Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

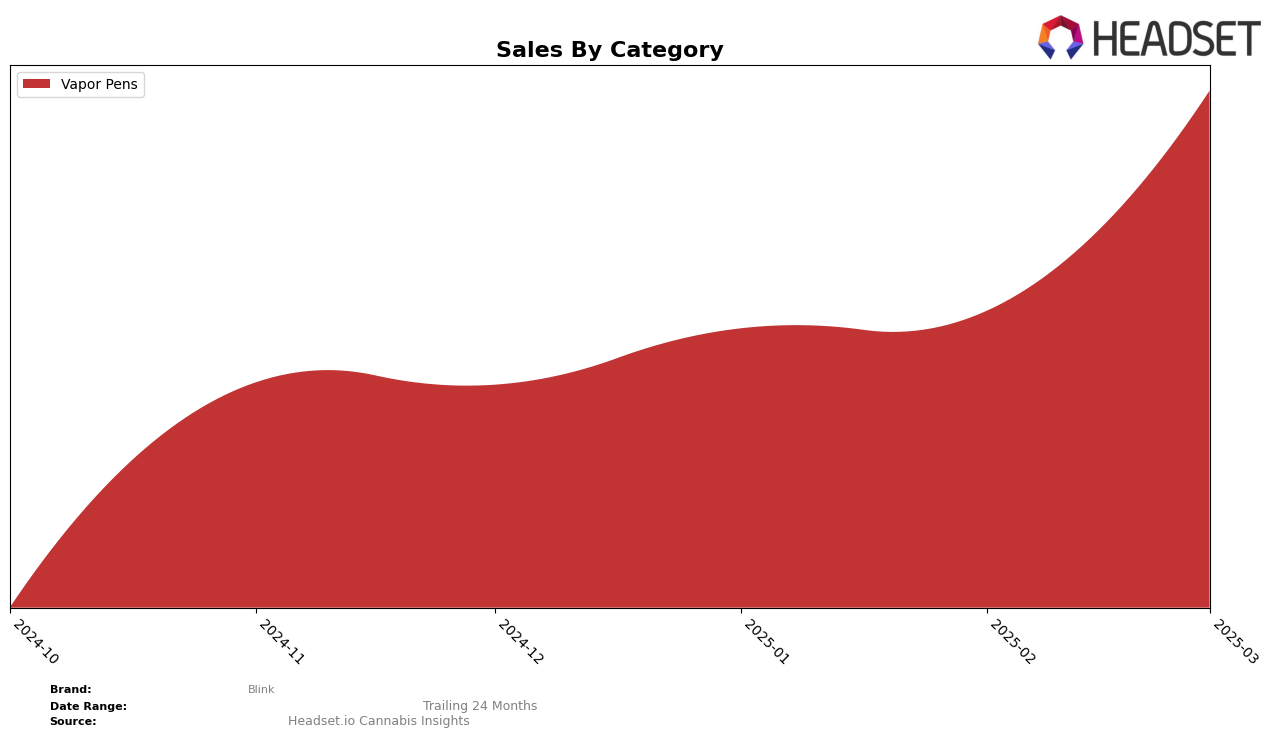

Blink has shown a consistent presence in the Vapor Pens category in Maryland over the past few months. The brand maintained its rank at 21 in both December 2024 and January 2025, briefly improving to 20 in February before returning to 21 in March. This stability in ranking suggests a steady performance in Maryland's competitive market, but also indicates room for growth if Blink aims to break into the top 20 consistently. The upward trend in sales from December through March, culminating in a significant increase in March, highlights a positive trajectory for Blink, although the brand's position outside the top 10 suggests there is still potential for further market penetration.

Despite the consistent sales growth in Maryland, Blink's absence from the top 30 brands in other states or provinces signifies a challenge in expanding its market footprint beyond this region. This lack of presence could be seen as a missed opportunity for Blink to diversify its market reach and capitalize on the growing demand for Vapor Pens in other states. However, the brand's ability to maintain a stable rank in Maryland could provide a strong foundation for strategic expansion efforts. The focus for Blink should likely be on leveraging its performance in Maryland to explore entry strategies into other promising markets where the brand is currently not ranked.

Competitive Landscape

In the Maryland Vapor Pens category, Blink has maintained a relatively stable position, ranking consistently around the 20th spot from December 2024 to March 2025. This steadiness in rank, however, contrasts with the dynamic shifts observed among its competitors. For instance, Hi*AF has shown a notable upward trajectory, climbing from 25th in December 2024 to 19th by March 2025, indicating a significant increase in market presence. Similarly, Just Vapes made a remarkable leap from 40th to 23rd place within the same period, suggesting a rapid growth in sales. Meanwhile, Equity Extracts experienced fluctuations, dropping to 25th in February 2025 before recovering to 20th in March. These movements highlight the competitive pressure on Blink, which, despite its stable rank, faces challenges from brands that are either rapidly ascending or recovering strongly in the rankings, potentially impacting Blink's future sales and market strategy.

Notable Products

In March 2025, the top-performing product for Blink is the Savage Roar BDT Distillate Disposable (1g) in the Vapor Pens category, leading the sales with 1140 units sold. Following closely is the Mad Scientist Sauce Disposable (1g), also in the Vapor Pens category, which secured the second position. The Mile High Volcano Sauce Disposable (1g) climbed to third place from fifth in February, showing a notable increase in sales. The Fruity Pebbles OG x Sour Dub Sauce Disposable (1g) dropped to fourth place from its top spot in January and February. Lastly, the Cambodian Thai Sauce Disposable (1g) maintained a consistent presence, rounding out the top five for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.