Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

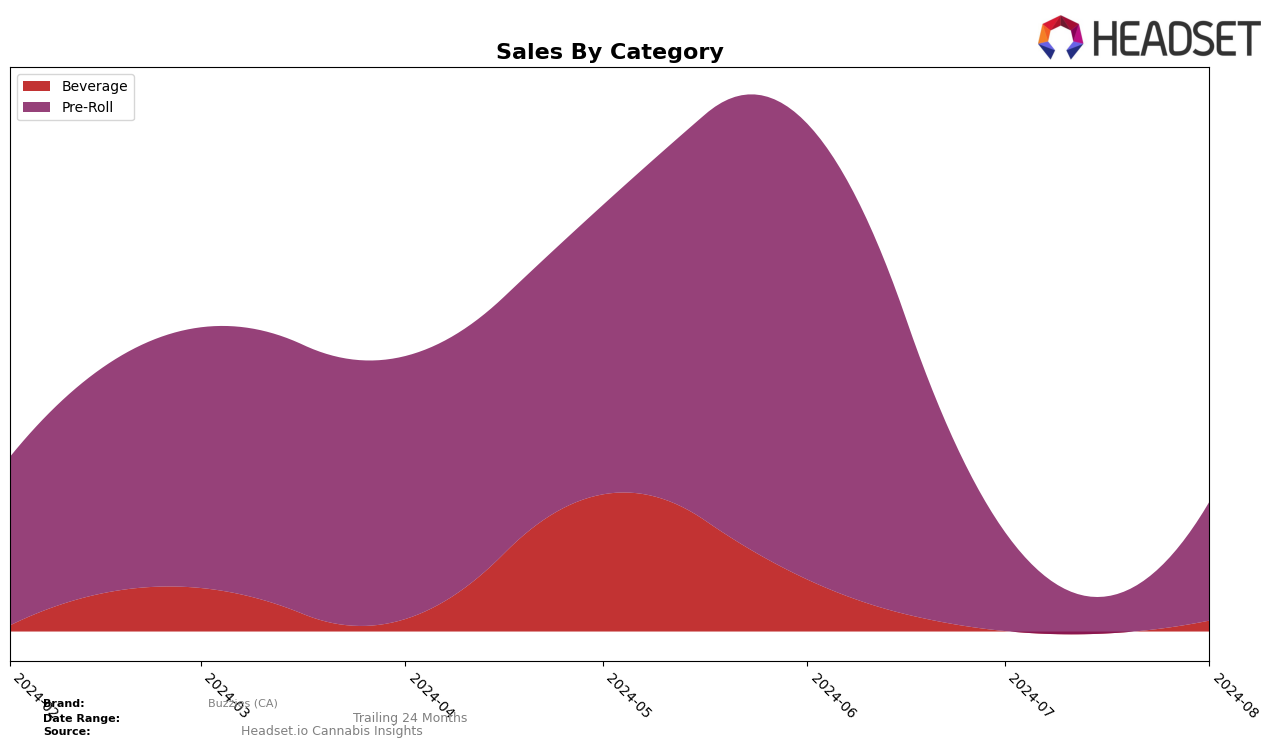

In the state of California, Buzzies (CA) has shown varying performance across different product categories. In the Beverage category, Buzzies (CA) experienced a notable decline in their ranking from May to August 2024, starting at 20th place in May and dropping to 24th place by June, before falling out of the top 30 entirely by July and August. This decline is accompanied by a significant drop in sales, from $38,880 in May to $17,884 in June. Such a trend suggests that the brand may be facing increased competition or shifting consumer preferences in this category. Conversely, in the Pre-Roll category, Buzzies (CA) was not ranked within the top 30 in May, and by June, it fell further to 83rd place, indicating challenges in maintaining a strong market presence in this segment as well.

These movements highlight the competitive nature of the cannabis market in California and the necessity for brands like Buzzies (CA) to continuously innovate and adapt to changing market dynamics. The absence of Buzzies (CA) from the top 30 rankings in the latter months of the period under review in both categories signals potential areas for improvement or strategic pivots. While the data points to some struggles, it also provides a roadmap for identifying where Buzzies (CA) might focus their efforts to regain market share and improve their standings in future months.

Competitive Landscape

In the highly competitive California cannabis beverage market, Buzzies (CA) has experienced notable fluctuations in its ranking and sales over recent months. In May 2024, Buzzies (CA) secured the 20th position, but by June 2024, it dropped to the 24th rank, and it was absent from the top 20 in July and August 2024. This decline in rank is significant as it indicates a potential decrease in market share and visibility. In contrast, brands like Olala and Bodega have also faced challenges, with Olala only appearing in the top 20 in August 2024 at the 24th position and Bodega not making it to the top 20 at all during this period. These trends suggest a volatile market where maintaining a consistent rank is challenging. For Buzzies (CA), the drop in rank and sales from May to June highlights the need for strategic marketing efforts to regain and sustain its position in the competitive landscape.

Notable Products

In August 2024, the top-performing product for Buzzies (CA) was the Indica Infused Pre-Roll 5-Pack (2.5g) in the Pre-Roll category, maintaining its number one rank with notable sales of 3977 units. The Honey Lemonade (100mg THC, 12oz) in the Beverage category held its second-place position, showing a consistent upward trend since June. The Hybrid Infused Pre-Roll 5-Pack (2.5g) secured the third spot, climbing from fifth place in May. Pink Lemonade (10mg THC, 12oz) in the Beverage category improved its rank to fourth place from fifth in July. Lastly, the Sativa Infused Pre-Roll 5-Pack (2.5g) in the Pre-Roll category remained steady in fifth place, showing consistent performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.