Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

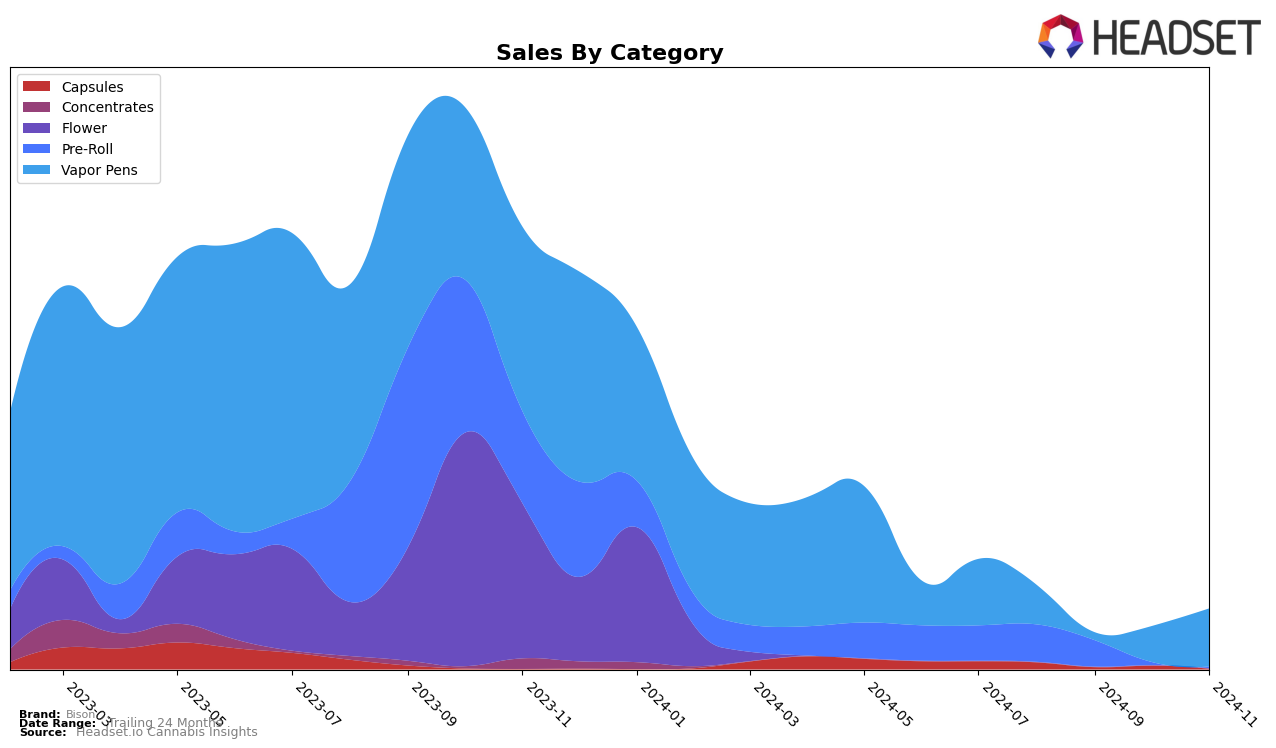

Bison's performance across various categories in Missouri reveals some intriguing trends. In the Capsules category, Bison achieved a notable rank of 4 in August 2024, but subsequently did not appear in the top 30, which suggests a significant drop in visibility or competition from other brands. This could indicate a potential area for improvement or a strategic shift in focus from Bison. Meanwhile, in the Pre-Roll category, Bison's ranking fell from 37 in August to 44 in September, after which it did not rank within the top 30, highlighting a downward trend that may require attention to regain market share.

Conversely, Bison's performance in the Vapor Pens category in Missouri shows a positive trajectory, with a significant rise from rank 70 in September to 44 by November 2024. This upward movement suggests a successful strategy or product offering that resonates well with consumers in this category. The consistent improvement in rankings over the months indicates a strengthening presence that could potentially lead to further gains if the trend continues. While specific sales figures are not disclosed here, the directional movement suggests a promising opportunity for Bison to capitalize on their momentum in the Vapor Pens category.

Competitive Landscape

In the Missouri vapor pens category, Bison has experienced notable fluctuations in its market position over the past few months. Starting at rank 53 in August 2024, Bison saw a dip to rank 70 in September, before recovering to rank 54 in October and further improving to rank 44 in November. This upward trend in rank suggests a positive reception to recent strategic adjustments or product offerings. In contrast, Smokey River Cannabis maintained a relatively stable presence, though it experienced a slight decline from rank 26 in September to 39 in November. Meanwhile, Cloud Cover (C3) and Flower by Edie Parker have shown less volatility, with ranks hovering in the 30s and 40s respectively, but neither brand has demonstrated the same upward momentum as Bison. The competitive landscape indicates that while Bison is making strides in improving its market position, it still faces significant competition from established brands like Smokey River Cannabis and Cloud Cover (C3), which have maintained higher sales figures over the same period.

Notable Products

In November 2024, Pineapple Express Distillate Disposable (2g) held the top position in Bison's product lineup, maintaining its number one rank from October with notable sales of 533 units. Forbidden Fruit Distillate Disposable (2g) improved its standing, moving from third to second place, while Jack Herer Distillate Disposable (2g) climbed from fifth to third. Gelato Distillate Disposable (2g) entered the rankings in November at fourth place, showing a strong debut. Calm Pre-Roll (1g) appeared in the rankings for the first time, securing the fifth position. The rankings indicate a strong preference for vapor pens in Bison's product range, with consistent improvements and new entries shaping the sales landscape.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.