Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

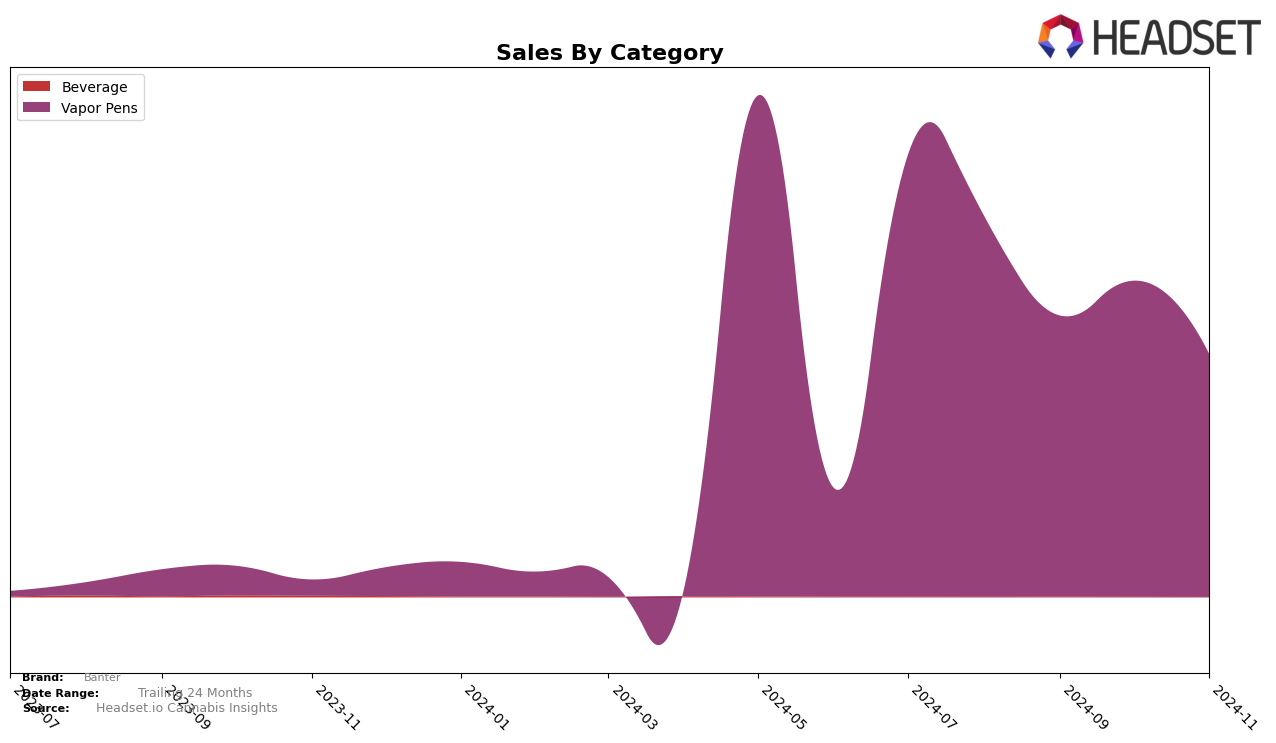

In the Vapor Pens category, Banter's performance has shown varying trends across different provinces. In Alberta, Banter has consistently maintained a presence within the top 30 brands, although its ranking has fluctuated from 22nd in August to 30th by November. This indicates a downward trend in market position, which might be a concern for the brand as it faces increasing competition. Conversely, in Ontario, Banter's ranking was absent in September, indicating it fell outside of the top 30, but it reappeared in October at 65th. This rebound suggests some recovery, though the brand's position remains volatile. Meanwhile, in Saskatchewan, Banter experienced a significant drop from 18th in August and September to 40th in October, and it was not ranked in November, suggesting a steep decline in market performance.

Sales trends for Banter in these regions also reflect the fluctuations in rankings. In Alberta, a decline in sales from August to November aligns with its drop in ranking, highlighting a potential area for strategic improvement. Ontario's sales figures show a slight recovery in October after being unranked in September, which could indicate efforts to regain market share. However, the sales in November were nearly identical to August, suggesting a plateau. Saskatchewan's sales data reveal a sharp decline in October, correlating with the drop in ranking, and the absence of a ranking in November suggests that sales likely did not recover enough to place the brand back in the top 30. These trends highlight the varying challenges and opportunities Banter faces across different markets, with each region showing distinct patterns in consumer preferences and competitive dynamics.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Banter has experienced a fluctuating performance in recent months, affecting its rank and sales trajectory. As of November 2024, Banter's rank dropped to 30th, a decline from its position at 22nd in August 2024. This downward trend is mirrored in its sales, which have decreased from September to November. Notably, Foray has also seen a decline in rank from 16th to 28th over the same period, with a significant drop in sales, suggesting a broader market challenge. Meanwhile, Versus maintained a relatively stable rank, only slightly dropping from 25th to 31st, indicating a consistent market presence despite sales fluctuations. Interestingly, Tuck Shop emerged in the rankings, climbing to 29th in November from being unranked in August, showcasing a potential new competitor gaining traction. These dynamics suggest that Banter faces intensified competition and market volatility, underscoring the need for strategic adjustments to regain its competitive edge in Alberta's vapor pen category.

Notable Products

In November 2024, Raspberry Rush Liquid Diamonds Cartridge (1g) emerged as the top-performing product for Banter, maintaining its number one rank from September, despite a slight decline in sales to 1979 units. Watermelon Wave Liquid Diamonds Cartridge (1g) followed closely at the second spot, dropping from its previous first-place position in October. Blueberry Blast Liquid Diamonds Disposable (1g) held steady at third place for the second consecutive month, reflecting consistent popularity in the Vapor Pens category. Blueberry Blast Liquid Diamonds Cartridge (1g) remained in fourth place, with minor fluctuations in sales figures over the months. Raspberry Ice Distillate Cartridge (1g) re-entered the rankings in November at fifth place, after not being ranked in October, indicating a resurgence in consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.