Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

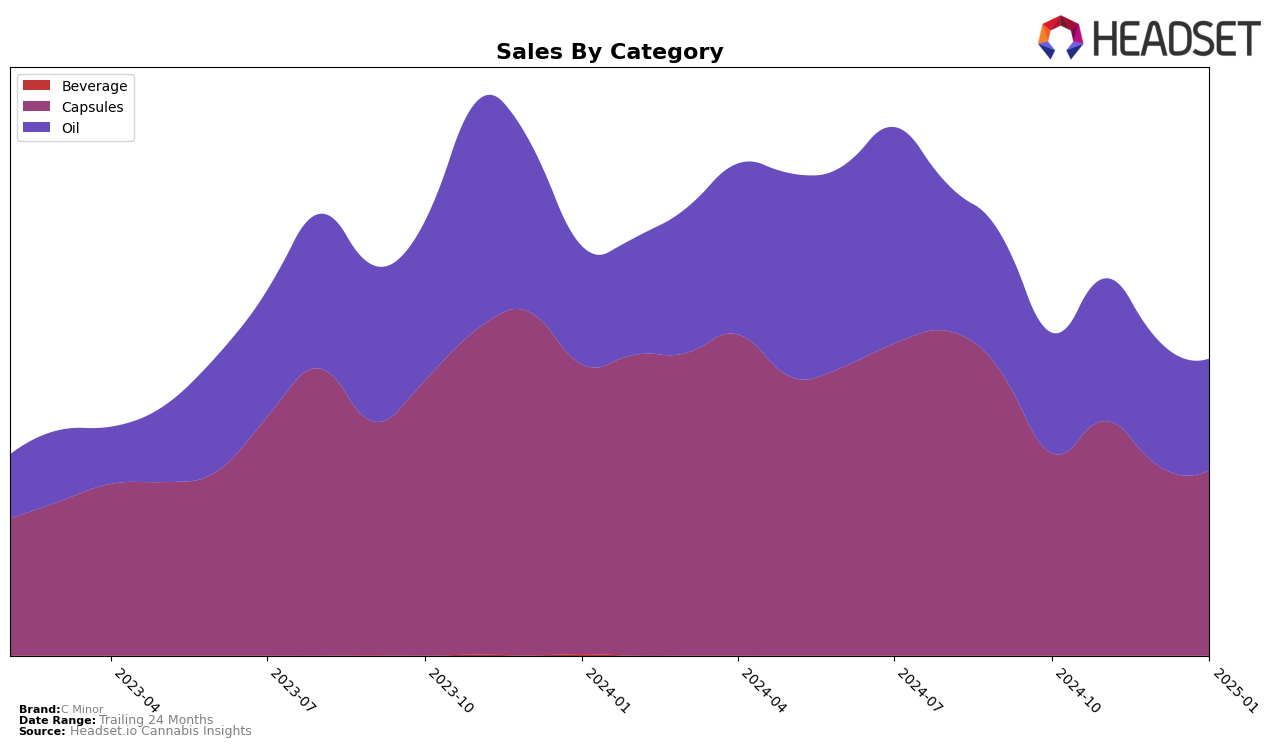

C Minor has shown a consistent performance in the Ontario market, particularly in the Capsules category. Over the months from October 2024 to January 2025, the brand maintained a stable ranking, holding steady at the 12th position for three consecutive months after a slight drop from 11th in October. This stability suggests a loyal consumer base or effective market strategies in place. However, the sales figures indicate a downward trend, with a noticeable decrease from November to January. This could be a point of concern if the trend continues, as it may affect their future rankings.

In the Oil category, C Minor's performance in Ontario was somewhat volatile, with rankings fluctuating between 16th and 20th place. The brand experienced a dip in December, falling to the 20th position, before recovering slightly to 17th in January. This movement highlights potential challenges in maintaining a competitive edge in the Oil category. Despite these fluctuations, the brand managed to recover some ground, although the overall sales figures reflect a gradual decline. The absence of C Minor from the top 30 in other states or provinces could indicate either a focus on the Ontario market or challenges in expanding their footprint elsewhere.

Competitive Landscape

In the Ontario capsules market, C Minor has experienced a relatively stable position, maintaining a rank of 12th from November 2024 to January 2025. However, its sales have shown a downward trend, decreasing from November's peak. In contrast, Simply Bare has consistently held a higher rank, moving up to 10th place by December 2024, despite a slight decline in sales. Meanwhile, Pennies has shown a positive trajectory, climbing from 14th in October to 11th in December, with sales increasing significantly over the same period, surpassing C Minor. Brands like Nutra and Frank have also seen improvements in rank and sales, indicating a competitive landscape where C Minor needs to strategize to regain momentum and improve its standing in the market.

Notable Products

In January 2025, the top-performing product from C Minor was the CBD Fast Acting 50 Max Softgels 30-Pack (1500mg CBD) in the Capsules category, maintaining its number one rank consistently over the past four months with sales of 938 units. The CBD 50 Max 3000 Oil Drops (60ml) held steady at the second position in the Oil category, showing little fluctuation in its ranking and sales figures throughout the observed months. The CBD Isolate 100 Max 3000 Oil (30ml) also remained stable at the third rank, demonstrating consistent performance in the Oil category. The Fast Acting Max Softgels 30-Pack (300mg) improved its position to fourth in December 2024 and maintained it into January 2025, indicating a positive reception. Lastly, the CBG:CBD 1:2 Max 2250 Ultra Formula Oil (30ml) was ranked fifth, having dropped from fourth in October and November 2024, suggesting a slight decline in its competitive standing.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.