Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

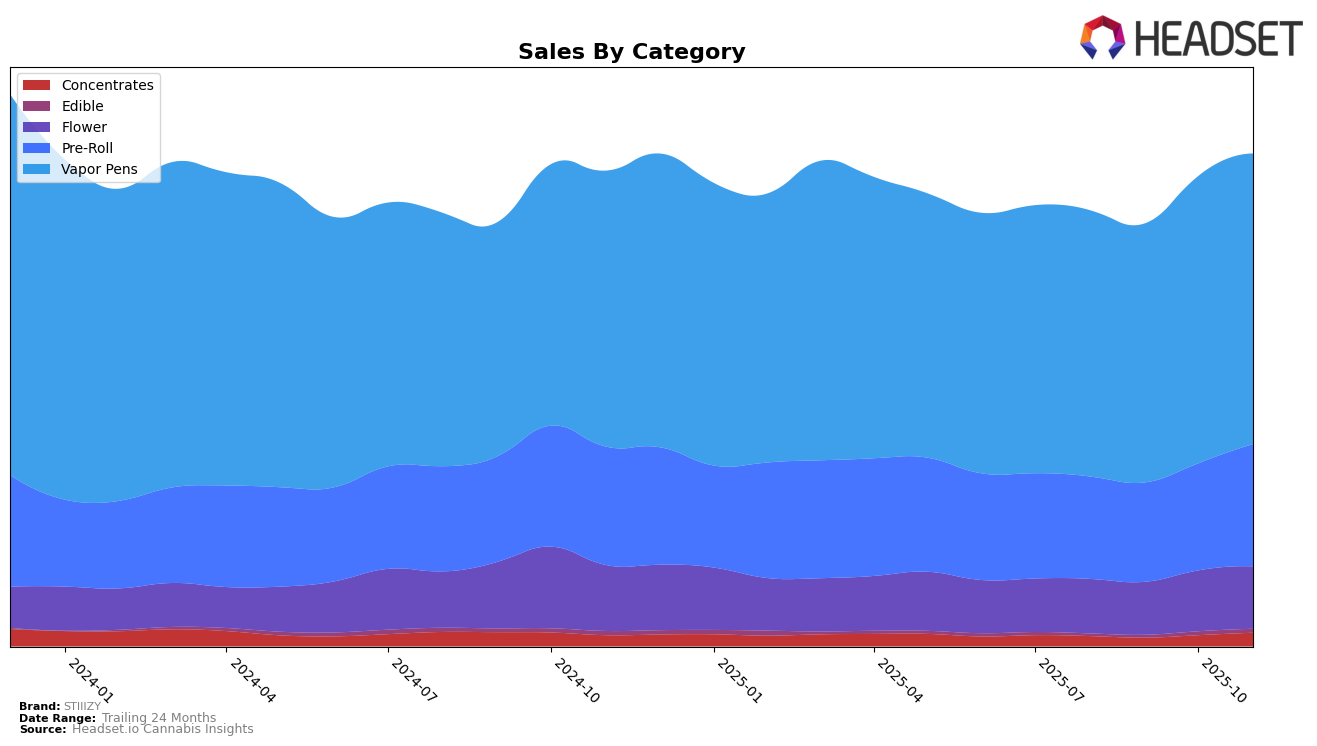

STIIIZY has demonstrated consistent performance across multiple states, particularly in the California and Nevada markets. In California, STIIIZY has maintained the top position in the Vapor Pens category from August to November 2025, showcasing its dominance in this segment. The brand also held the second position in the Flower and Pre-Roll categories, indicating robust consumer demand and a strong market presence. Meanwhile, in Nevada, STIIIZY secured the first position in the Pre-Roll category throughout the same period, while consistently holding the second position in both the Flower and Vapor Pens categories. This stability in rankings across key categories highlights STIIIZY's strong foothold in these states.

In Arizona, STIIIZY has achieved notable success in the Pre-Roll category, maintaining a solid second place from August through November 2025. This performance is complemented by a consistent fifth-place ranking in the Vapor Pens category, reflecting a steady consumer base. Notably, STIIIZY's sales in the Pre-Roll category in Arizona have shown a positive upward trend, increasing from approximately $2.1 million in August to nearly $3 million in November. However, the brand's absence from the top 30 in other significant categories in Arizona suggests potential areas for growth and expansion. These insights underline STIIIZY's strengths and opportunities in different markets, providing a glimpse into its strategic positioning across the cannabis industry.

Competitive Landscape

In the competitive landscape of vapor pens in California, STIIIZY continues to dominate as the leading brand, maintaining its top rank consistently from August to November 2025. This sustained leadership is particularly notable given the presence of formidable competitors such as Raw Garden and Plug Play, which have consistently held the second and third ranks, respectively, during the same period. While Raw Garden and Plug Play have experienced fluctuations in their sales figures, STIIIZY has demonstrated a robust upward trend in sales, further solidifying its market dominance. This consistent performance underscores STIIIZY's strong brand presence and consumer loyalty in the California vapor pen market, positioning it well ahead of its closest competitors.

Notable Products

In November 2025, the Blue Dream Distillate STIIIZY Pod (1g) maintained its position as the top-performing product for STIIIZY, with sales reaching 40,789 units. The 40's - Blue Dream Infused Pre-Roll 5-Pack (2.5g) saw a significant rise, climbing from fourth place in October to second in November, indicating a strong increase in demand. The Blue Burst BDT Distillate STIIIZY Pod (1g) dropped slightly to the third position, while the Skywalker OG CDT Distillate STIIIZY Pod (1g) remained steady at fourth place. Notably, the Pineapple Express Botanically Derived Terpenes Distillate STIIIZY Pod (1g) entered the rankings at fifth place, showcasing its growing popularity. These shifts highlight dynamic changes in consumer preferences within the STIIIZY product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.