Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

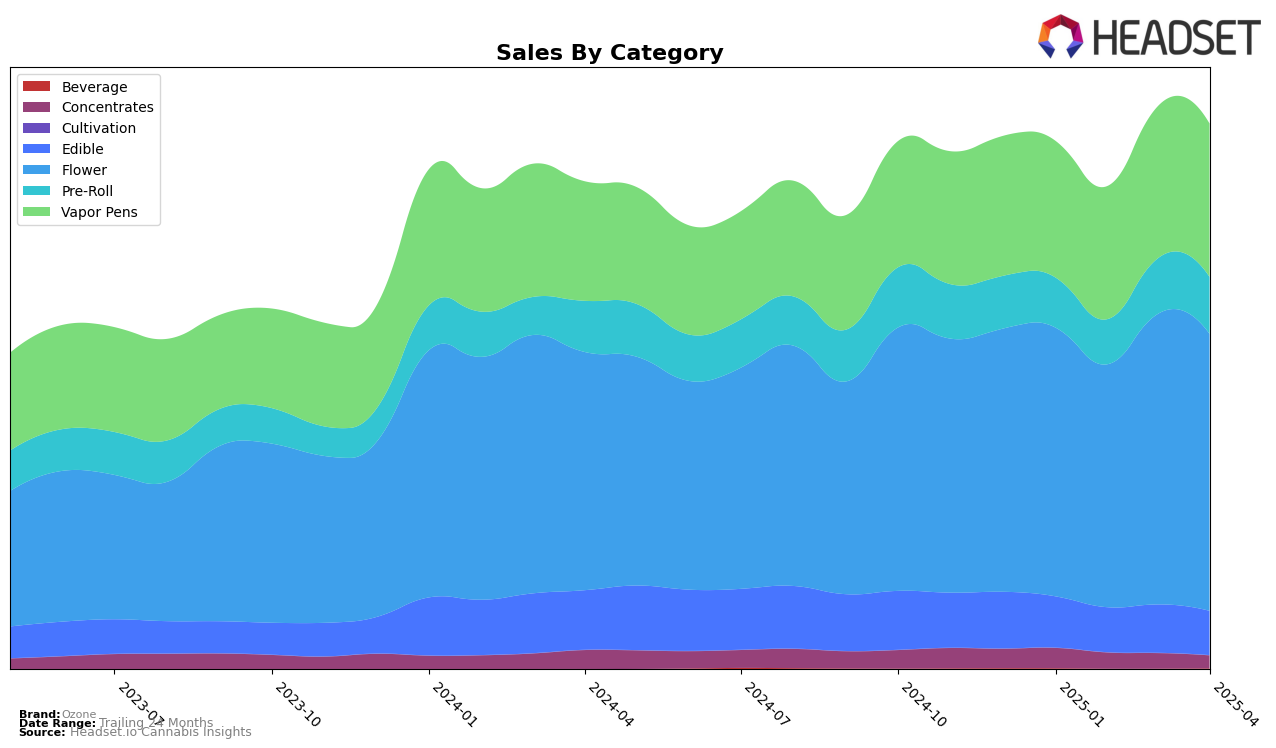

Ozone's performance across various states and categories presents an intriguing mix of stable rankings and noteworthy fluctuations. In Illinois, Ozone has consistently maintained a strong presence in the Flower category, although it slipped from the second to the third rank by April 2025. Meanwhile, their Vapor Pens category saw a slight improvement, moving from fourth to third place over the same period. However, Ozone's absence from the Concentrates category rankings after January could indicate a decline in that segment. In Massachusetts, the Flower category saw a recovery from seventh to fifth place, hinting at a resurgence in consumer interest or strategic adjustments by the brand.

In New Jersey, Ozone has maintained a dominant position in the Flower category, securing the top rank consistently from January through April 2025. This suggests a robust brand presence and consumer preference in this category. The Edible category, however, saw a gradual decline from fourth to seventh place, which might warrant strategic reevaluation. In contrast, Michigan displayed positive momentum for Ozone's Flower category, climbing from fifteenth to seventh place, indicating potential growth opportunities. Notably, Ozone's Vapor Pens in Ohio improved their position from fifth to third place by April, reflecting increased consumer demand or effective market strategies. These movements highlight Ozone's dynamic performance across states and categories, revealing areas of strength and potential challenges.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Ozone has experienced a notable shift in its market position from January to April 2025. Initially holding the second rank, Ozone maintained this position through February and March but slipped to third in April. This change is particularly significant given the rise of Simply Herb, which improved its rank from fourth in January to second by April, overtaking Ozone. Despite this, Ozone's sales figures have shown resilience, although they experienced a decline from March to April. The consistent top performance of High Supply / Supply, which held the first rank throughout this period, underscores the competitive pressure in the market. Meanwhile, Rythm and Daze Off have maintained stable positions, indicating a relatively steady competitive environment. This dynamic suggests that while Ozone remains a strong contender, it faces increasing competition from brands like Simply Herb, necessitating strategic adjustments to regain its previous standing.

Notable Products

In April 2025, Butterstuff Pre-Roll (1g) maintained its top position in the Pre-Roll category with sales reaching 27,360 units, showing consistent leadership from previous months. Reserve - Butter Stuff (28g) rose to the second rank in the Flower category, up from fourth in March, indicating a significant increase in consumer preference. Bananaconda Pre-Roll (1g) slipped to the third position in the Pre-Roll category, despite a steady increase in sales figures. Meanwhile, Bananaconda (28g) entered the Flower category rankings at fourth place, highlighting its growing popularity. PK Crasher Pre-Roll (1g) debuted at fifth place, showing potential for future growth in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.