Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

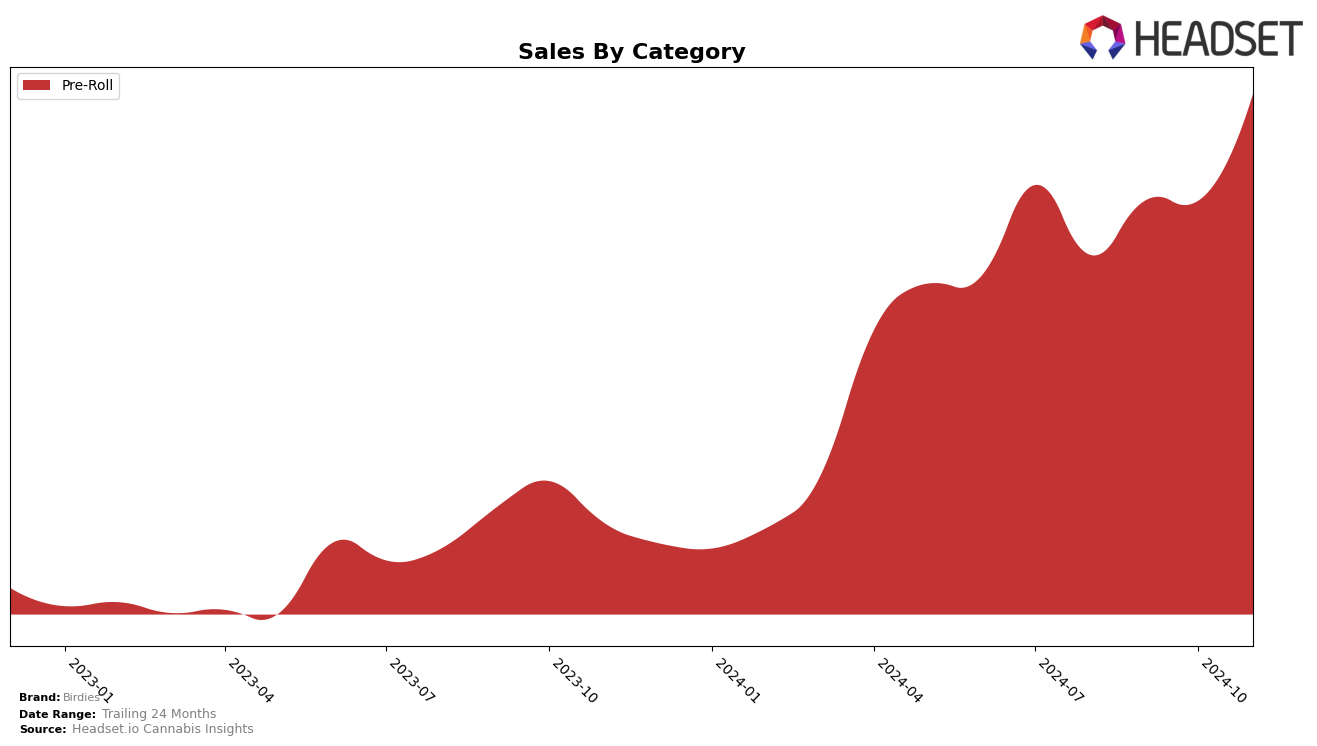

Birdies has demonstrated notable performance in the Pre-Roll category across different states, with significant upward trends in rankings and sales. In Arizona, Birdies has shown a consistent climb from the 11th position in August 2024 to 7th in November 2024, indicating a strengthening market presence. This positive movement is coupled with a substantial increase in sales, highlighting the brand's growing popularity and consumer preference in the state. However, in California, Birdies was absent from the top 30 in August 2024, but made a notable entry at 97th in September and climbed to 76th by November. This suggests a gradual yet promising improvement in market penetration in California, albeit from a lower starting point compared to Arizona.

While Birdies' performance in Arizona showcases a strong upward trajectory, its journey in California reflects the challenges of establishing a foothold in a highly competitive market. The absence from the top 30 in August 2024 in California underscores the hurdles faced by the brand, yet the subsequent rise in rankings indicates strategic efforts to capture market share. The contrasting scenarios in these states highlight the varying dynamics and competitive landscapes Birdies navigates across regions. Such insights provide a glimpse into the brand's strategic positioning and market adaptation, offering valuable lessons for stakeholders interested in the cannabis industry's evolving trends.

Competitive Landscape

In the competitive landscape of the Arizona pre-roll category, Birdies has shown a notable upward trajectory in its market positioning over the past few months. From August to November 2024, Birdies improved its rank from 11th to 7th, indicating a significant gain in market presence. This improvement is particularly noteworthy when compared to competitors like Sublime, which remained relatively stable around the 9th and 10th positions, and Find., which experienced a decline from 5th to 8th place. Meanwhile, Tumble and The Pharm maintained stronger positions, consistently ranking in the top 6. Birdies' sales growth, particularly the jump from October to November, suggests a positive trend that could potentially challenge these higher-ranked competitors if sustained. This dynamic shift highlights Birdies' increasing appeal and market penetration, setting the stage for potential future advancements in the Arizona pre-roll market.

Notable Products

In November 2024, the top-performing product for Birdies was the Hybrid Classic Pre-Roll 10-Pack (7g), which ascended to the number one rank with notable sales of 3,895 units, overtaking its previous third-place position from October. The Indica Classic Pre-Roll 10-Pack (7g) maintained a strong presence, holding the second rank consistently for two months. The Sativa Classic Pre-Roll 10-Pack (7g), previously the top product, experienced a drop to third place in November. The Indica Ultra Diamond Infused Pre-Roll 3-Pack (2.5g) remained stable at fourth place, while the Hybrid Ultra Diamond Infused Pre-Roll 3-Pack (2.5g) rounded out the top five, showing a slight improvement from its previous fifth-place standing. This shift in rankings highlights the growing preference for Hybrid products among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.