Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

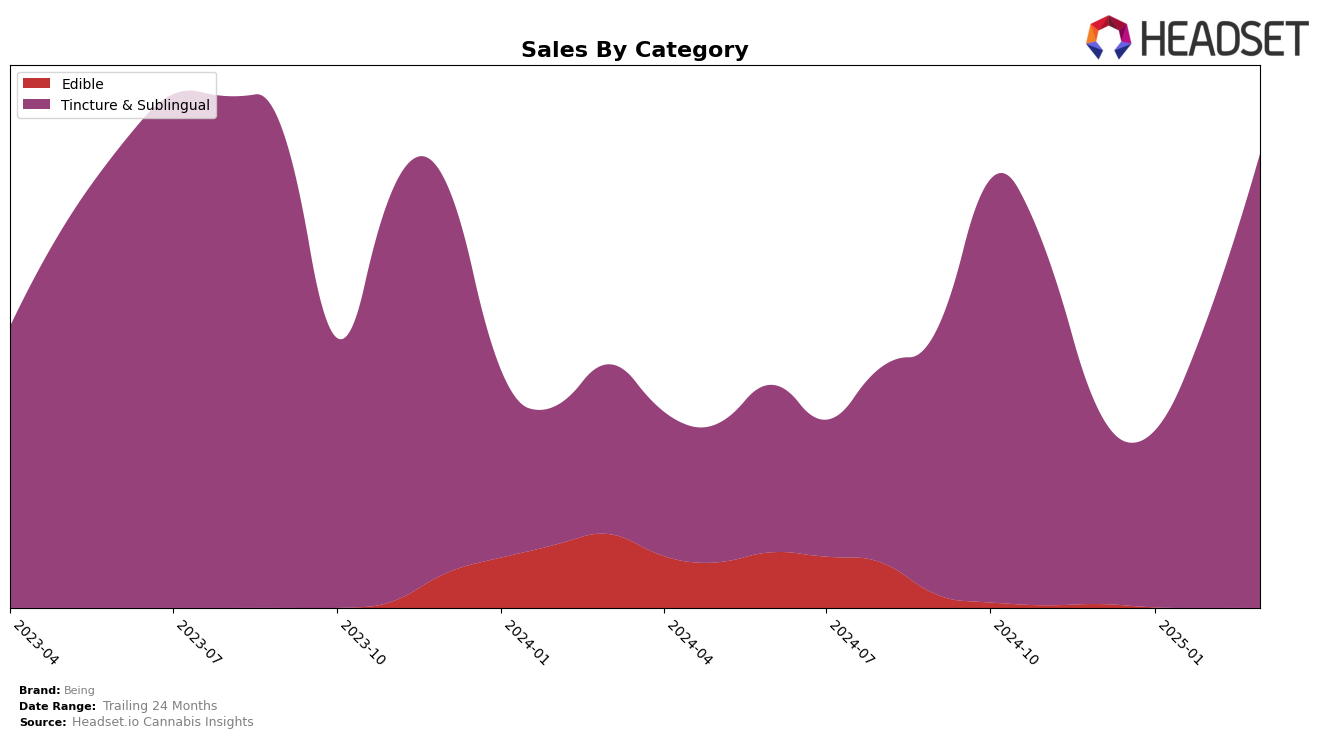

Being has shown remarkable consistency in the Tincture & Sublingual category across certain Canadian provinces. In British Columbia, the brand has maintained a stronghold, consistently ranking at the top position from December 2024 through March 2025. This indicates a solid consumer base and effective brand strategy in the province. Notably, sales in March 2025 witnessed a significant increase, suggesting either a successful marketing campaign or a seasonal demand spike. Meanwhile, in Saskatchewan, Being emerged as the top brand in February and March 2025, despite not being in the top 30 in the preceding months. This sudden rise could be attributed to strategic market penetration or a shift in consumer preferences.

While Being's performance in British Columbia remains stable at the pinnacle, the brand's absence from the top 30 rankings in Saskatchewan prior to February 2025 raises questions about its market presence earlier in the period. The brand's ability to climb to the number one spot in just a couple of months is noteworthy and could be reflective of aggressive market strategies or new product offerings that resonated well with consumers. The lack of rankings in other states or provinces suggests that Being's focus or success might be concentrated in these regions, or that they are yet to make significant inroads elsewhere. Such information points to potential growth opportunities if the brand decides to expand its footprint beyond its current strongholds.

Competitive Landscape

In the British Columbia Tincture & Sublingual category, Being has consistently maintained its top rank from December 2024 through March 2025. This unwavering position highlights its dominance in the market, especially as it has not been displaced by any competitors during this period. The brand's sales trajectory also shows a significant upward trend, with a notable increase from February to March 2025, suggesting a growing consumer preference or successful marketing strategies. While specific competitors are not listed in the top 20 for this category, Being's ability to sustain its number one rank amidst potential market pressures underscores its strong brand presence and consumer loyalty in British Columbia.

```

Notable Products

In March 2025, Being's top-performing product was THC Fast Acting Oral Quickstrip 10-Pack (100mg), maintaining its leading position for four consecutive months with sales reaching 2575 units. CBD Fast Acting Oral Quickstrip 10-Pack (100mg CBD) climbed to the second rank, up from third in December 2024 and second in January 2025, with notable sales of 204 units. The product CBG :THC 3:1 Red Raspberry Gummies 4-Pack (30mg CBG, 10mg THC) did not rank in March 2025, having previously held the second and third ranks in December 2024 and January 2025, respectively. The Tincture & Sublingual category continues to dominate, with its products holding the top two spots. Overall, these rankings reflect a consistent demand for quickstrip formats over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.