Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

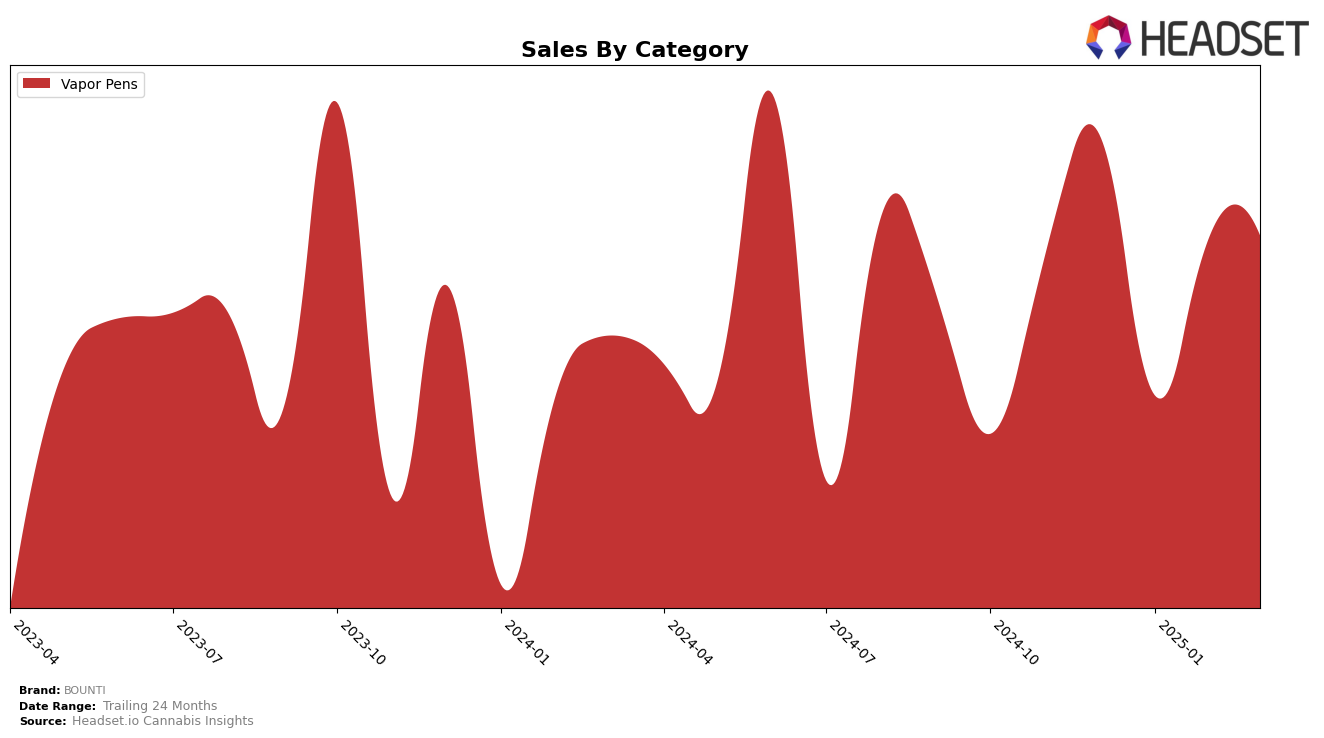

BOUNTI has demonstrated a notable performance in the Vapor Pens category within Nevada. Starting from December 2024, the brand was ranked 17th, and despite a dip to 19th in January 2025, it quickly rebounded to 14th place by February and maintained this position through March. This upward trend indicates a solid recovery and consistent demand for BOUNTI's products in the Nevada market. The sales figures reflect this positive trend, with a significant increase from January to February, suggesting that the brand's strategies or product offerings resonated well with consumers during this period.

Interestingly, BOUNTI's presence in other states or categories is not detailed in the top 30 rankings, which could be interpreted as a gap in their market penetration or a strategic focus primarily on Nevada's Vapor Pens category. This absence from the top rankings in other areas might present both a challenge and an opportunity for BOUNTI to diversify its reach and explore new markets or categories. The brand's performance in Nevada could serve as a benchmark for expansion strategies in other regions. However, without further data, it's difficult to ascertain the specific challenges or strategies BOUNTI might be employing outside of Nevada.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, BOUNTI has experienced fluctuating ranks over the past few months, indicating a dynamic market presence. As of March 2025, BOUNTI holds the 14th position, showing a slight improvement from its 19th rank in January 2025. This upward trend suggests a recovery in sales performance, although it remains behind competitors like Alternative Medicine Association / AMA, which climbed steadily from 18th to 12th place, and Srene, which, despite some fluctuations, maintains a competitive edge at 15th place. Meanwhile, TRENDI has seen a decline, dropping from 5th to 13th, which could present an opportunity for BOUNTI to capture more market share. Notably, Dabwoods Premium Cannabis entered the rankings in February 2025 and quickly rose to 16th place by March, highlighting the competitive pressure BOUNTI faces as new entrants gain traction. These shifts underscore the importance for BOUNTI to leverage strategic marketing and product differentiation to enhance its market position in the coming months.

Notable Products

In March 2025, the top-performing product for BOUNTI was the Tropical Trainwreck Live Resin Disposable (0.5g) in the Vapor Pens category, which ascended to the first position with sales reaching 698 units. This product consistently held the second rank in the previous months before climbing to the top spot. The Blue Dream Distillate Disposable (0.5g) dropped to second place, despite being the leader in February, with sales of 615 units. Guava OG CO2 Distillate Cartridge (0.5g) made a notable entry into the rankings at third place, showing a strong sales increase since its absence in February. Creamsicle Distillate Cartridge (0.5g) and Tropical Trainwreck Distillate Cartridge (0.85g) both tied at fourth place, marking their first appearance in the rankings for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.