Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

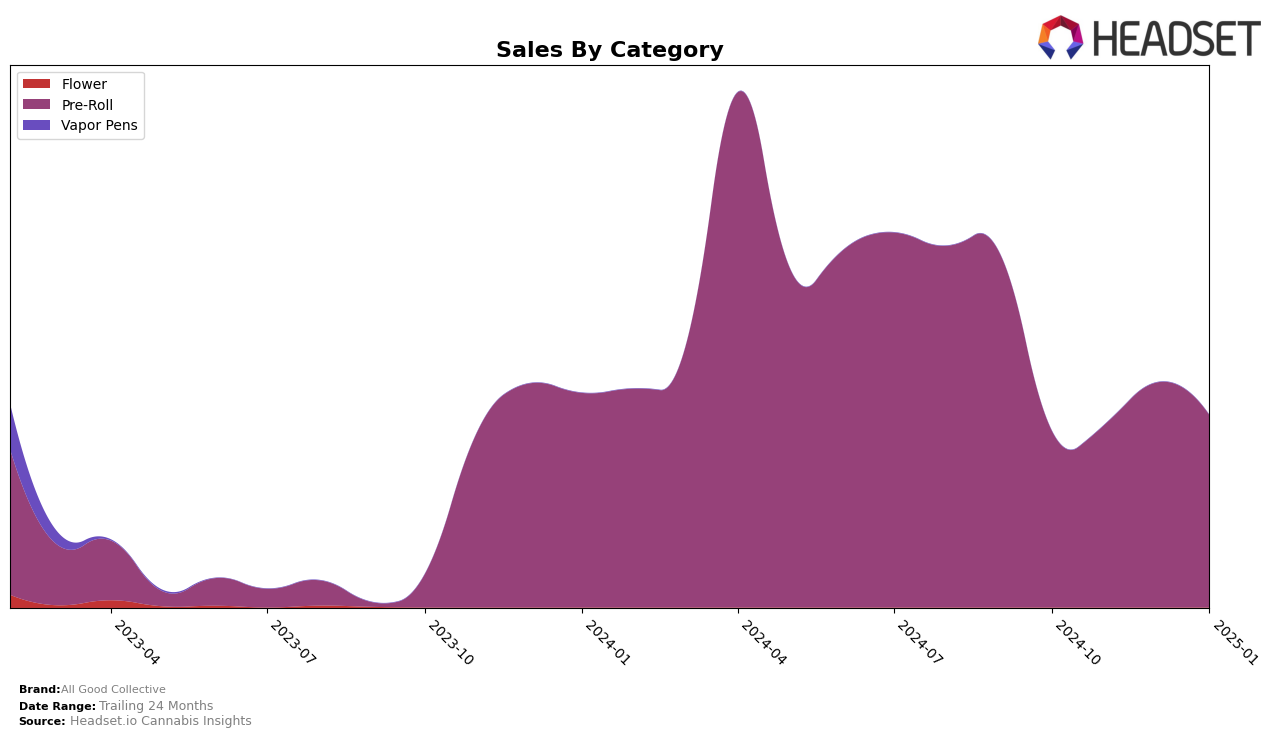

All Good Collective has shown notable progress in the pre-roll category in Colorado over the past few months. Starting from a ranking of 33 in October 2024, the brand climbed to 29 by November and reached 22 in December, before slightly dropping to 23 in January 2025. This upward trend, particularly the impressive leap in December, indicates a strengthening presence in the Colorado market. However, the slight dip in January suggests there might be competitive pressures or seasonal factors impacting their performance. Despite this, the overall trajectory remains positive, showcasing the brand's growing appeal in the pre-roll segment.

It's important to note that All Good Collective did not make it into the top 30 brands in Colorado before October, which highlights their recent ascent as a significant achievement. The brand's ability to break into the rankings and maintain a position demonstrates effective strategic adjustments or increased consumer interest. While specific sales figures are not disclosed beyond the initial months, the movement in rankings suggests a robust competitive strategy that is beginning to pay off. Observers will be keen to see if All Good Collective can sustain this momentum and further solidify its position in the months to come.

Competitive Landscape

In the competitive landscape of the Colorado Pre-Roll category, All Good Collective has shown a notable improvement in rank from October 2024 to January 2025, moving from 33rd to 23rd place. This upward trajectory suggests a positive reception of their products, especially when compared to competitors like D's Trees, which experienced a slight decline, dropping from 23rd to 25th. Meanwhile, Next1 Labs LLC has remained relatively stable, hovering around the 20th position, but their sales have been consistently higher than those of All Good Collective. Interestingly, TWAX has made a significant leap from 78th to 24th, indicating a rapidly growing market presence that could pose a future challenge. All Good Collective's sales saw a peak in December 2024, aligning with their best rank during this period, which highlights the importance of maintaining momentum to continue climbing the ranks in this competitive market.

Notable Products

In January 2025, the top-performing product for All Good Collective was the Blackberry Infused Pre-Roll 10-Pack (3.5g) in the Pre-Roll category, maintaining its number one rank from the previous two months with sales of 758 units. The Grape Infused Pre-Roll 10-Pack (3.5g) held steady at second place, showing a slight increase in sales to 436 units. The Vanilla Infused Pre-Roll 10-Pack (5g) climbed back up to third place after slipping to fourth in December 2024. Pineapple Infused Pre-Roll 10-Pack (5g) dropped one position to fourth, while the newly introduced Blackberry Infused Pre-Roll 10-Pack (5g) debuted at fifth place. These rankings highlight a consistent preference for the Blackberry flavor, while the Vanilla and Pineapple variants experienced fluctuations in their positions over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.