Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

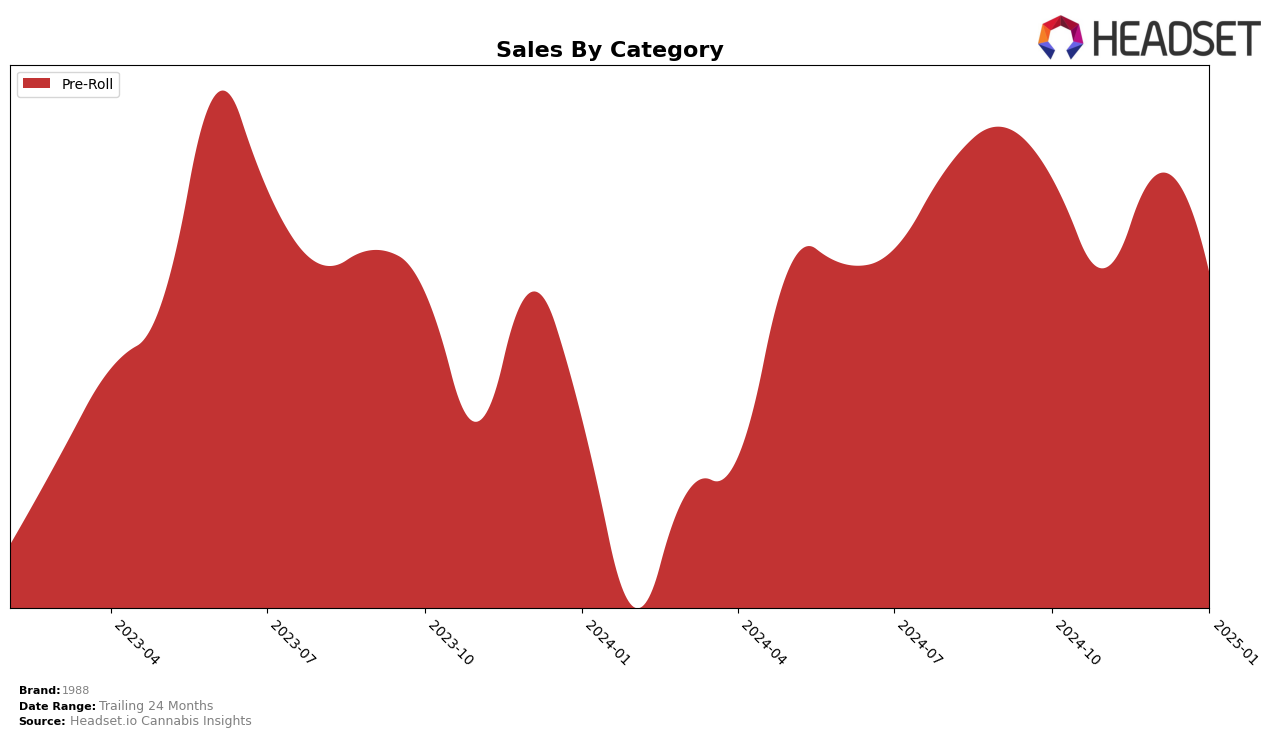

The cannabis brand 1988 has shown varied performance across different states and categories, with notable movements in the Pre-Roll category. In Illinois, 1988's ranking hovered around the 38th to 41st positions from October 2024 to January 2025, indicating a relatively stable presence just outside the top 30. Despite fluctuating sales figures, with a noticeable dip in January 2025, the brand has not yet broken into the top tier of the market. Meanwhile, in Massachusetts, 1988 did not make it into the top 30 rankings at all during the recorded months, suggesting significant room for growth or a need for strategic adjustments to increase market penetration in this state.

In contrast, Washington presents a more optimistic scenario for 1988 in the Pre-Roll category. The brand consistently maintained a ranking within the top 20, improving from 19th in October and November 2024 to 16th in December 2024 and January 2025. This upward trend in Washington is supported by relatively stable sales figures, which remained robust even as they experienced minor fluctuations. This suggests that 1988 has a strong foothold in Washington, potentially offering a blueprint for success that could be replicated in other markets where the brand's presence is not as strong.

Competitive Landscape

In the competitive landscape of the Washington Pre-Roll category, 1988 has shown a steady improvement in its rankings, moving from 19th place in October 2024 to 16th place by December 2024, maintaining this position into January 2025. This upward trend in rank indicates a positive reception in the market, despite facing stiff competition from brands like Agro Couture, which consistently held a higher rank, peaking at 13th in November 2024. Meanwhile, Legit (WA) experienced a decline from 11th place to 15th by January 2025, suggesting potential market share redistribution that 1988 could capitalize on. Additionally, Fire Bros. remained stable but below 1988 in terms of sales volume, indicating that 1988's strategies might be effectively capturing consumer interest. These dynamics highlight opportunities for 1988 to further enhance its market position by leveraging its current momentum and addressing the competitive pressures from higher-ranked brands.

Notable Products

In January 2025, the top-performing product from 1988 was the African Mango Infused Blunt (1g) in the Pre-Roll category, maintaining its consistent number 1 ranking with sales of 5,666 units. Watermelon Zkittlez Infused Blunt (1g) held the second position, showing a significant increase in sales compared to previous months. Blueberry Infused Blunt (1g) climbed to the third position, improving from its fourth-place ranking in December 2024. Ice Cream Cookies Infused Blunt (1g) dropped to fourth place, while Honey Infused Blunt (1g) remained steady in fifth place. Overall, the top products showed stability in their rankings, with notable sales growth for Watermelon Zkittlez Infused Blunt (1g) and Blueberry Infused Blunt (1g) over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.