Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

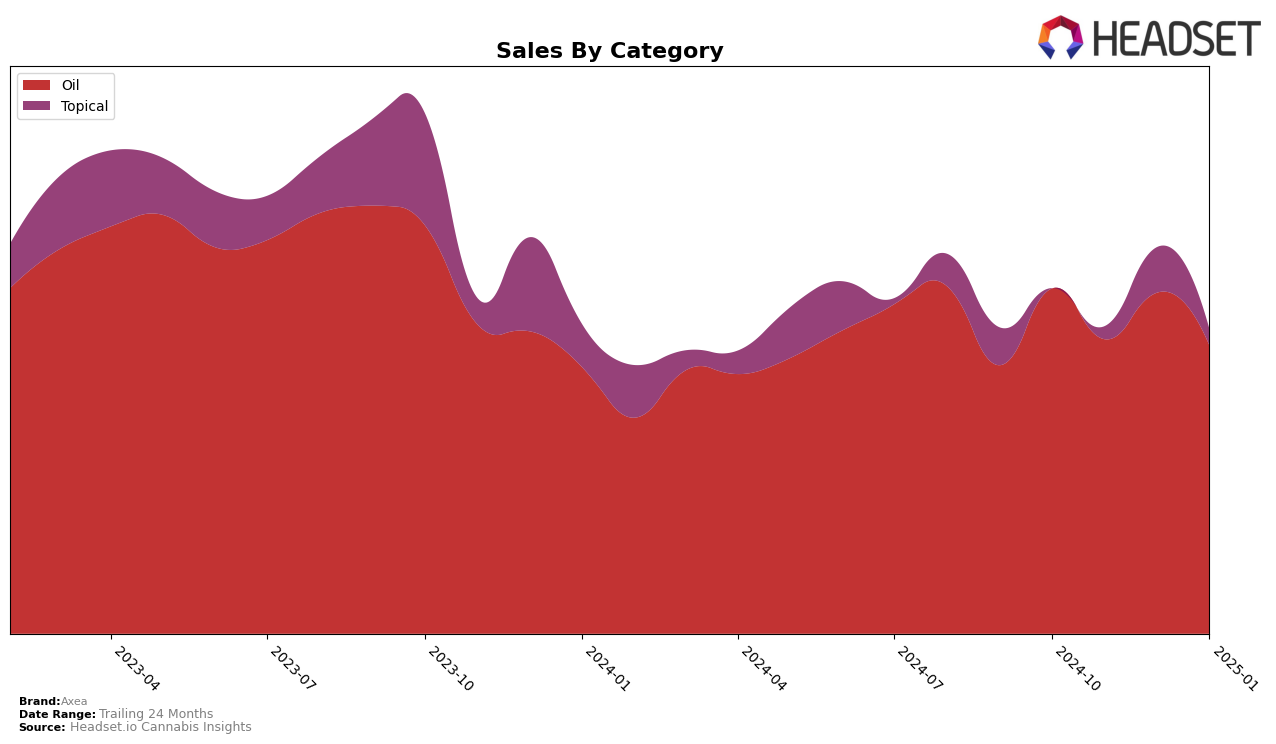

In the Canadian market, Axea has demonstrated a consistent presence in the oil category within Ontario. Over the months from October 2024 to January 2025, Axea has maintained a steady ranking, hovering around the top 10, with positions fluctuating between 8th and 10th place. This stability suggests a solid consumer base and a reliable demand for their oil products. Despite a slight dip in sales in November 2024, Axea managed to recover and maintain its ranking, indicating resilience in a competitive market. The ability to stay within the top 10 is a positive indicator of brand strength in Ontario's oil category.

While Axea's performance in Ontario's oil segment is noteworthy, it is important to highlight that the brand did not appear in the top 30 rankings for other states or categories during this period. This absence could suggest areas for potential growth or improvement, as expanding their presence beyond Ontario could offer new opportunities for market penetration. Understanding the dynamics of other regions and categories could be crucial for Axea's strategic planning and long-term growth. The brand's focus on maintaining its stronghold in Ontario might be a deliberate strategy, but exploring additional markets could provide a more robust competitive edge.

Competitive Landscape

In the competitive landscape of the oil category in Ontario, Axea has demonstrated resilience and adaptability in its market positioning. Over the four-month period from October 2024 to January 2025, Axea's rank fluctuated between 8th and 10th place, indicating a stable presence in the top tier despite competitive pressures. Notably, ufeelu consistently outperformed Axea, maintaining a rank between 7th and 8th, with a clear upward trajectory in sales, suggesting a growing consumer preference. Meanwhile, Glacial Gold held a strong position, ranking 5th initially but slipped to 6th in January 2025, which may indicate potential vulnerabilities that Axea could capitalize on. Twd. and Divvy remained behind Axea, with Twd. consistently ranking lower and Divvy re-entering the top 20 in December 2024. Axea's ability to maintain its rank amidst these dynamics suggests a solid brand loyalty and market strategy, though the brand may need to innovate or enhance its offerings to climb higher in the rankings and close the gap with leading competitors.

Notable Products

In January 2025, the top-performing product for Axea was the THC-Free Daytime CBD Isolate Oil (30ml), maintaining its consistent number one rank with sales of 788 units. The CBD Frankinsence Dead Sea Pink Himalayan Bath Salt (250mg CBD, 250g) held steady at the second position, following its rise from fourth place in October 2024. The CBN/CBD Nighttime THC-Free Isolate Oil (30ml) remained in third place, though its sales figures saw a decline from previous months. Notably, the THC Pure Isolate Oil (30ml) climbed from fifth in October to tie for third in January, marking a significant improvement in its ranking. Meanwhile, the THC-Free Be Well CBG Isolate Oil (30ml) dropped to fourth place, continuing its downward trend in sales and ranking since October 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.