Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

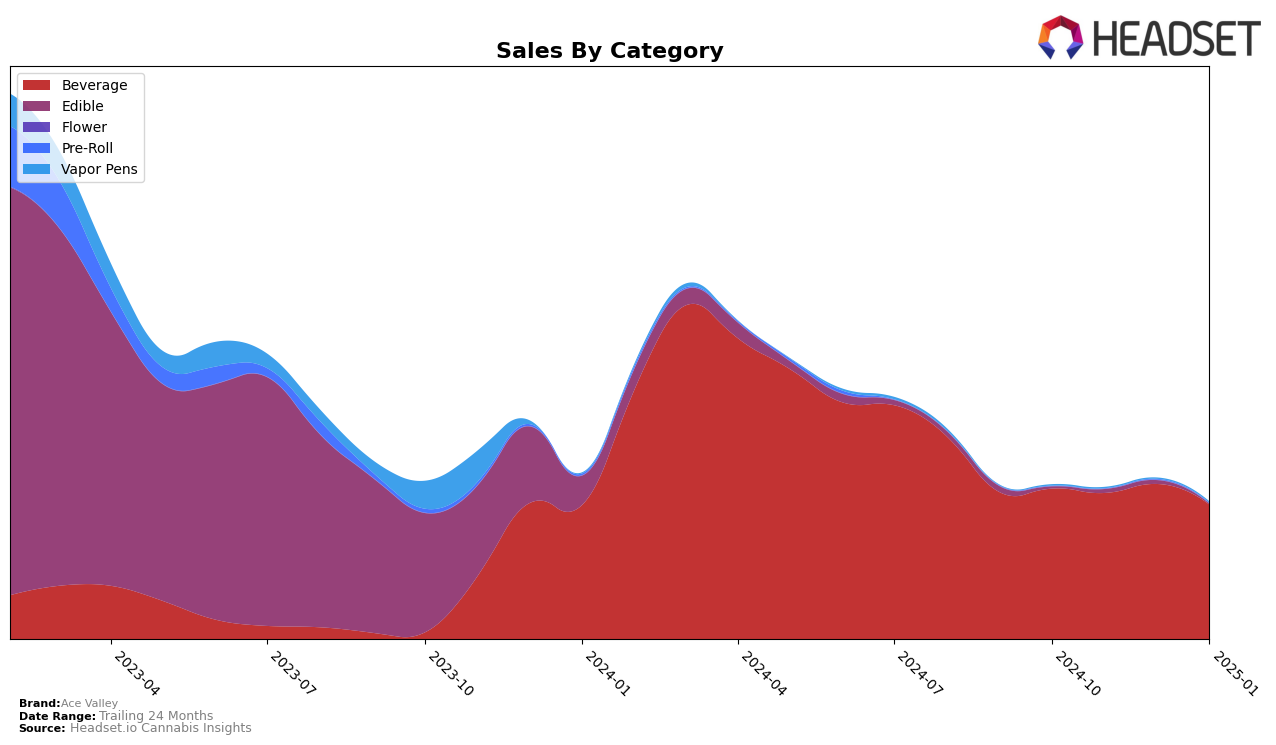

Ace Valley has shown a consistent presence in the British Columbia market within the Beverage category, maintaining a stable position around the mid-teens. From October 2024 to January 2025, their rank fluctuated slightly between 16th and 17th place. This stability is complemented by a noticeable increase in sales, peaking in December 2024 before a slight dip in January 2025. Such performance indicates a strong foothold in the British Columbia beverage market, suggesting that Ace Valley's offerings are well-received and maintaining consumer interest over time.

In contrast, Ace Valley's performance in the Ontario market tells a different story. The brand's rank in the Beverage category shows a declining trend, dropping from 27th place in October 2024 to completely falling out of the top 30 by January 2025. This decline is mirrored by a decrease in sales figures over the same period, which could suggest challenges in maintaining consumer interest or increased competition within the Ontario market. The absence from the top 30 in January highlights a potential area for strategic improvement or repositioning to regain market share in this region.

Competitive Landscape

In the competitive landscape of the beverage category in British Columbia, Ace Valley consistently maintained a mid-tier position, ranking 16th to 17th from October 2024 to January 2025. Despite a steady increase in sales from October to December, Ace Valley's rank remained relatively stable, indicating that while sales were improving, competitors were also experiencing growth. Notably, Green Monke saw a significant drop in rank from 7th in October to 17th by January, suggesting a sharp decline in sales momentum. Meanwhile, Second Nature improved its position from 18th to 14th, reflecting a strong sales surge in December. Señorita also showed volatility, peaking at 12th in November and December before dropping to 15th in January. The absence of Sheeesh! from the rankings after October suggests it fell out of the top 20, highlighting the dynamic and competitive nature of the market. These shifts underscore the importance for Ace Valley to continue enhancing its market strategies to maintain and improve its standing amidst fluctuating competitor performances.

Notable Products

In January 2025, Ace Valley's top-performing product was the CBD/CBG Blueberry Acai Sparkling Water, maintaining its number one rank from previous months despite a slight decrease in sales to 4732 units. The CBD Passion Fruit Guava Sparkling Water also held steady at the second position, with sales figures remaining consistent compared to prior months. The CBD/THC 4:1 Grapefruit Gummies climbed back to the third rank after briefly dropping to fourth in December. A notable new entry in the rankings is the Indica 510 Distillate Cartridge, which debuted at fourth place. The CBN/THC 1:2 Blackberry Lemon Dream Gummies reappeared in the rankings, securing the fifth position after being absent in November and December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.