Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

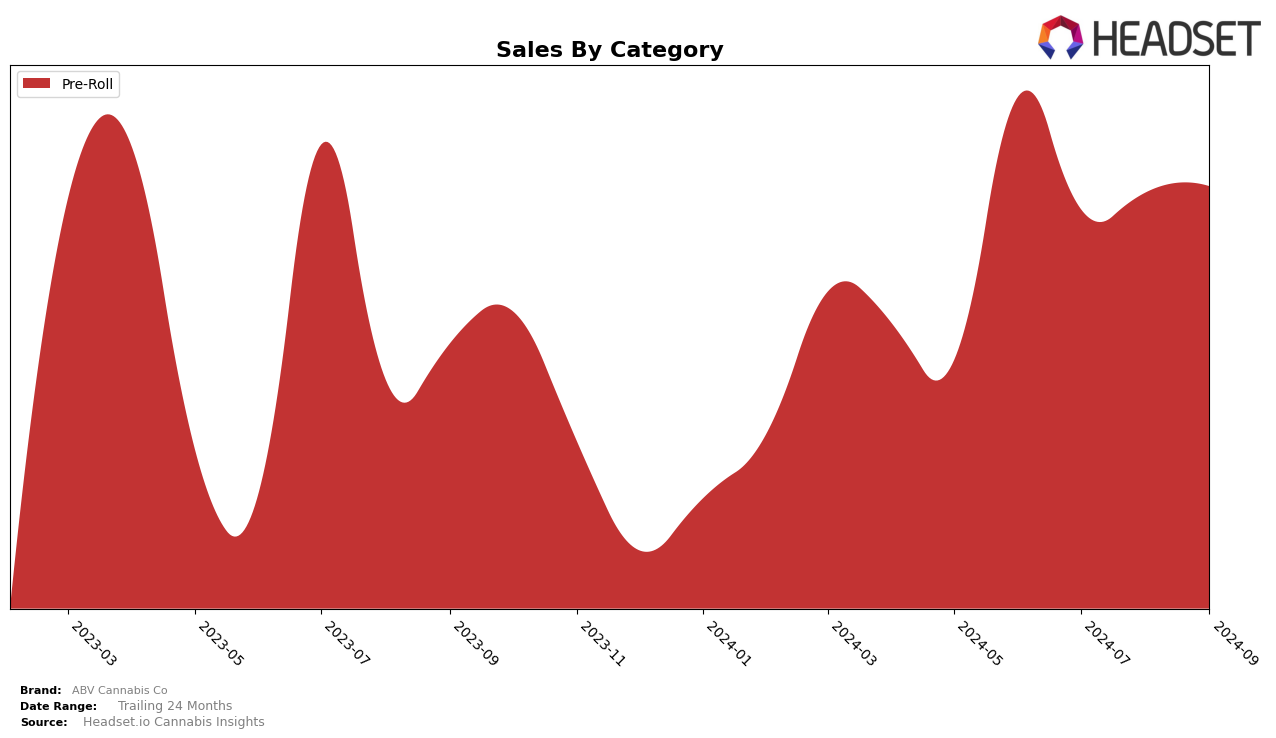

ABV Cannabis Co has shown a steady presence in the Pre-Roll category within the state of Missouri. Throughout the months from June to September 2024, the brand maintained a ranking within the top 30, fluctuating slightly between positions 26 and 28. Despite these minor shifts, the brand's consistent ranking suggests a stable foothold in the Missouri market. However, the fact that the brand did not break into the top 25 indicates potential areas for growth and increased competition that ABV Cannabis Co might face in this category. The sales figures over these months suggest a gradual recovery from a dip in July to a more stable performance in subsequent months, indicating resilience and potential for strategic improvements.

While ABV Cannabis Co has maintained its presence in Missouri, the absence of rankings in other states or provinces signifies either a lack of market penetration or a highly competitive landscape in those regions. This could be perceived as a challenge for the brand to expand its reach and diversify its market presence beyond Missouri. The consistent performance in Missouri's Pre-Roll category could serve as a foundation for ABV Cannabis Co to strategize its entry or improve its standing in other markets. Such movements are crucial for the brand to capitalize on its existing strengths and address areas where it is not yet visible, thereby enhancing its overall market performance and brand recognition.

Competitive Landscape

In the Missouri pre-roll market, ABV Cannabis Co has experienced fluctuating rankings from June to September 2024, maintaining a position outside the top 20 brands, with ranks of 26, 28, 27, and 27 respectively. This indicates a relatively stable yet challenging competitive landscape for ABV Cannabis Co, as it strives to climb higher in the rankings. Notably, Daybreak Cannabis has shown significant volatility, achieving a peak rank of 16 in both July and August before dropping to 26 in September, suggesting potential opportunities for ABV Cannabis Co to capitalize on any inconsistencies in Daybreak's market performance. Meanwhile, Willie's Reserve consistently hovered around the 23rd position, indicating a steady competitor just above ABV Cannabis Co. The rise of Lotus Premium Extracts from 48th in June to 28th in September, and Notorious climbing from 38th to 29th, highlights a dynamic market where emerging brands are rapidly gaining traction, posing both a challenge and a potential benchmark for ABV Cannabis Co to strategize its growth and improve its market share.

Notable Products

In September 2024, the Hawaiian Fonta x Sour Diesel Pre-Roll 3-Pack (1.5g) emerged as the top-performing product for ABV Cannabis Co, climbing to the first rank with sales of 1104 units. The Problem Child x Megatron Pre-Roll 3-Pack (1.5g) followed closely, securing the second position. The Wedding Crasher Pre-Roll 7-Pack (3.5g) maintained its presence in the top three, though it slipped from second to third place compared to August. The Problem Child Pre-Roll 3-Pack (1.5g) dropped to fourth rank from its previous top position in June. The Blueberry Yum Yum Pre-Roll 7-Pack (3.5g) consistently held its place in the rankings, ending at fifth in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.