Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

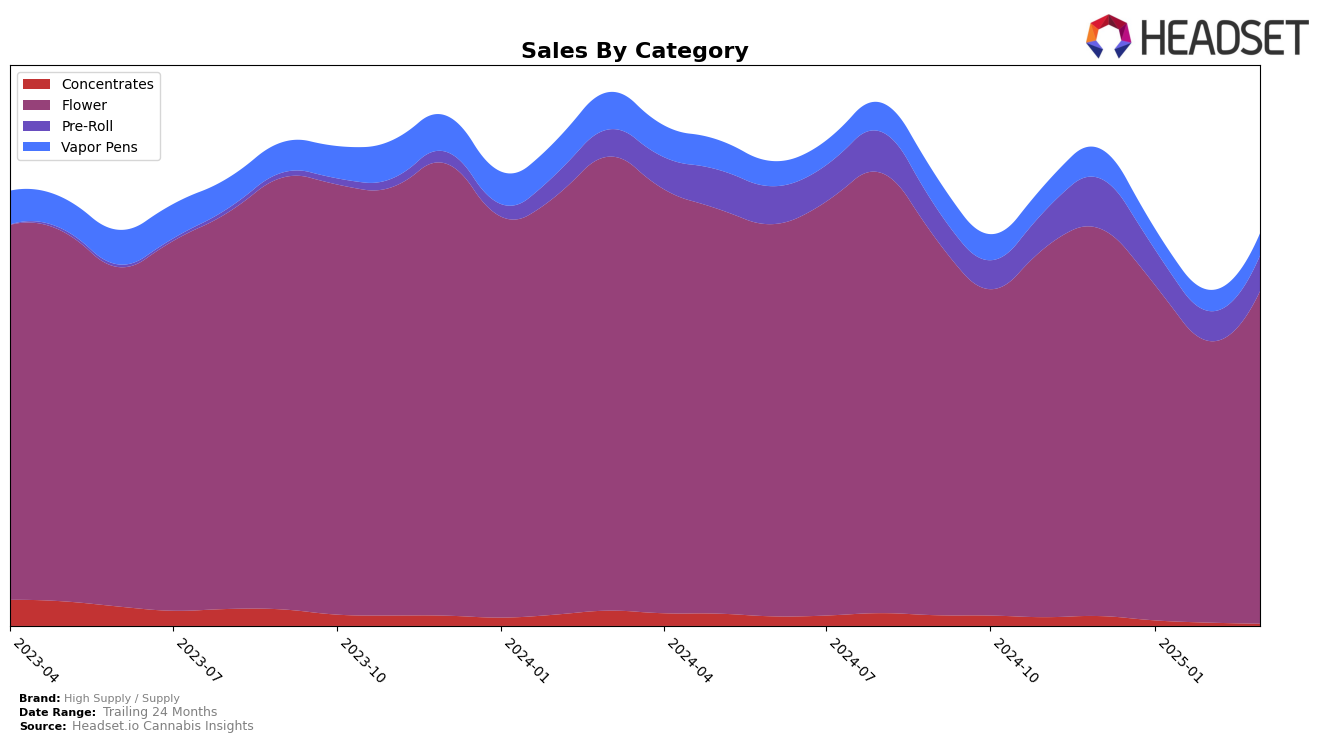

High Supply / Supply demonstrates a strong presence in the Illinois market, particularly in the Flower category, where it consistently holds the top position from December 2024 through March 2025. This dominance highlights its robust market share and consumer preference in the state. In contrast, their performance in the Pre-Roll category shows a gradual decline, moving from 4th to 8th place over the same period, which may indicate increasing competition or shifting consumer preferences. The brand's presence in the Concentrates category in Illinois, however, is not ranked in the top 30 after December 2024, suggesting a potential area for growth or reevaluation of their strategy in this segment.

In Massachusetts, High Supply / Supply maintains a stable position in the Flower category, consistently ranking 2nd from December 2024 through March 2025. This stability suggests a strong foothold and steady demand for their products in this category. However, their performance in Pre-Rolls shows a slight improvement, moving from 12th to 9th place by March 2025, indicating a positive trend that could be capitalized on for further growth. Meanwhile, in Michigan, the brand experiences a more volatile ranking in the Flower category, dropping from 8th in December 2024 to 21st in February 2025, before recovering to 16th in March 2025. This fluctuation might reflect competitive pressures or changes in consumer behavior within the state.

Competitive Landscape

In the highly competitive Illinois flower market, High Supply / Supply has consistently maintained its leading position, ranked first from December 2024 through March 2025. This dominance is particularly notable given the steady performance of its closest competitor, Ozone, which has held the second rank throughout the same period. Despite a decrease in sales from December to February, High Supply / Supply's sales rebounded in March, indicating resilience and effective market strategies. Meanwhile, Simply Herb has shown a slight upward trend, moving from fourth to third place by February, but still trails behind Ozone. The consistent top ranking of High Supply / Supply highlights its strong brand presence and customer loyalty in Illinois, setting a high bar for competitors in the flower category.

Notable Products

In March 2025, the top-performing product for High Supply / Supply was the McLaren Pre-Roll (1g) in the Pre-Roll category, which ascended to the number one rank from second place in February, with notable sales of 7,171 units. The Banana Mints Pre-Roll (1g) made a strong debut, securing the second position. Circus Ring Pre-Roll (1g) followed closely, ranking third, maintaining its position as it entered the rankings for the first time. Kush Mints Popcorn (7g) in the Flower category ranked fourth, indicating a strong presence in the market despite being a new entry. Grease Monkey x Tina Pre-Roll (1g) remained consistent at fifth, showing stable sales performance compared to February.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.