Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

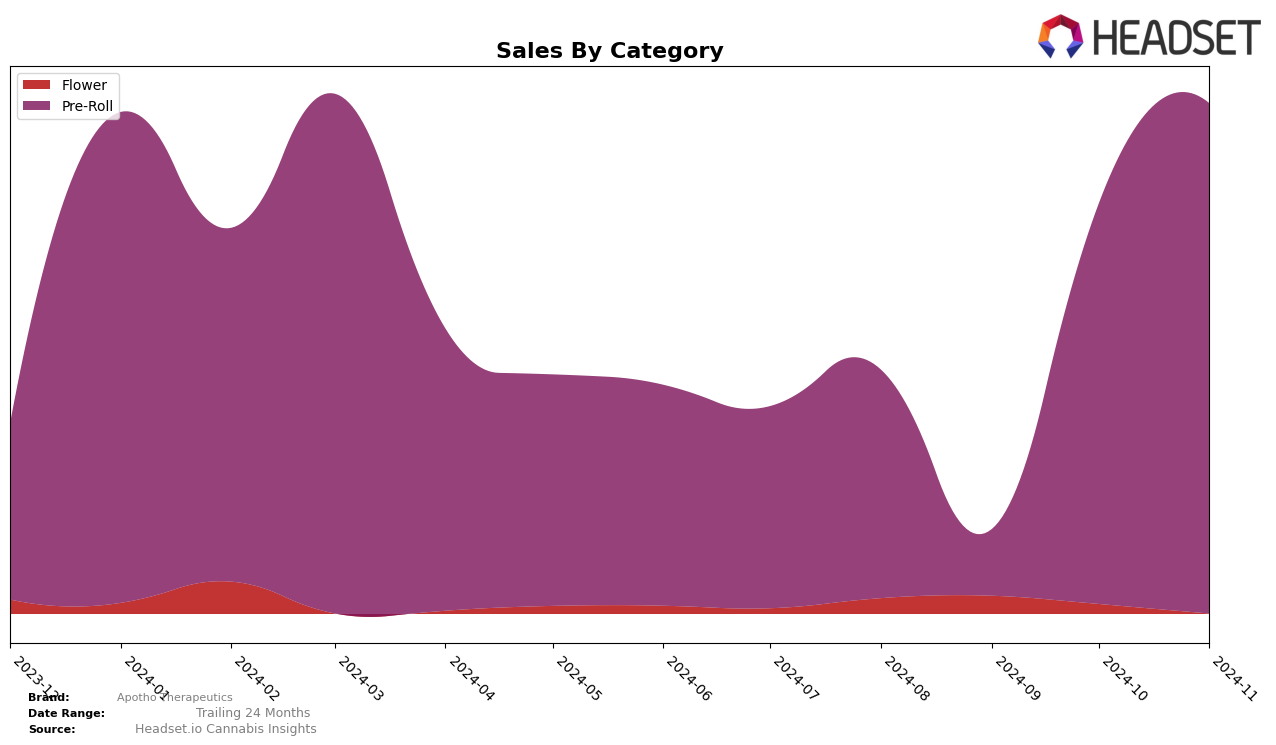

Apotho Therapeutics has shown a notable upward trajectory in the Pre-Roll category within Massachusetts. In August 2024, the brand was ranked 66th, which was outside the top 30, indicating a relatively low market presence at that time. However, by October 2024, Apotho Therapeutics had made significant strides, moving up to the 35th position and continuing to climb to the 23rd spot by November. This improvement suggests a strong growth in market share and consumer interest in their Pre-Roll products. The increase in their sales figures from $94,572 in August to $211,410 in November further underscores their successful penetration into the Massachusetts market.

While Apotho Therapeutics has made impressive gains in Massachusetts, the absence of rankings in other states or provinces for the Pre-Roll category could indicate limited geographical reach or market strategy focused primarily on Massachusetts. The lack of presence in the top 30 brands in other regions might be seen as a potential area for growth or a strategic decision to consolidate their position in Massachusetts before expanding further. This focused approach could either be a calculated move to build a stronghold in a single market or a sign of untapped potential in other markets that could be explored in the future. The brand's performance in Massachusetts certainly sets a foundation for potential expansion and success in other regions.

Competitive Landscape

In the Massachusetts pre-roll category, Apotho Therapeutics has shown a notable improvement in its market position over recent months. After not ranking in the top 20 in September 2024, Apotho Therapeutics made a significant comeback, climbing to the 35th position in October and further advancing to the 23rd position by November. This upward trajectory suggests a positive trend in sales performance, indicating a growing consumer preference for their products. In comparison, Cloud Cover (C3) maintained a steady presence in the top 25, consistently holding the 22nd rank from October to November. Meanwhile, Bountiful Farms experienced a decline, dropping from the 11th position in October to 21st in November, which could potentially benefit Apotho Therapeutics as they continue to capture market share. Additionally, Miss Grass showed a similar upward trend, moving from 28th in October to 24th in November, indicating competitive pressure in the market. These dynamics highlight the competitive landscape in which Apotho Therapeutics is gaining ground, suggesting potential for further growth and increased market presence.

Notable Products

In November 2024, the top-performing product for Apotho Therapeutics was Orangesicle Pre-Roll (1g), which climbed to the number one rank with a notable sales figure of 4465 units. Black Domina Pre-Roll (1g) followed closely, dropping to the second rank from its previous top position in October. Spritzer Pre-Roll (1g) entered the rankings for the first time in November, securing the third spot. Cookies & Cream Pre-Roll (1g) also made its debut in the rankings, taking fourth place. Strawberry Jams Pre-Roll (1g) saw a slight decline, moving from fourth in October to fifth in November, indicating a shift in consumer preferences within the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.