Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

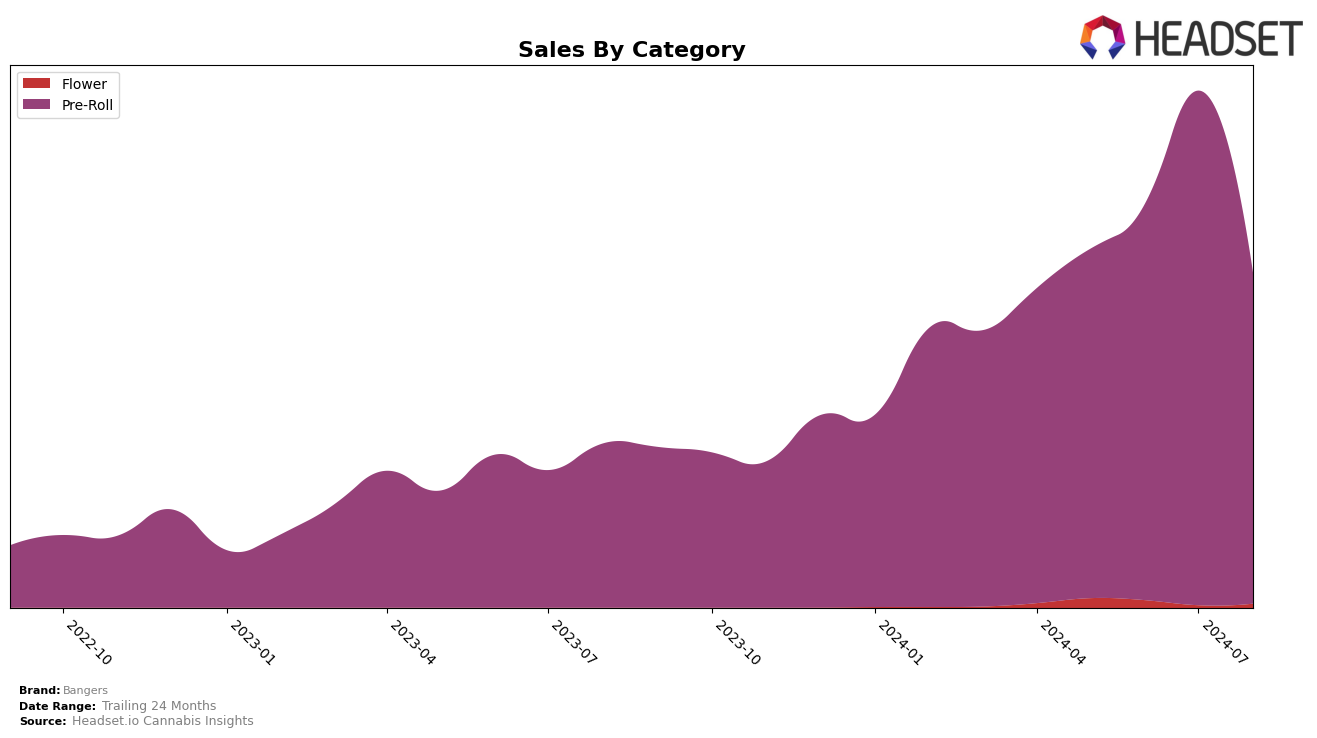

Bangers has shown notable performance improvements in the Pre-Roll category across multiple states, with Arizona being a standout. In Arizona, Bangers climbed from a rank of 44 in May 2024 to 22 by August 2024, reflecting a steady upward trajectory. This improvement is underscored by a significant increase in sales, which rose from $41,767 in May to $70,412 in August. This consistent rise in rankings and sales suggests a growing consumer preference for Bangers' products in Arizona's competitive market.

In contrast, Bangers' performance in California presents a more mixed picture. After climbing from a rank of 56 in May to 35 in July, Bangers experienced a dip to 51 in August. Despite this fluctuation, the brand saw a substantial increase in sales between May and July, peaking at $323,268 in July before dropping to $177,217 in August. The decline in both rank and sales in August indicates potential challenges in maintaining market momentum in California's dynamic market landscape. This variability highlights the importance of closely monitoring market conditions and consumer trends to sustain growth in such a competitive environment.

Competitive Landscape

In the competitive landscape of the California Pre-Roll category, Bangers has experienced notable fluctuations in rank and sales over the past few months. While Bangers saw a significant rise from 56th in May 2024 to 35th in July 2024, it dropped to 51st in August 2024. This volatility contrasts with the more stable performance of competitors like Raw Garden, which improved its rank from 65th in May to 46th in August, and Cruisers, which maintained a relatively steady position around the mid-40s. Despite a peak in sales in July, Bangers' August sales dipped significantly, suggesting potential challenges in maintaining consistent market traction. Meanwhile, 3C Farms / Craft Cannabis Cultivation and Alien Labs have shown gradual improvements in rank, indicating growing consumer interest. These dynamics highlight the competitive pressures Bangers faces and underscore the importance of strategic adjustments to sustain its market position.

Notable Products

In August 2024, the top-performing product for Bangers was Pineapple OG Infused Pre-Roll 2-Pack (1g), which climbed from third place in July to first place, achieving sales of $4005. Strawberry Cheesecake Infused Pre-Roll 2-Pack (1.2g) secured the second position, making a notable entry into the rankings. Lime Slushy Infused Pre-Roll 2-Pack (1.2g) maintained a strong performance, moving up from being unranked in July to third place in August. Cherry Zlushie Infused Pre-Roll 2-Pack (1.2g) rose to fourth place from fifth in July. Grape Ape Infused Pre-Roll 2-Pack (1.2g) saw a significant drop, falling from first place in July to fifth place in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.