Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

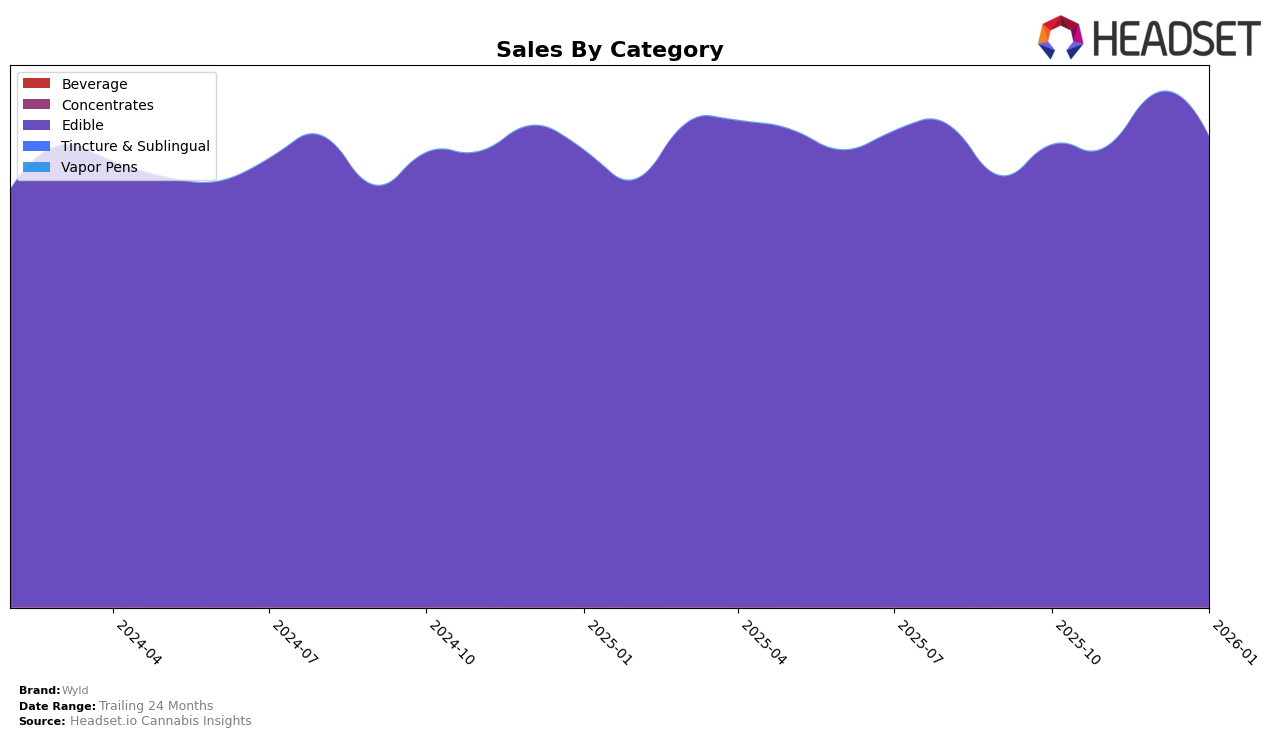

Wyld has consistently demonstrated strong performance across several states, particularly in the Edible category. In Arizona, California, Colorado, and Nevada, Wyld has maintained the top position throughout the observed months from October 2025 to January 2026, underscoring their dominance in these markets. Notably, in Maryland, Wyld was absent from the top 30 in November 2025, which could indicate a temporary disruption or competitive pressure in that period. Meanwhile, Michigan also showcases Wyld's strength, maintaining a first-place rank consistently, although there was a slight decline in sales from December to January.

In Illinois, Wyld saw a minor fluctuation, dropping to second place in December 2025 before reclaiming the top spot in January 2026. This movement suggests competitive dynamics in the Illinois market. Meanwhile, in New York, Wyld consistently held a third or fourth rank, indicating room for growth despite a significant increase in sales over the months. In Massachusetts and Missouri, Wyld maintained a steady third-place ranking, suggesting a stable presence but potential challenges in climbing higher. The data reveals Wyld's strong foothold in the Edible category, with a few areas presenting opportunities for further expansion and market penetration.

Competitive Landscape

In the California edibles market, Wyld has consistently maintained its top position from October 2025 through January 2026, showcasing its dominance and strong consumer preference. Despite the competitive landscape, Wyld's sales have shown a steady upward trajectory, peaking in December 2025, which indicates effective marketing strategies and product appeal. In contrast, Camino and Kanha / Sunderstorm have remained in the second and third ranks respectively, with Camino's sales figures trailing behind Wyld but still significantly ahead of Kanha / Sunderstorm. This stable ranking suggests that while Wyld is leading, Camino is a strong competitor with potential to challenge Wyld's position if trends shift. The consistent rankings and sales figures highlight Wyld's robust market presence and the need for competitors to innovate to close the gap.

Notable Products

In January 2026, Wyld's top-performing product was the CBD/CBN/THC 1:1:1 Indica Boysenberry Gummies 10-Pack, maintaining its first-place ranking consistently since October 2025 with sales reaching 328,012 USD. The CBN/THC 2:1 Indica Elderberry Gummies 10-Pack held steady in the second position across these months, with January sales slightly decreasing to 201,670 USD. Sativa Raspberry Gummies 10-Pack continued to secure the third rank, despite a slight dip in sales to 153,670 USD. The Indica Marionberry Gummies 10-Pack remained fourth, showing a consistent trend in rankings but experiencing a drop in sales. Notably, the CBG/THC 1:1 Hybrid Pear Enhanced Gummies 10-Pack entered the rankings in January 2026, debuting at fifth place with sales of 128,083 USD.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.