Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

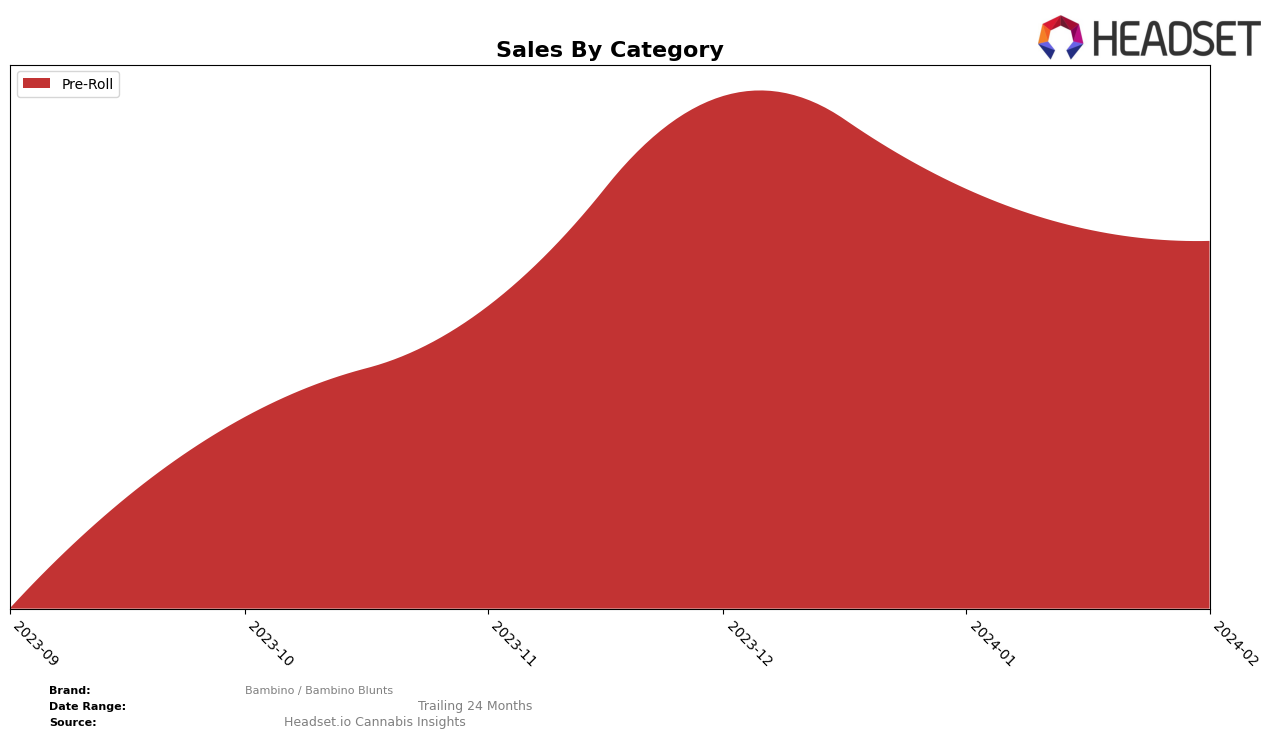

In the competitive cannabis market of Missouri, Bambino / Bambino Blunts has shown a noteworthy performance in the Pre-Roll category, demonstrating a positive trajectory in rankings over the recent months. Starting outside of the top 30 in November 2023, the brand made a significant leap into the rankings, securing the 28th position by December 2023, and maintaining a stable presence at the 27th spot through January and February 2024. This upward movement is indicative of growing consumer acceptance and preference for Bambino / Bambino Blunts' offerings in the state's Pre-Roll market. The sales figures reflect this positive trend, with a notable increase from November 2023's sales of $67,396 to December 2023, where sales surged to $108,172, before stabilizing in the subsequent months. This suggests an expanding market share and a solidifying position within Missouri's competitive landscape.

However, the absence of Bambino / Bambino Blunts from the top 30 brands in the Pre-Roll category in November 2023 highlights initial challenges in capturing market attention amidst a crowded space. The quick recovery and subsequent stability in rankings from December 2023 through February 2024 underscore a successful strategic adjustment and growing consumer base. The consistent ranking at the 27th position, alongside a slight decrease in sales from January to February 2024, suggests a phase of consolidation for the brand within the Missouri market. This performance trajectory, marked by initial hurdles followed by rapid improvement and stabilization, offers valuable insights into the brand's market dynamics, consumer reception, and the effectiveness of its strategies in navigating the competitive landscape of the cannabis industry in Missouri.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Missouri, Bambino / Bambino Blunts has shown a notable trajectory in terms of rank and sales, amidst a dynamic market. Initially ranked 37th in November 2023, Bambino / Bambino Blunts made a significant leap to 28th in December, maintaining a strong position at 27th in January 2024, and slightly adjusting to 27th in February 2024. This movement indicates a positive trend in both rank and sales, showcasing the brand's growing appeal and market penetration. Competitors such as Bison and Vibe Cannabis (MO) have experienced fluctuations in their rankings, with Bison seeing a decline from 15th to 26th from November 2023 to February 2024, and Vibe Cannabis (MO) moving from 18th to 25th in the same period. Other brands like Daybreak Cannabis and Notorious have also seen significant rank changes, indicating a highly competitive and shifting market. Bambino / Bambino Blunts' steady rise in the ranks, despite the competitive pressures and the dynamic nature of the market, highlights its growing prominence and potential for increased market share in Missouri's Pre-Roll category.

Notable Products

In February 2024, Bambino / Bambino Blunts saw Chemdawg OG Infused Blunt (1.4g) as its top-selling product in the Pre-Roll category, with sales reaching 895 units. Following closely behind was the Kush Cake Infused Blunt (1.4g), which was the previous month's leader but dropped to second place with 870 units sold. The third spot was taken by Grape Juice Infused Blunt (1.4g), marking its entry into the top three with 840 units sold, despite not being ranked in January. Trop Cherry Blunt (1.25g) and OG Wreck Infused Blunt (1.4g) rounded out the top five, with the latter experiencing a significant drop from the top position in December to fifth in February. These shifts in rankings highlight dynamic consumer preferences within the Bambino / Bambino Blunts lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.