Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

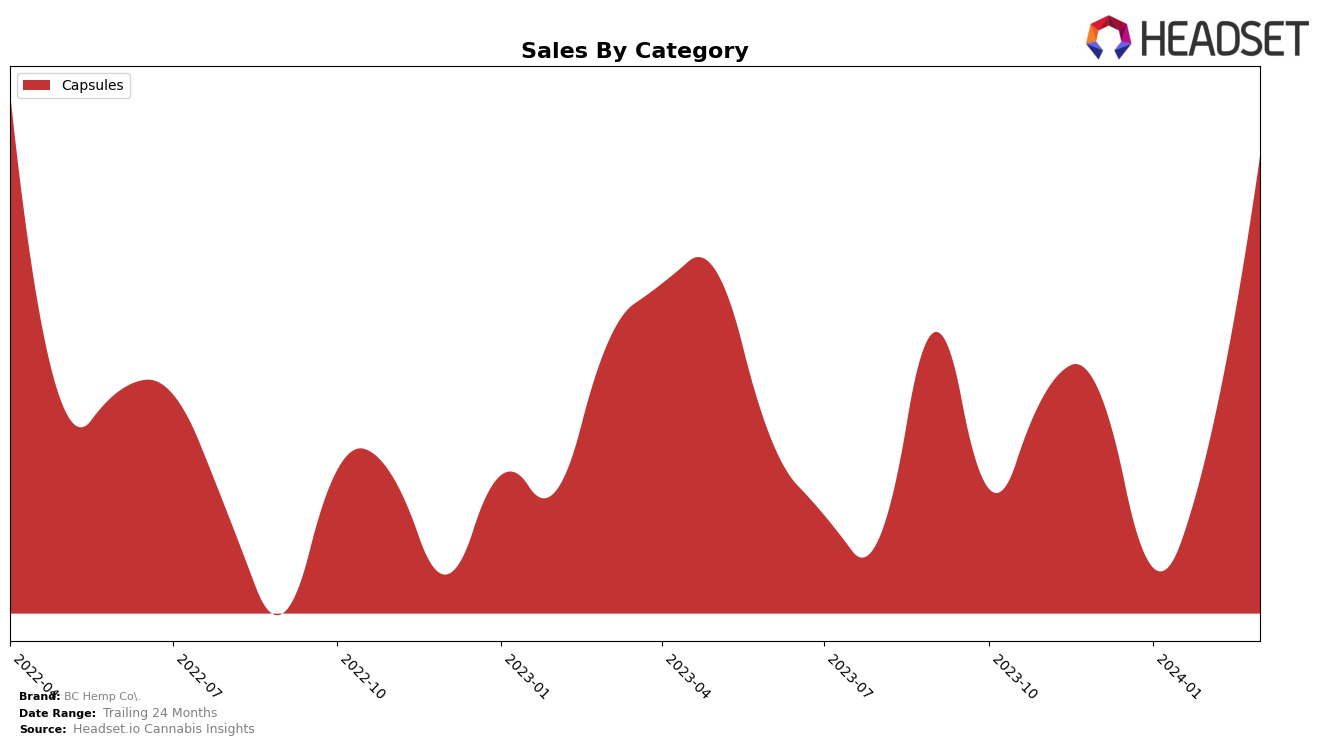

In Michigan, BC Hemp Co. has demonstrated a notable presence in the Capsules category, reflecting a consistent performance over recent months. Starting from December 2023, the brand held the 6th rank, experienced a slight dip to the 8th position in January 2024, but impressively bounced back to 6th place in February and maintained this rank into March. This fluctuation, particularly the recovery and maintenance of its position, underscores the brand's resilience and ability to regain its footing in a competitive market. Although there was a significant drop in sales from December to January, the following months saw a remarkable recovery, with March 2024 sales more than doubling February's figures, showcasing a strong consumer demand for their Capsule products.

While the provided data focuses solely on Michigan, the performance of BC Hemp Co. in this state offers valuable insights into its market dynamics and consumer preferences. The recovery in sales and stable ranking within the top 10 brands for Capsules in Michigan suggest a loyal customer base and effective market strategies. However, the absence of information regarding the brand's performance across other states or provinces, as well as in other product categories, leaves room for speculation about its overall market footprint and diversification. This singular snapshot of success in the Capsules category within Michigan highlights the brand's potential, yet it's important to consider how it scales and competes across broader markets and product lines.

Competitive Landscape

In the competitive landscape of the Michigan cannabis capsules market, BC Hemp Co. has shown a notable performance. Initially ranked 6th in December 2023, it experienced a slight dip to 8th place in January 2024 before climbing back to 6th in February and maintaining this rank into March 2024. This fluctuation in ranking is mirrored by its sales trajectory, which saw a significant dip in January followed by a robust recovery, ultimately leading to a substantial increase in March. Competitors such as Pure Essentials and Neno's Naturals have maintained higher ranks and sales throughout this period, indicating a strong presence in the market. Meanwhile, brands like Tree House CBD and Mary's Medicinals have shown fluctuations in both rank and sales, but none have matched BC Hemp Co.'s dramatic recovery in March 2024. This analysis suggests that while BC Hemp Co. faces stiff competition, its recent sales surge could signify a growing momentum within the Michigan capsules category, potentially affecting its market position and competitive standing in the longer term.

Notable Products

In Mar-2024, BC Hemp Co.'s top-performing product was the Full Spectrum Capsules 60-Pack (1500mg) within the Capsules category, maintaining its number one rank consistently from Dec-2023 through Mar-2024. This product saw a significant sales increase in March, reaching 59 units sold. Notably, this marks the highest sales figure for a single product in the dataset for that month. The consistent top ranking of the Full Spectrum Capsules 60-Pack (1500mg) over four months highlights its steady popularity and consumer demand within the BC Hemp Co. lineup. Unfortunately, without additional data, comparisons to other products in the same period are limited, but this product's performance is clearly a standout.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.