Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

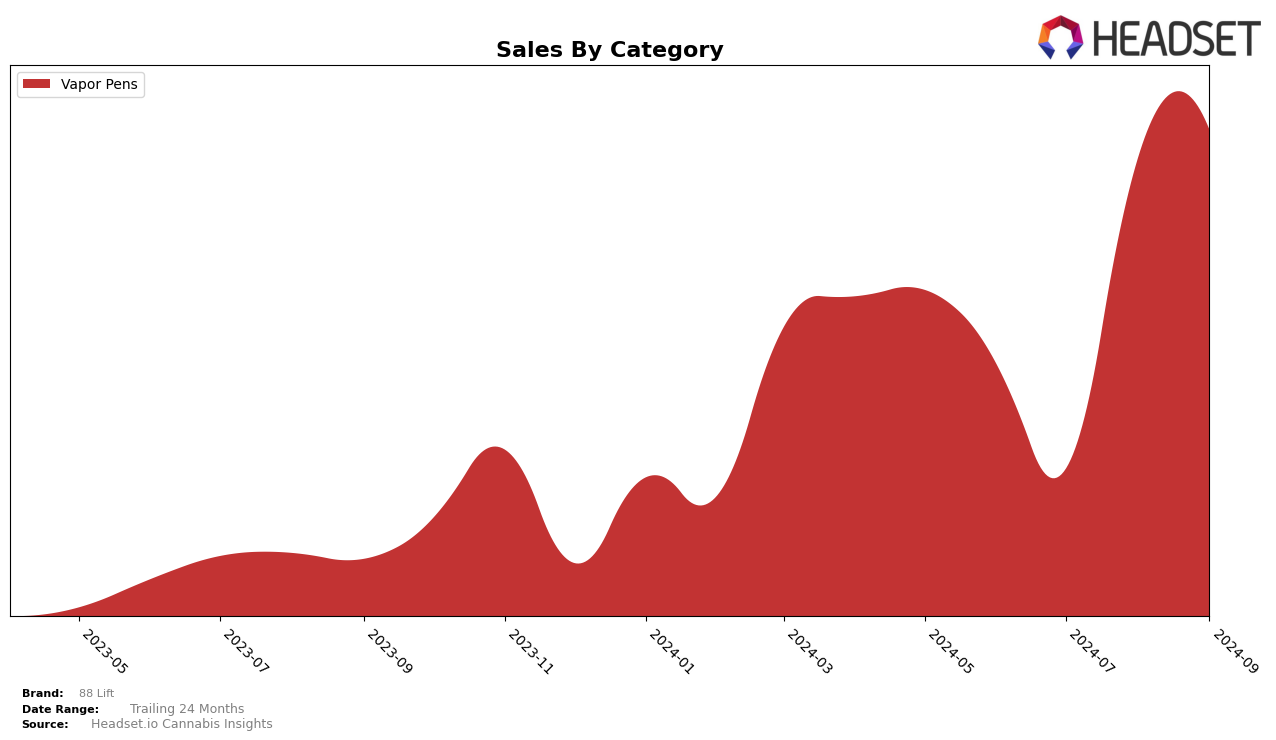

In the state of Ohio, 88 Lift has shown notable progress in the Vapor Pens category. Starting from June 2024, the brand was ranked 32nd but did not make it into the top 30 in July, indicating a temporary dip in performance. However, by August, 88 Lift managed to reclaim its 32nd position and further improved to 28th place by September 2024. This upward trajectory suggests a positive reception of their products in the Ohio market, particularly in the latter months of the quarter, with a significant rise in sales from July to September.

The fluctuations in 88 Lift's ranking in Ohio highlight both challenges and opportunities in maintaining a competitive edge in the Vapor Pens category. The absence from the top 30 in July could be seen as a setback, but the brand's ability to recover and improve its standing by September is indicative of strategic adjustments or increased consumer interest. While specific sales figures for each month are not extensively detailed here, it's clear that the brand's performance is gaining momentum, which might be worth watching for future developments. This pattern of rank changes can be critical for stakeholders looking to understand market dynamics and brand positioning within the state.

Competitive Landscape

In the competitive landscape of vapor pens in Ohio, 88 Lift has shown a notable fluctuation in its rankings from June to September 2024. Starting at rank 32 in June, 88 Lift experienced a dip to rank 40 in July, indicating a potential challenge in maintaining market presence. However, the brand rebounded to rank 32 in August and further improved to rank 28 in September, suggesting a positive trend in consumer reception or strategic adjustments. In contrast, competitors like Standard Farms and Lighthouse Sciences have shown more stability, with Standard Farms maintaining a presence in the top 20 until August before dropping out, and Lighthouse Sciences consistently ranking within the top 30. Meanwhile, Fuzed and The Solid have shown varied performance, with Fuzed improving its rank over the months, while The Solid's rank remained relatively unchanged. The competitive shifts highlight the dynamic nature of the market and the importance for 88 Lift to continue its upward momentum to capture a larger market share.

Notable Products

In September 2024, Pineapple Mayhem Distillate Disposable (0.84g) emerged as the top-performing product for 88 Lift, climbing from the third position in August to first, with sales reaching 1,197 units. 9lb Hammer 2.0 Distillate Disposable (0.84g) followed closely, dropping from its previous top spot in August to second place, recording sales of 1,090 units. Lavender Kush 2.0 Distillate Disposable (0.84g) maintained a consistent performance, holding steady in third place across both August and September. Iced Watermelon 2.0 Distillate Disposable (0.84g) saw a decline, moving from second in August to fourth in September. Notably, Sunday Slurrmon Live Resin Disposable (0.84g) was not ranked for September, despite being the leader in June and July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.