Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

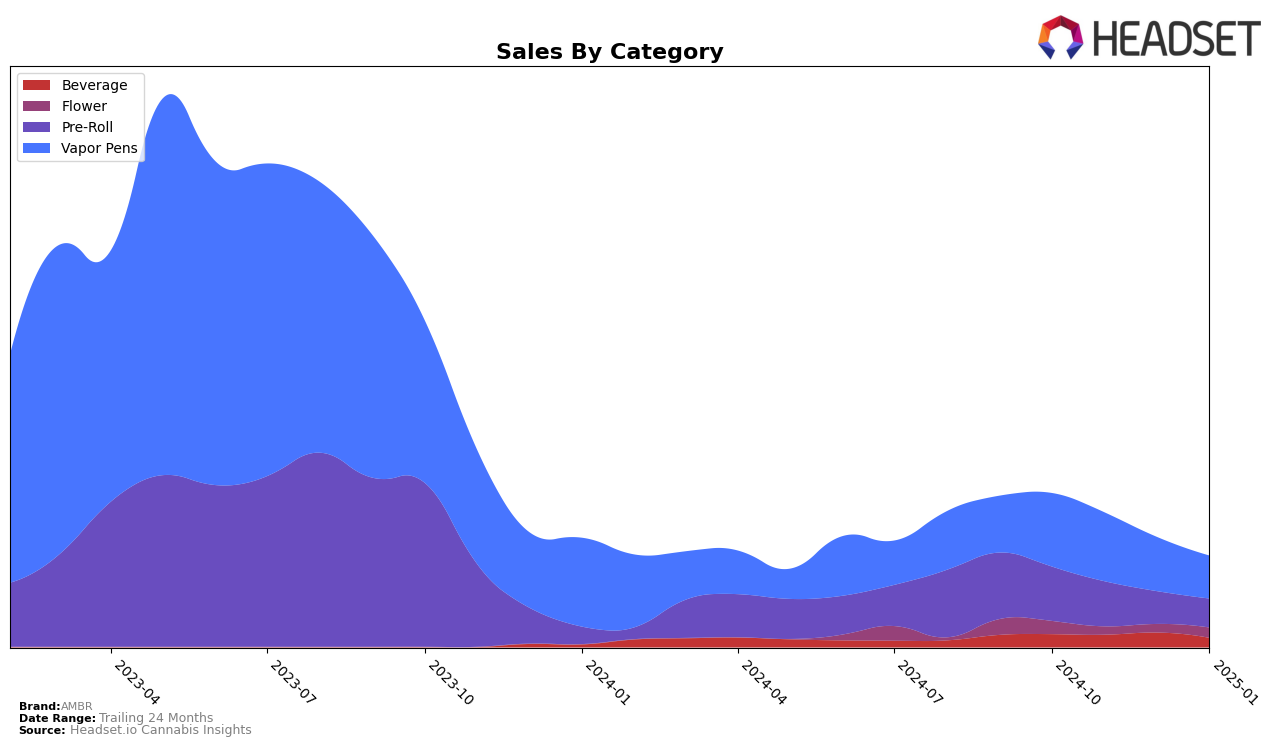

AMBR's performance across different categories and regions has shown notable fluctuations over recent months. In Alberta, the brand's ranking in the Vapor Pens category has consistently remained outside the top 30, with positions ranging from 55th to 66th between October 2024 and January 2025. Despite the lower rankings, there is a slight upward trend in sales from November to January, which may suggest a gradual increase in consumer interest or market penetration. However, the brand's persistent absence from the top 30 indicates that there is significant competition in this category within the province.

In Ontario, AMBR has had mixed results across its categories. The brand's Beverage category has maintained a steady presence within the top 30, showing a slight improvement from 30th in October 2024 to 28th in January 2025. This consistency suggests a stable demand for AMBR beverages in the region. Conversely, the Vapor Pens category in Ontario has seen a decline in rankings, dropping from 54th in October to 73rd by January, accompanied by a notable decrease in sales. This drop could indicate a shift in consumer preferences or increased competition, challenging AMBR's position in the market.

Competitive Landscape

In the competitive landscape of Vapor Pens in Ontario, AMBR has experienced notable fluctuations in its market rank, reflecting a dynamic competitive environment. Starting from October 2024, AMBR held a relatively strong position at rank 54, but by January 2025, it had slipped to rank 73. This decline in rank is significant, especially when compared to competitors like Divvy, which maintained a more stable rank, fluctuating between 66 and 68. Meanwhile, Greybeard showed a positive trend, improving its rank from 94 to 75 over the same period, potentially indicating a growing market presence that could be drawing customers away from AMBR. Additionally, Phant and Pepe have also been active in the market, with Phant maintaining a competitive rank close to AMBR's, and Pepe re-entering the top 20 by January 2025. These shifts suggest that AMBR may need to reassess its strategies to regain its competitive edge and stabilize its sales performance in the Ontario Vapor Pens market.

Notable Products

In January 2025, the top-performing product from AMBR was Sativa Red Energy Soda with 10mg THC, maintaining its position as the number one ranked product for the second consecutive month, despite a decrease in sales to 954 units. The GLTO Infused Pre-Roll 3-Pack made a notable entrance, ranking second, demonstrating strong sales momentum. Indica Orange Crusher Soda, another beverage, dropped to third place from the second position in December, reflecting a significant decline in sales. The Ambr x SJ - Birthday Cake Infused Pre-Roll held steady at fourth place, consistent with its December ranking, while the Gelato Infused Blunt slipped to fifth position after a strong first-place showing in November. Overall, the January rankings highlight a competitive market with shifts primarily in the beverage category.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.