Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

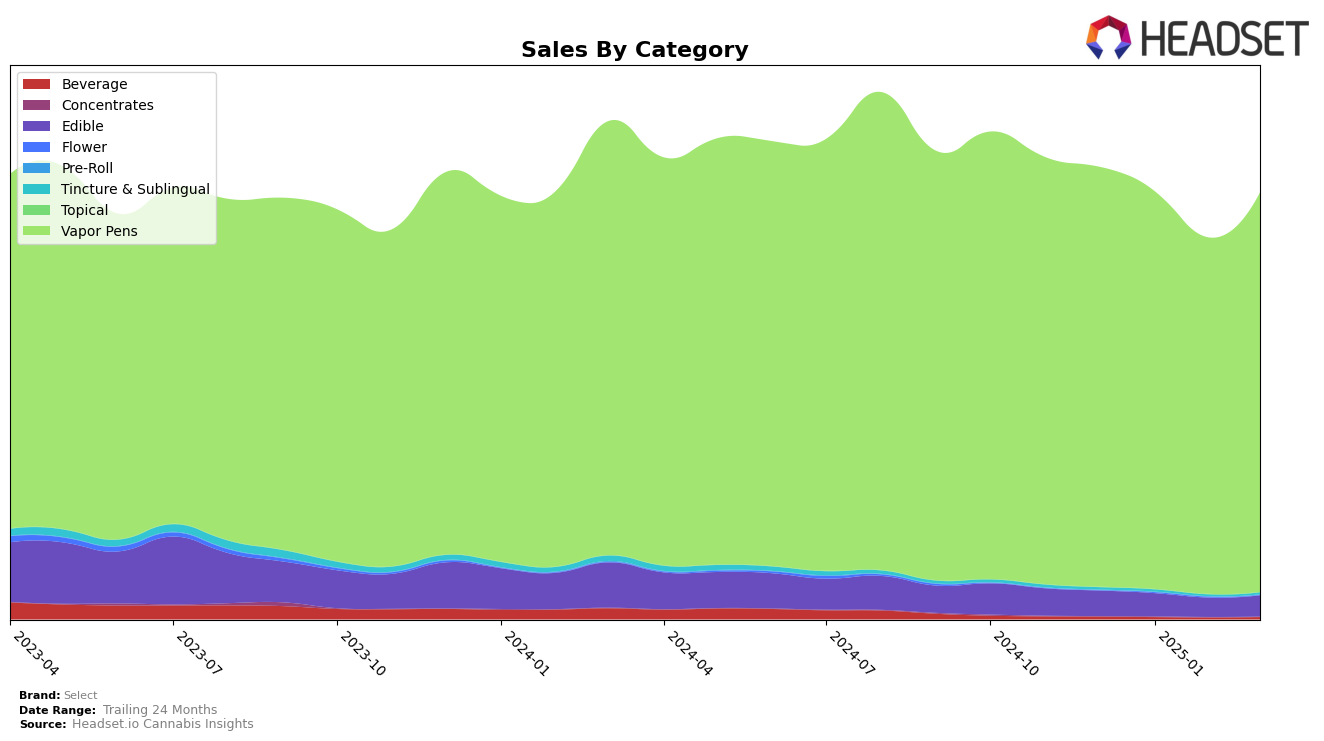

In the realm of vapor pens, Select has maintained a dominant position in several key markets. In Arizona and Maryland, Select has consistently held the number one spot from December 2024 through March 2025. This unwavering leadership is indicative of the brand's strong market penetration and consumer loyalty in these states. Meanwhile, in Illinois and New Jersey, Select has consistently secured the second position, showing a solid performance despite the competitive landscape. Notably, in Massachusetts, Select improved its rank from third to second position by February 2025, highlighting a positive trend in consumer preference.

However, Select's performance varies across other markets. In Nevada, the brand maintained a steady fourth position, indicating a stable presence but room for growth. On the other hand, Select's ranking in Missouri and Oregon showed some fluctuation, with rankings hovering around the 19th to 21st positions, suggesting challenges in gaining a stronger foothold. Notably, in New York, Select dropped out of the top 30 after January 2025, which could be a point of concern for the brand's market strategy in the state. This diverse performance across states underscores the varying competitive dynamics and consumer preferences that Select must navigate to optimize its market share.

Competitive Landscape

In the Arizona Vapor Pens category, Select has maintained a dominant position, consistently holding the top rank from December 2024 through March 2025. This stability in rank underscores Select's strong market presence and consumer preference in the region. Despite facing competition from brands like STIIIZY and Mfused, which have alternated between the second and third positions, Select's sales have shown a steady upward trajectory. This suggests a robust brand loyalty and effective market strategies that have allowed Select to not only retain its leading position but also expand its sales margin over competitors. The consistent top ranking and increasing sales highlight Select's effective market penetration and brand strength in the Arizona Vapor Pens market.

Notable Products

In March 2025, the top-performing product for Select was the Fruit Stiq - Sweet Strawberry Distillate Disposable (1g) in the Vapor Pens category, reclaiming its number one position from December 2024 with sales of 12,393 units. The Fruit Stiq - Blackberry Blast Distillate Disposable (1g), which had held the top spot in January and February, slipped to second place. The Fruit Stiq - Key Lime Tide BDT Distillate Disposable (1g) consistently maintained its presence in the top three, ranking third in March. The Fruit Stiq - Go Go Guava Distillate Disposable (1g) showed stable performance, securing the fourth rank for two consecutive months. Notably, the Fruit Stiq - Lemon Sunset Distillate Disposable (1g) entered the rankings at fifth place, demonstrating a positive trend in its sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.