2020 to March 2021, Pennsylvania medical cannabis sales came in at $909M.

Monthly cannabis sales in Pennsylvania

Sales growth in Quarter 1

.png)

When we break down sales at the quarter level, medical cannabis sales growth in Pennsylvania has been even more rapid at 120%. In dollar terms, sales in Q1 almost reached $270M, and was up by $146M from the previous year. This type of rapid growth is typically seen in new markets, where businesses are just getting started and are in the stages of ramping up.

Average basket size

When comparing medical markets, Pennsylvania’s average basket size was two times as high as Michigan’s and 1.5 times as high as Oregon’s in the past 12 months. Possible explanations to these differences are the available categories, product availability in general, and pricing. Edibles and Pre-Rolls, for example, are not available in Pennsylvania and are considered to be less expensive product options that could drive the average basket size down.

Basket size and items in a basket

Both the average basket size and the average number of items per basket grew in April 2020 and held steady through the spring and summer. In the fall and winter, average items per basket declined relatively fast while the average basket size decline was more modest. This may be a seasonal trend, however we don’t have two years of data to verify this assumption.

Average item price

As average items and basket sizes in the previous slide indicated, average item prices held relatively steady over the past 13 months from March 2020 to March 2021.

Category sales in Pennsylvania

From April 2020 to March 2021, Flower was the largest category at $394M, followed by Vapor Pens at $335M. Pre-Rolls and Edibles are both absent here, since these categories are not offered in the PA market.

Category share growth

Flower has been steadily gaining share, going from 38% in March 2020 to 45% in March 2021. Vapor Pens, on the other hand, have seen their share decrease from 42%to 36% during the same time period.

Average prices of cannabis categories

Among the categories available in the Pennsylvania medical market, Concentrates had the highest average item price at $61. Tinctures, Flower, and Vapor Pens also had an average item price of more than $50.

Conclusion

As we can see, Pennsylvania is on a path to rapid growth. Doubling in year over year sales from March 2020 to March 2021, Pennsylvania also surpassed $100M in sales for the first time in March 2021. Average basket size is higher compared to other markets, but average items per basket have been declining since fall 2020. At the category level, Flower has been steadily gaining share over the past year at the cost of Vapor Pen share, which has been steadily declining over the same time period. We’ll keep an eye on Pennsylvania as it continues to grow and be ready for adult-use legalization when it happens! In the meantime, sign up for a demo of Insights Premium to learn how you can stay ahead of all the opportunities and trends in the cannabis market.

Key takeaways

• The Pennsylvania market is off to a fast start, surpassing $100M in sales in March 2021.

• Growth is driven by consumers purchasing significantly more on every occasion than in other markets, as seen in the average basket size. As the market matures, spend per basket could begin to decline

.• PA’s average basket size is high at $123.88. This is likely because more affordable products, such as Pre-Rolls and Edibles, are absent in the market

.• Flower is steadily gaining share in the market. This may be because as the market matures, more products are becoming accessible to consumers.