Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

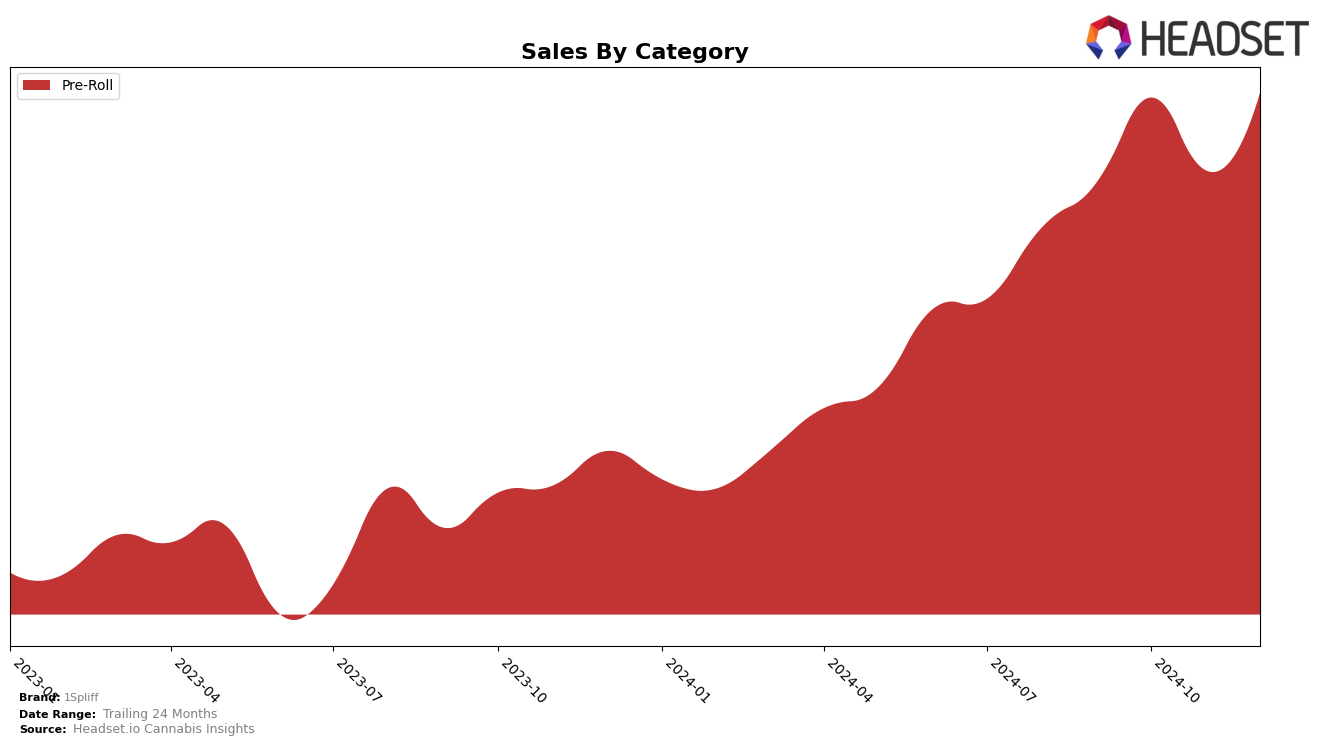

1Spliff has demonstrated notable performance improvements in the Pre-Roll category across different markets. In Alberta, the brand moved from being ranked outside the top 30 in September to achieving the 27th position by December 2024. This upward trajectory indicates a growing acceptance and popularity of their products within the province. Such progress can be seen as a positive sign, suggesting effective strategies in market penetration and consumer engagement. However, the fact that 1Spliff was not initially ranked in the top 30 in September highlights a challenging start, emphasizing the competitive nature of the Pre-Roll category in Alberta.

In contrast, 1Spliff maintained a relatively stable presence in the Ontario market, consistently ranking around the 14th position over the last four months of 2024. This consistency suggests a strong foothold in Ontario's Pre-Roll category, with sales figures showing a steady performance. Despite a slight dip in November, the brand quickly rebounded in December, indicating resilience and possibly effective promotional strategies or product offerings that resonate well with Ontario consumers. The brand's ability to maintain a top 15 position in such a competitive market underscores its strong brand recognition and consumer loyalty.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, 1Spliff has demonstrated a stable yet fluctuating presence in the rankings over the last few months of 2024. Starting at 14th place in September, 1Spliff improved to 13th in October, dipped to 15th in November, and climbed back to 14th in December. This indicates a resilient performance amidst a dynamic market. Notably, Spinach maintained a consistent position slightly ahead of 1Spliff, holding 11th place in September and October before dropping to 13th in November and December. Meanwhile, Thumbs Up Brand showed significant upward momentum, moving from 19th in September to 12th by November and December, suggesting a robust growth trajectory that 1Spliff may need to monitor closely. Dime Industries remained steady at 16th, while CountrySide Cannabis mirrored 1Spliff's ranking movements, indicating a closely matched competition. These shifts highlight the competitive pressures 1Spliff faces and underscore the importance of strategic positioning to maintain and improve its market standing.

Notable Products

In December 2024, the top-performing product from 1Spliff was Cannon Pre-Roll (1g), which climbed to the number one rank from its previous second position in November, with notable sales reaching 7,292 units. Hawaiian Snowcone Pre-Roll 7-Pack (3.5g) slipped to second place after consistently holding the top spot for the preceding three months. Pink Lemonade Pre-Roll 7-Pack (3.5g) maintained its third position from November, showing stable performance. Grape Escape Pre-Roll 7-Pack (3.5g) remained steady at fourth place, mirroring its ranking in October and November. Orange Rntz Pre-Roll 7-Pack (3.5g) continued its decline, ending the year at fifth place after starting at second in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.