Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

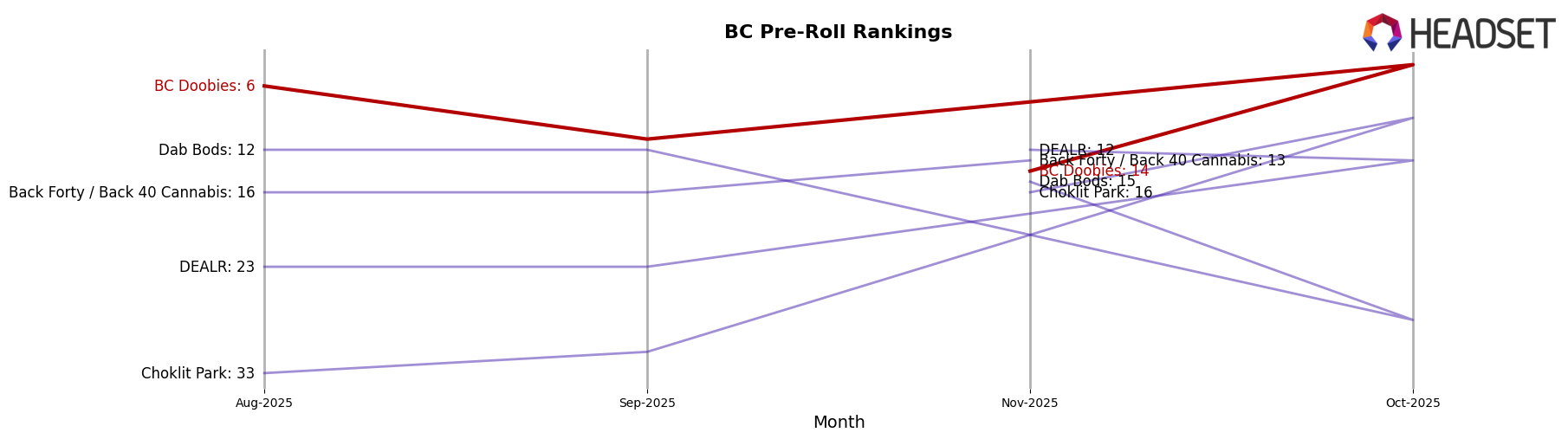

BC Doobies has shown fluctuating performance across different states and categories, with notable changes observed in British Columbia and Ontario. In British Columbia, BC Doobies' ranking in the Pre-Roll category experienced significant movement, with the brand rising to the 4th position in October 2025 before dropping to 14th in November. This indicates a volatile market presence, potentially influenced by seasonal demand or competitive pressures. The sales figures reflect this volatility, with a peak in October followed by a substantial decline in November. Such fluctuations suggest that while BC Doobies can capture consumer interest, sustaining that momentum remains a challenge in this market.

In contrast, the performance of BC Doobies in Ontario tells a different story. The brand has struggled to break into the top 30 in the Pre-Roll category, consistently ranking outside of this range from August through November 2025. This persistent lower ranking suggests that BC Doobies faces stiff competition or lacks the brand recognition needed to make a significant impact in Ontario. The sales trend in Ontario is relatively stable but modest, with a slight dip in November compared to previous months. This stability, albeit at a lower level, might indicate a loyal but limited consumer base. Understanding the factors behind these differing performances in British Columbia and Ontario could provide insights for strategic adjustments.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, BC Doobies has experienced notable fluctuations in its ranking and sales performance. Despite a strong start in August 2025 with a rank of 6th, BC Doobies saw a dip to 11th in September, only to recover impressively to 4th place in October. However, by November, the brand had slipped to 14th, indicating a volatile market presence. This fluctuation is contrasted by brands like Dab Bods, which maintained a relatively stable position, albeit with a dip to 28th in October before climbing back to 15th in November. Meanwhile, Choklit Park showcased a significant rise from 31st in September to 9th in October, though it fell to 16th in November. The competitive dynamics are further highlighted by Back Forty / Back 40 Cannabis, which re-entered the top 20 in November at 13th after being absent in October. These shifts suggest that while BC Doobies has the potential for high sales, maintaining a consistent market position amidst dynamic competitors remains a challenge.

Notable Products

In November 2025, the top-performing product from BC Doobies was the Tokyo Sunset Pre-Roll 3-Pack (1.5g), which climbed to the number one spot with sales reaching 8,282 units. The Bubblegum Ice Cream Pre-Roll 2-Pack (2g) secured the second position, maintaining a strong presence despite not ranking in October. Deep Fried Ice Cream Pre-Roll 2-Pack (2g) made a notable return, ranking third after not being in the top ranks for the previous two months. Genghis Chron Pre-Roll 10-Pack (5g) slipped to fourth place from its consistent second position in September and October. Brazilian Haze Pre-Roll 2-Pack (2g) experienced a significant drop, moving from the top rank in October to fifth in November, indicating a sharp decline in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.