Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

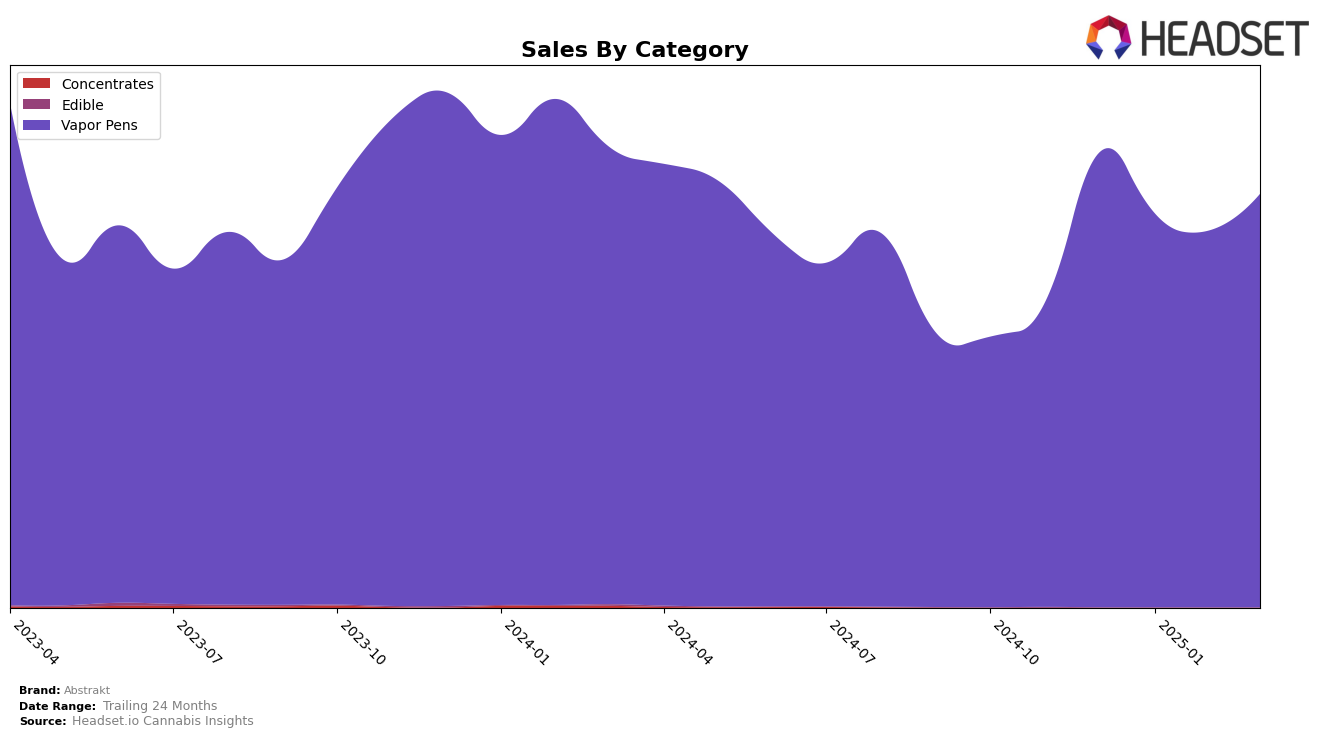

Abstrakt has shown impressive performance in the Arizona market, particularly in the Vapor Pens category. Over the past few months, the brand has consistently maintained a strong presence, ranking within the top 6. Notably, Abstrakt improved its position from 6th in January 2025 to 4th in March 2025. This upward movement suggests a positive reception of their products in the market, despite a dip in sales from December 2024 to February 2025. The recovery in March indicates a potential rebound, possibly driven by strategic adjustments or new product offerings.

While Abstrakt's performance in Arizona is commendable, the absence of rankings in other states or provinces could suggest a limited geographic reach or competitive challenges outside their stronghold. The lack of top 30 placements in other regions may indicate room for growth and expansion opportunities. Understanding the dynamics of different markets and consumer preferences could be key for Abstrakt to replicate its Arizona success elsewhere. This insight into their market presence provides a glimpse into their strategic focus and potential areas for development.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Abstrakt has demonstrated a dynamic shift in its market position over recent months. While initially ranked 5th in December 2024, Abstrakt experienced a slight dip to 6th in January 2025, only to rebound to 5th in February and ascend to 4th by March 2025. This upward trend suggests a positive reception of their products, potentially driven by strategic marketing or product enhancements. In contrast, Mfused maintained a steady presence, consistently ranking in the top 3, while STIIIZY fluctuated between the 2nd and 3rd positions. Notably, Dime Industries and WTF Extracts experienced a decline in their rankings, which could indicate an opportunity for Abstrakt to capture more market share. The competitive dynamics in this category highlight the importance of continuous innovation and customer engagement to maintain and improve brand standing.

Notable Products

In March 2025, the top-performing product from Abstrakt was Raspberry Lemonade Distillate Cartridge (1g) in the Vapor Pens category, reclaiming the number one rank with sales of 8,761 units. Martian Piss Liquid Diamond Disposable (1g) dropped to second place after leading in January and February. Blue Cacti Diamond Disposable (1g) consistently maintained its position at third place throughout the past four months. Strawberry Cough Distillate Cartridge (1g) held steady at fourth place since January, showing a gradual increase in sales. New to the top five in March, Gelatti Liquid Diamond Disposable (1g) made its debut at fifth place, indicating a strong entry in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.