Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

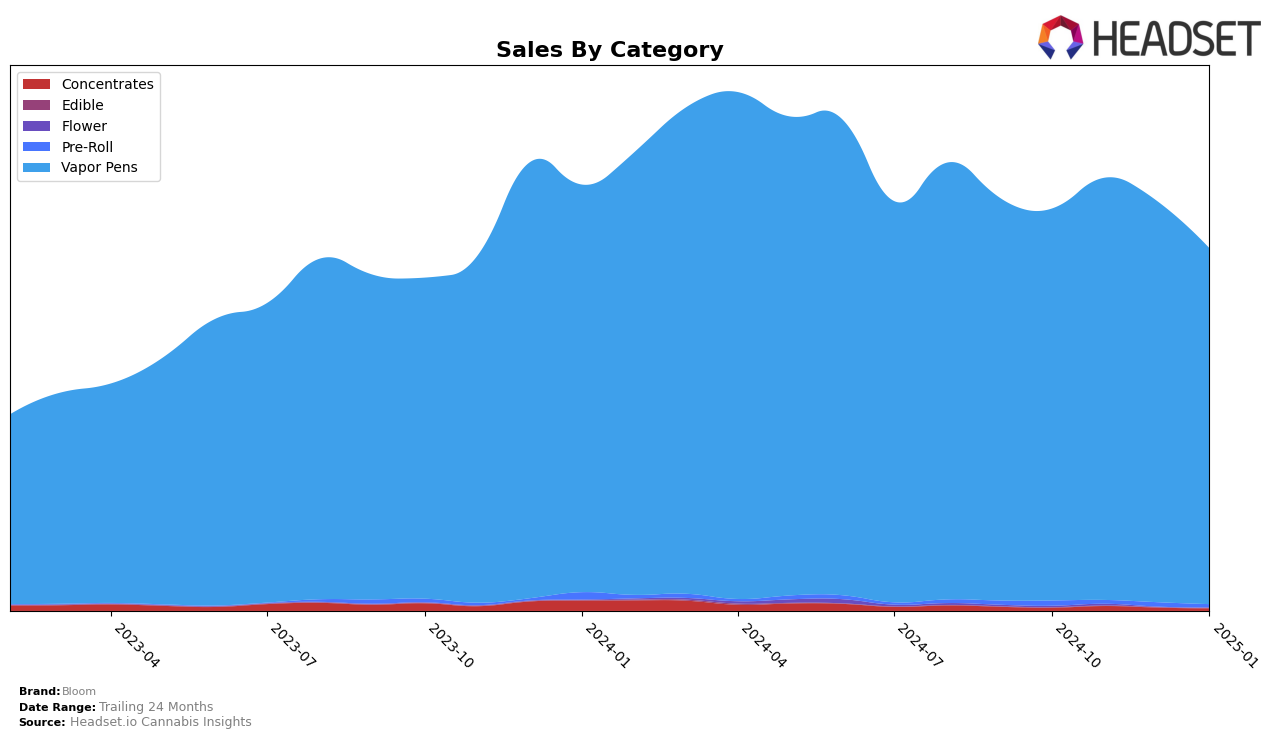

Bloom's performance in the vapor pens category shows varying results across different states. In California, Bloom consistently maintained a stable position, ranking 15th from October 2024 through January 2025, despite a slight decrease in sales from October to January. This stability in California contrasts with its performance in Illinois, where Bloom experienced a downward trend, dropping from 24th place in October 2024 to 33rd by January 2025. Notably, Bloom's sales in Illinois were halved over this period, indicating potential challenges in market penetration or competition. Similarly, in Michigan, Bloom was not in the top 30 in November and January, suggesting inconsistent performance and possibly highlighting competitive pressures or shifting consumer preferences in the region.

In contrast, Bloom's presence in New York appears more favorable, with rankings fluctuating slightly but maintaining a position within the top 20. The brand showed a significant sales increase in November 2024, which might be attributed to strategic marketing efforts or seasonal demand spikes. However, despite these gains, Bloom's rank remained relatively stable, suggesting a competitive landscape where maintaining position requires consistent effort. The variability in Bloom's rankings across these states highlights the brand's need to adapt its strategies to local market conditions to enhance its performance and market share further. Observing these trends could provide insights into regional consumer behaviors and the competitive dynamics Bloom faces in each market.

Competitive Landscape

In the competitive landscape of vapor pens in California, Bloom has maintained a consistent presence, ranking 15th in October, December, and January, with a slight dip to 16th in November. Despite this stability, Bloom faces stiff competition from brands like West Coast Cure and Cold Fire, which have shown fluctuating yet generally higher rankings. Notably, Dabwoods Premium Cannabis has demonstrated a strong upward trend, peaking at 10th in November and December before slightly dropping to 13th in January. While Bloom's sales have seen a gradual decline from October to January, competitors like Cold Fire have also experienced a similar downward trend, suggesting a broader market shift. However, Dabwoods' sales surge in November indicates potential shifts in consumer preferences that Bloom might need to address to improve its market position.

Notable Products

In January 2025, Bloom's top-performing product was the Pineapple Express Live Resin Surf Disposable (1g) in the Vapor Pens category, maintaining its number one rank from December 2024 with sales of 4681 units. The Maui Wowie Live Resin Surf Disposable (1g) followed closely in second place, showing a slight improvement from its third position in November 2024. Pineapple Sherbert Live Resin Surf Disposable (1g) climbed to third place, demonstrating a positive trend as it was not ranked in October or November 2024. The Apple Sundae Live Resin Surf Disposable (1g) debuted at fourth place, indicating a strong entry into the market. Lastly, the Rainbow Z Live Resin Surf Disposable (1g) secured the fifth spot, rounding out the top performers for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.