Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

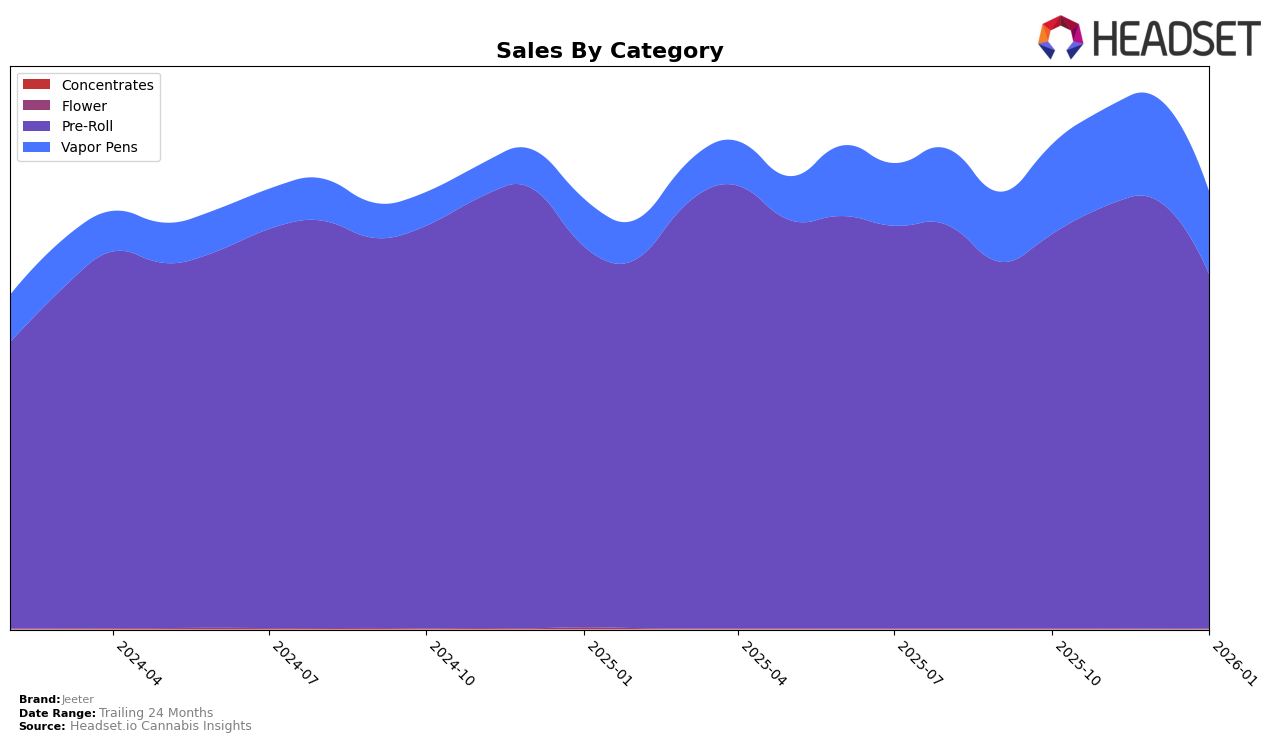

Jeeter has shown a strong performance in the Pre-Roll category across several states, consistently ranking at the top in markets like California, Massachusetts, and Michigan. In these states, Jeeter maintained the number one position from October 2025 through January 2026. However, in New York, the brand fluctuated slightly, holding positions 4 and 5 during the same period. Interestingly, Jeeter's presence in British Columbia was not as dominant initially, as they were not in the top 30 brands in October 2025, but they quickly climbed to the 6th and 7th positions in the following months, showing a promising upward trend.

In the Vapor Pens category, Jeeter's performance was more varied. In Arizona, the brand consistently stayed within the top 10, though they did not break into the top 5, indicating a stable but less dominant presence compared to their Pre-Roll category. Similarly, in California and Massachusetts, Jeeter maintained a steady ranking between 6th and 9th, suggesting a strong foothold but with room for growth. However, in Michigan, Jeeter saw a decline, dropping from 7th in October 2025 to 11th by January 2026, which could be an area of concern as they were pushed out of the top 10. This mixed performance across the Vapor Pens category highlights the competitive nature of the market and the varying consumer preferences across different regions.

Competitive Landscape

In the highly competitive California pre-roll market, Jeeter has consistently maintained its leading position from October 2025 to January 2026, holding the number one rank throughout this period. Despite a slight dip in sales from December 2025 to January 2026, Jeeter's dominance remains unchallenged, with its sales figures significantly surpassing those of its closest competitors. STIIIZY, ranked second, has shown a strong upward sales trend, particularly from November to December 2025, but still trails behind Jeeter by a substantial margin. Meanwhile, Kingpen consistently holds the third position, with a steady sales performance that does not threaten Jeeter's lead. This consistent ranking and sales performance highlight Jeeter's strong brand presence and customer loyalty in the California pre-roll category.

Notable Products

In January 2026, Jeeter's top-performing product was the Baby Jeeter - Multi-Pack Infused Pre-Roll 5-Pack (2.5g) which maintained its top rank from the previous months despite a dip in sales to 34,760 units. The Baby Jeeter - Bubba Gum Diamond Infused Pre-Roll 5-Pack (2.5g) consistently held the second position, showing stable performance. Notably, the Baby Jeeter - Blue Zkittles Quad Infused Pre-Roll 5-Pack (2.5g) climbed to the third position from fifth in December, indicating a positive trend. Meanwhile, the Baby Jeeter - Grandaddy Purple Quad Infused Pre-Roll 5-Pack (2.5g) saw a slight decline, moving from third in December to fourth in January. Lastly, the Baby Jeeter - Strawberry Sour Diesel Liquid Diamond Infused Pre-Roll 5-Pack (2.5g) remained steady in fifth place, reflecting consistent demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.