Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

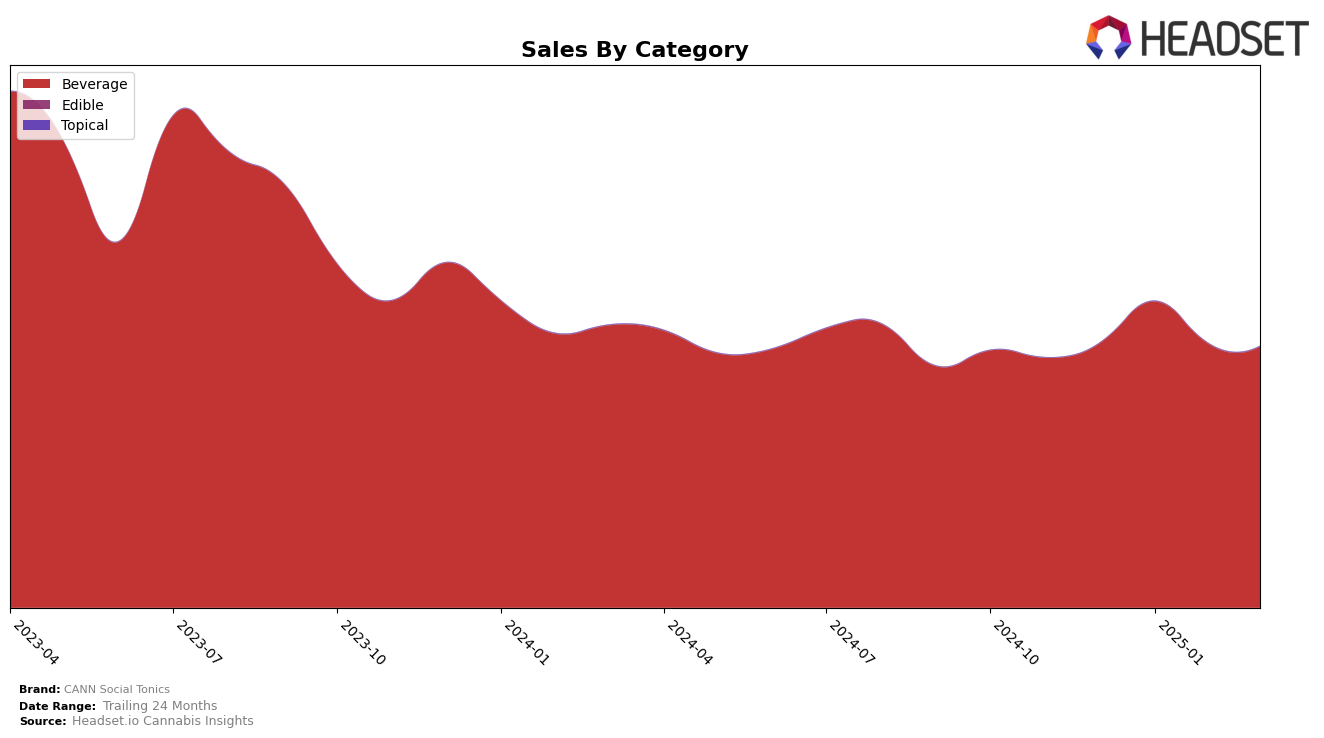

CANN Social Tonics has demonstrated a consistent presence in the California beverage category, maintaining a steady third-place ranking from December 2024 through March 2025. This stability in one of the largest cannabis markets suggests a strong brand loyalty and a well-entrenched position among consumers. In Massachusetts, however, while the brand was able to climb to the third position in January and February 2025, it experienced a slight dip to fifth place by March, indicating potential competitive pressures or a shift in consumer preferences. Such fluctuations highlight the dynamic nature of the cannabis beverage market and the need for brands to continuously adapt to maintain their standings.

In contrast, CANN Social Tonics' performance in Illinois shows a positive upward trajectory, improving its ranking from 14th in December 2024 to 12th by March 2025. This upward movement, coupled with an increase in sales, suggests growing brand recognition and acceptance in a market where they were previously outside the top tier. The absence of CANN Social Tonics from the top 30 in other states or provinces indicates areas where the brand could focus its efforts for expansion. Such insights into geographic performance can be crucial for strategic planning and resource allocation as the brand seeks to strengthen its market presence across different regions.

Competitive Landscape

In the competitive landscape of the California cannabis beverage market, CANN Social Tonics has consistently maintained its position as the third-ranked brand from December 2024 through March 2025. Despite facing strong competition, CANN Social Tonics has managed to sustain its rank, indicating a stable consumer base and effective market strategies. The leading brand, St Ides, continues to dominate with significantly higher sales, while Uncle Arnie's holds the second position with sales figures more than double those of CANN Social Tonics. Meanwhile, Manzanita Naturals and Not Your Father's Root Beer have shown some fluctuations in rank, with the latter moving up to fourth place in March 2025. This competitive dynamic highlights the challenges CANN Social Tonics faces in climbing higher in rank, yet its consistent performance suggests a strong brand presence and potential for growth in the California market.

Notable Products

In March 2025, CANN Social Tonics' top-performing product was the CBD/THC 2:1 Lemon Lavender Social Tonic 6-Pack, maintaining its number one rank from the previous two months with sales of 5,154 units. The CBD/THC 2:1 Blood Orange Cardamom Social Tonic 6-Pack followed closely, improving its rank to second place from third in February. The Hi Boy - Blood Orange Cardamom Social Tonic 4-Pack held steady at third place, despite a decrease in sales to 3,304 units. New to the top ranks is the CBD/THC 2:1 Grapefruit Rosemary Social Tonic 6-Pack, debuting at fourth place. Meanwhile, the Hi Boy - Lemon Lavender Social Tonic 4-Pack slipped to fifth place, showing a consistent decline in sales over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.