Dec-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

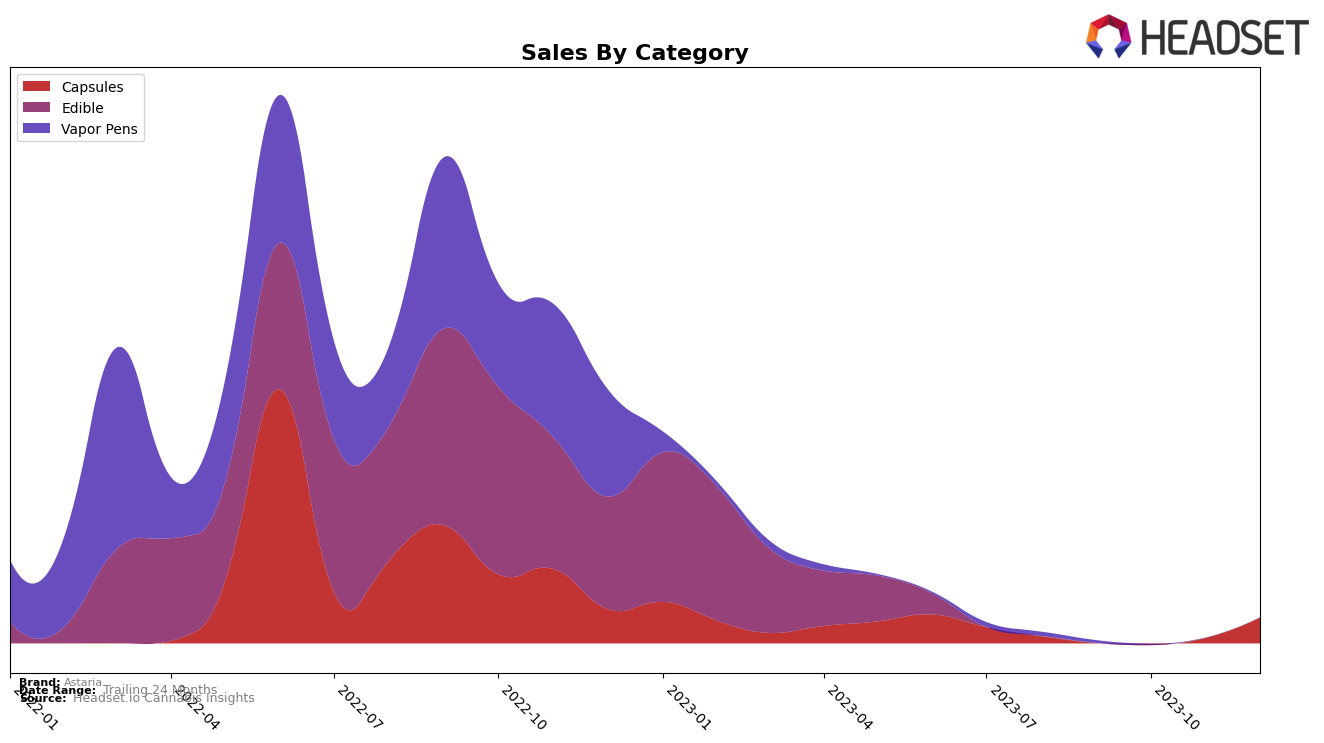

Looking at the performance of Astaria, specifically in the category of Capsules, we can observe some interesting trends. In the state of Massachusetts, the brand has shown a positive upward movement in its ranking. While no ranking data is available for September and October 2023, indicating that the brand was not in the top 20 for those months, Astaria made a strong comeback in November 2023, securing the 7th position. The upward trend continued into December 2023, with Astaria moving up one spot to the 6th position. This progression suggests an increased market presence and consumer preference for Astaria's Capsules in Massachusetts.

In terms of sales, the data reveals a significant surge from November to December 2023. Although the exact sales figures for September and October are not provided, the November sales stood at 391 units. This number experienced a remarkable increase in December, with sales skyrocketing to 1,836 units. This substantial growth in sales, combined with the improvement in ranking, points towards a promising end of the year for Astaria in the Capsules category within Massachusetts. However, it would be interesting to see if this momentum carried into the following year and how it compared to the performance in other states and categories.

Competitive Landscape

In the Massachusetts Capsules category, Astaria has shown a notable upward trend in the last quarter of 2023. Despite not ranking in the top 20 brands in September and October, Astaria made a significant leap to the 7th position in November and further improved to 6th place in December. This growth is even more impressive when compared to competitors like Blue River Extracts and Sanctuary Medicinals, who have maintained a steady rank but not shown the same level of progress. Another competitor, Garden Remedies, despite having a higher rank in November, fell behind Astaria in December. Interestingly, Western MA Hemp Inc. who was ahead of Astaria in September, did not appear in the top 20 brands for the rest of the quarter, indicating a potential decline. The sales trend for Astaria also mirrors its rank, with sales increasing significantly from November to December.

Notable Products

In December 2023, Astaria's top-performing product was the CBD/THC/CBN 1:1:1 Sleep Capsules 20-Pack, which falls under the Capsules category. This product maintained its top rank from November 2023, showing consistent high performance. Notably, sales for this product significantly increased from 10 in November to 48 in December, indicating a strong upward trend. On the other hand, the CBD/THC/CBN 1:1:1 Sleep Distillate Cartridge, which is a Vapor Pen, did not rank in December despite being the top product in September. The data suggests a shift in customer preference towards Capsules over Vapor Pens during this period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.