Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

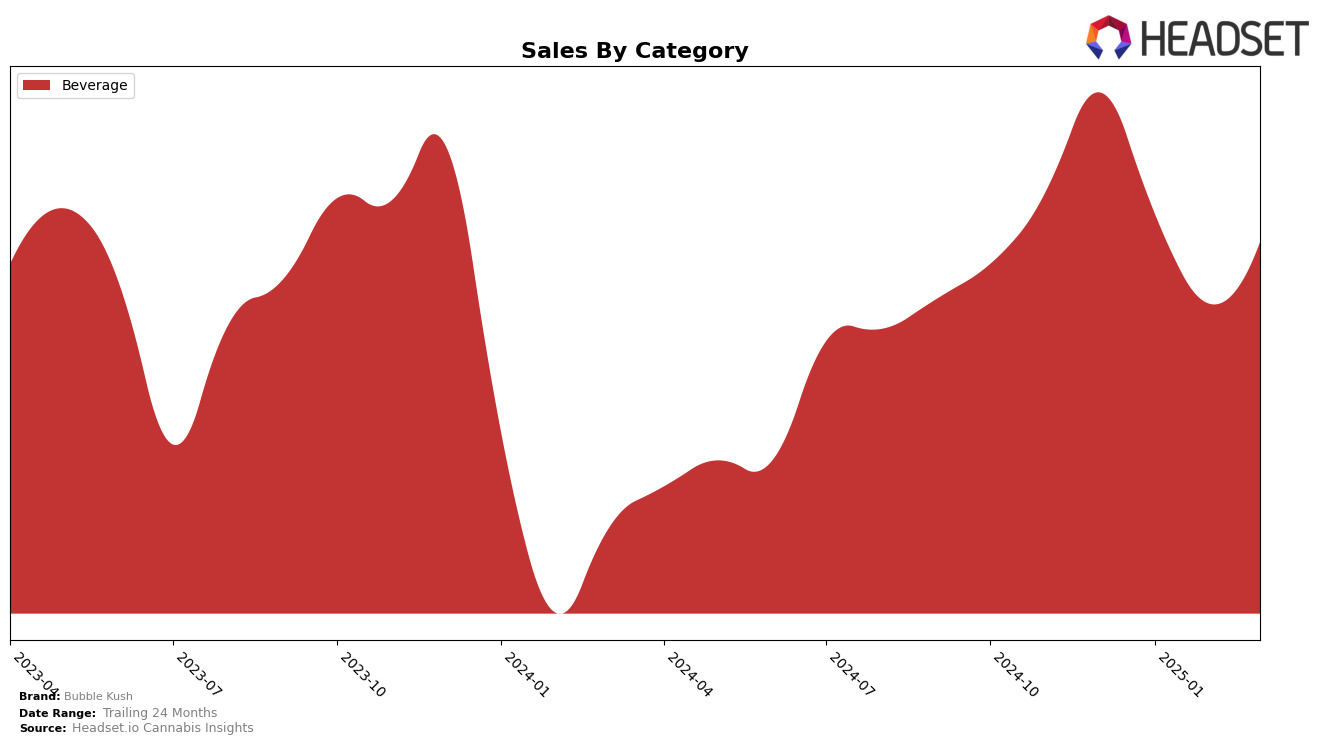

Bubble Kush has shown a consistent performance in the Beverage category across various Canadian provinces, with notable stability in rankings. In Alberta, the brand maintained a steady position, ranking fourth from January to March 2025. This consistency suggests a strong foothold in the Alberta market despite a gradual decline in sales over these months. Meanwhile, in British Columbia, Bubble Kush experienced a slight dip from first to third place between December 2024 and January 2025 but managed to hold onto the third position through March 2025. This indicates a competitive landscape in British Columbia, where maintaining a top-three position is significant.

In Ontario, Bubble Kush consistently ranked ninth in the Beverage category from December 2024 to March 2025. Although the brand did not advance in rankings, maintaining a top-ten position in a populous province like Ontario is noteworthy. However, the absence of a top-30 ranking in other states or categories could be seen as a challenge for Bubble Kush in expanding its market presence beyond its current strongholds. This suggests potential areas for growth if the brand seeks to diversify its reach and improve its standings in other regions or product categories.

Competitive Landscape

In the competitive landscape of the beverage category in British Columbia, Bubble Kush has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially leading the category in December 2024, Bubble Kush saw a decline to the third position by January 2025, where it remained through March. This shift is particularly significant given the consistent performance of competitors like Sweet Justice, which maintained the top rank from February onwards, and XMG, which held a steady second position after briefly topping the ranks in January. Meanwhile, Mollo consistently secured the fourth spot, indicating a stable performance. Bubble Kush's sales trajectory mirrored its rank changes, with a noticeable dip in February before rebounding in March, yet still trailing behind the sales figures of Sweet Justice and XMG. These dynamics suggest that while Bubble Kush remains a strong contender, it faces stiff competition from brands that have shown resilience and growth in the market.

Notable Products

In March 2025, the top-performing product for Bubble Kush was the Root Beer Beverage (10mg THC, 355ml) in the Beverage category, maintaining its first-place rank from previous months with sales of 28,912 units. The Lemon Lime Soda (10mg THC, 355ml) moved up to the second position, showcasing a steady increase in popularity. The Orange Soda (10mg THC, 355ml), previously holding the second rank, slipped to third place, indicating a slight dip in sales figures. Meanwhile, the Original Cola (10mg THC, 355ml) remained consistently at the bottom of the rankings, with minimal sales. These shifts highlight changing consumer preferences within the Beverage category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.