Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

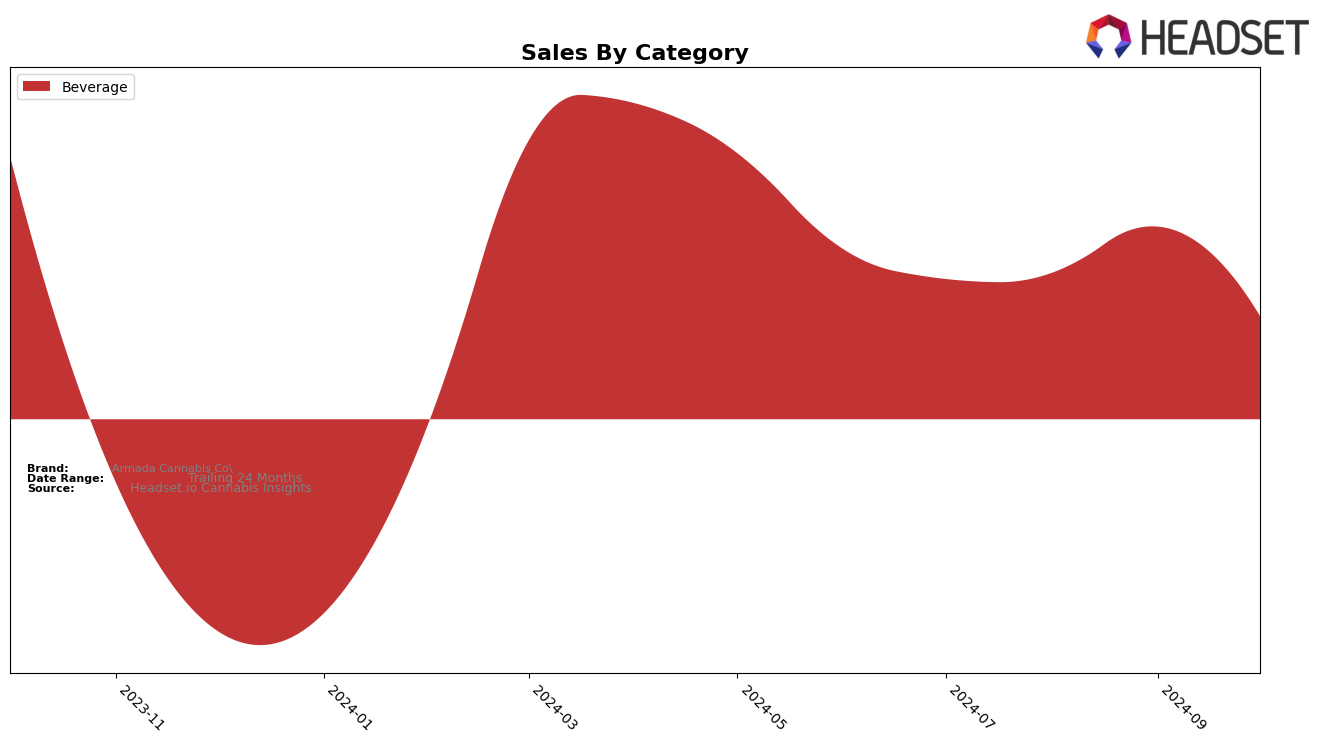

Armada Cannabis Co. has shown a notable performance in the Beverage category within Michigan. Over the past few months, the brand has consistently maintained a strong presence, ranking 10th in both July and August 2024. A slight improvement was observed in September 2024, where Armada climbed to the 8th position, before settling back to the 9th position in October 2024. This fluctuation in rankings indicates a competitive market environment, but Armada's ability to remain within the top 10 highlights its resilience and strong consumer base in the region. Notably, the brand's sales peaked in September, suggesting successful promotional strategies or product launches during that period.

While Armada Cannabis Co.'s performance in Michigan is commendable, it is important to note that the brand did not make it into the top 30 rankings in other states or provinces for the Beverage category during the same time frame. This absence from top rankings outside of Michigan could be indicative of either a strategic focus on the Michigan market or challenges in penetrating other markets. The brand's consistent ranking within Michigan suggests a solid market presence, yet there remains potential for growth and expansion into new regions. As the market continues to evolve, observing Armada's strategies and performance in other states could provide insights into its broader market ambitions.

Competitive Landscape

In the competitive landscape of the Michigan beverage category, Armada Cannabis Co. has shown a dynamic shift in rankings over the past few months. Starting from a consistent 10th position in July and August 2024, Armada Cannabis Co. improved to 8th place in September, before slightly declining to 9th in October. This fluctuation in rank reflects a competitive market where brands like Pleasantea and Detroit Edibles / Detroit Fudge Company have maintained stronger positions, consistently ranking higher than Armada Cannabis Co. Notably, Pleasantea has held a steady 6th or 7th place, indicating robust sales performance. Meanwhile, Ray's Lemonade entered the top 20 in October, debuting at 8th place, which could pose a new challenge for Armada Cannabis Co. as they strive to regain and improve their market position.

Notable Products

In October 2024, Armada Cannabis Co.'s top-performing product was Apple Cider (20mg) in the Beverage category, maintaining its number one rank from previous months. This product experienced a notable sales increase, reaching 10,748 units sold. The consistent top ranking of Apple Cider (20mg) highlights its strong market presence and popularity among consumers. Over the months from July to October, this product has shown a steady growth trajectory, indicating effective marketing strategies or strong consumer loyalty. The upward trend in sales suggests that Armada Cannabis Co. has successfully tapped into consumer preferences with this beverage offering.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.