Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

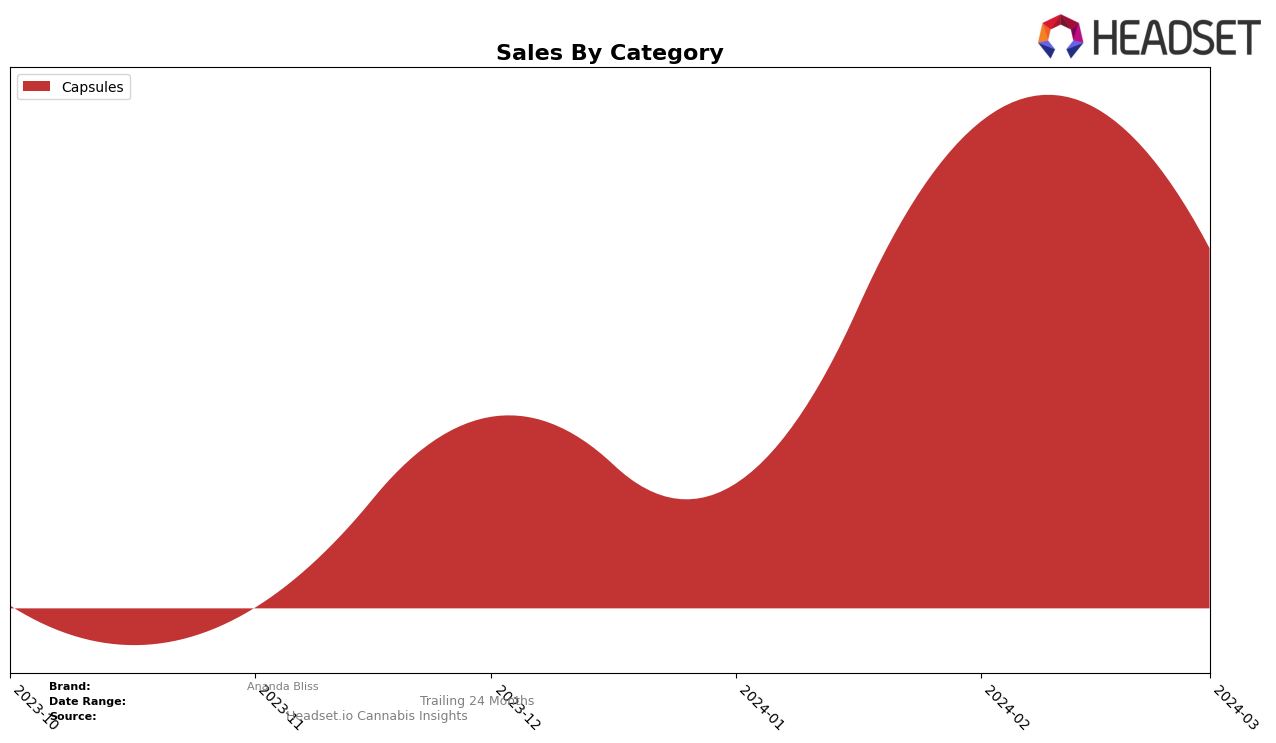

Ananda Bliss has shown a consistent performance in the Ohio market, particularly within the capsules category. While the brand experienced a slight dip in ranking from December 2023 to January 2024, falling from 8th to 10th, it quickly rebounded back to the 8th position in February and maintained this rank into March 2024. This fluctuation is noteworthy, especially considering the increase in sales from December's $2,937 to a peak of $4,700 in February before slightly dropping to $3,944 in March. The resilience in rankings, despite the initial drop, indicates a solid consumer base and effective recovery strategies. The sales trend suggests a growing demand for Ananda Bliss's capsules in Ohio, highlighting the brand's ability to navigate the competitive landscape and retain customer interest over time.

However, the absence of Ananda Bliss from the top 30 brands in other states or categories within the same timeframe suggests a focused or limited market presence. This could be interpreted in several ways; it might indicate a strategic concentration on the Ohio market and the capsules category, or it could highlight areas of potential growth and expansion for the brand. The lack of presence in other states or categories does not necessarily reflect negatively on Ananda Bliss but rather underscores the importance of understanding regional market dynamics and consumer preferences. For businesses and investors, this could signal untapped opportunities for Ananda Bliss to broaden its market reach or diversify its product offerings. Further analysis of market trends, competitive positioning, and consumer behavior would be essential to fully assess the brand's performance and strategic direction.

Competitive Landscape

In the competitive landscape of the capsules category in Ohio, Ananda Bliss has seen fluctuating ranks over the recent months, indicating a dynamic market presence. Starting from December 2023 in 8th place, it experienced a slight dip to 10th in January 2024, before climbing back to 8th in February and settling at 8th again in March 2024. This journey reflects a resilience in maintaining its market position amidst fierce competition. Notably, The Standard has shown a remarkable improvement, moving from 10th to 6th place, surpassing Ananda Bliss by March 2024 with higher sales volume. Similarly, The Solid has demonstrated significant growth, leaping from 11th to 7th place by March, indicating a strong upward trend and a direct challenge to Ananda Bliss's market share. Meanwhile, Bliss, despite a strong start in 5th place in December, saw a decline to 10th by March, showing volatility that could benefit Ananda Bliss if leveraged correctly. One Orijin has had an inconsistent presence, missing from the rankings in February, which might indicate an opportunity for Ananda Bliss to capture a portion of their market share. These shifts highlight the competitive dynamics within the Ohio capsules market, where Ananda Bliss must navigate carefully to improve its rank and sales.

Notable Products

In Mar-2024, Ananda Bliss saw the CBD/THC 1:1 Calm Chaga Mushroom Capsules 11-Pack (110mg CBD, 110mg THC) leading the sales with 38 units, marking its ascent to the top spot from the consistent second position it held in the preceding months. The THC/CBD/CBG 2:1:4 Boost Capsules 22-Pack (110mg THC, 61.6mg CBD, 233.2mg CBG), previously the best-seller, shifted to the second rank with a slight decrease in sales. Interestingly, the THC/CBN 1:1 Night Capsules 11-Pack (110mg THC, 110mg CBN), which was not ranked in Dec-2023, showed significant growth, moving up to share the second place in Mar-2024. This indicates a growing consumer interest in products with CBN, highlighting a potential trend in the cannabis market. Overall, these changes underscore a dynamic competitive landscape within Ananda Bliss's product offerings, with consumer preferences shifting towards a broader spectrum of cannabinoid formulations.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.