Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

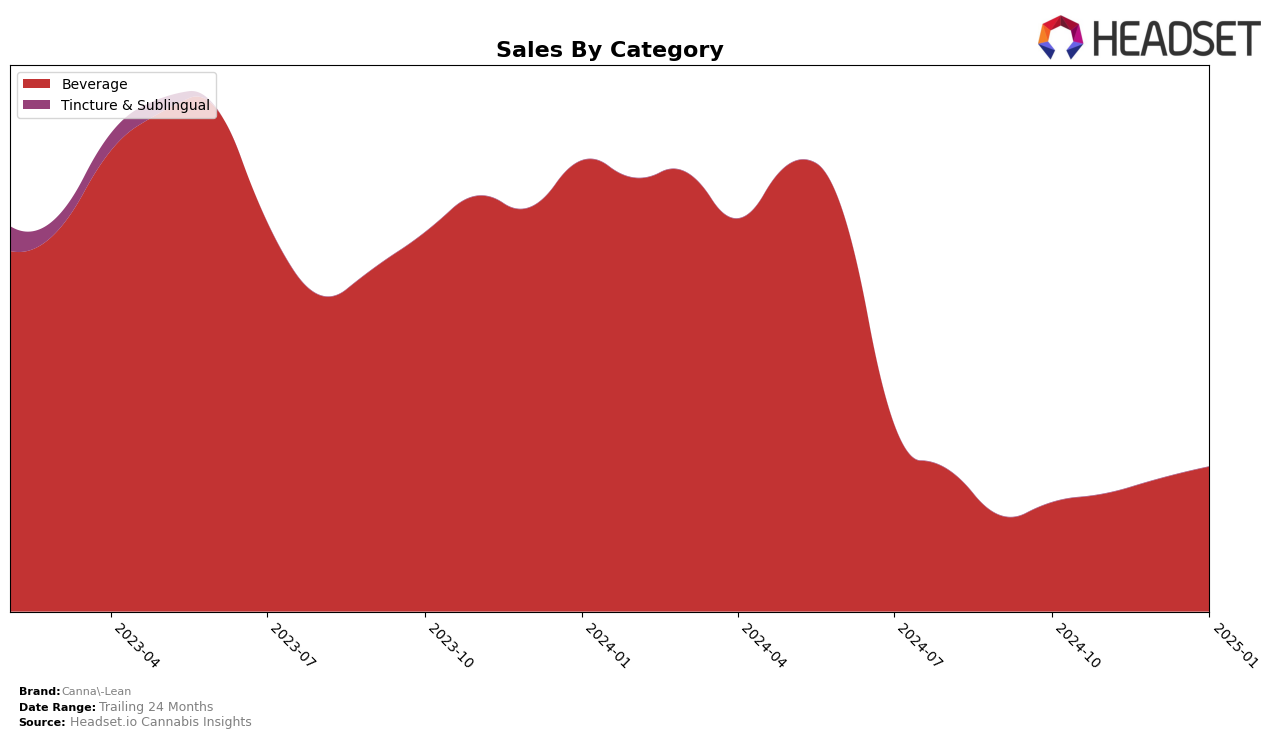

In the dynamic landscape of cannabis products, Canna-Lean has shown a steady upward trajectory within the California beverage category over the past few months. From October 2024 to January 2025, the brand has consistently improved its standing, moving from the 15th position up to the 12th position. This climb in rankings reflects a positive reception in the market, possibly driven by strategic marketing efforts or product innovations. The increase in sales figures—from $54,161 in October to $72,004 in January—further underscores the brand's growing popularity among consumers in California.

While Canna-Lean's performance in California is commendable, it is important to note that the brand has not appeared in the top 30 rankings in other states or provinces across different categories. This absence could indicate a more localized appeal or a strategic focus on the California market, which is one of the largest and most competitive in the cannabis industry. Observers might find it intriguing to consider how Canna-Lean's strategies in California could be adapted or expanded to gain traction in other regions. Understanding these dynamics could provide deeper insights into the brand's potential for broader market penetration.

Competitive Landscape

In the competitive landscape of the California beverage category, Canna-Lean has shown a promising upward trajectory in terms of rank and sales. Over the four-month period from October 2024 to January 2025, Canna-Lean improved its rank from 15th to 12th, indicating a steady climb amidst strong competition. Notably, Cannavis Syrup experienced fluctuations, dropping to 16th in December before recovering to 13th in January, while Mary Jones saw a decline to 14th in January. Lime and Sip Elixirs maintained more stable positions, with Lime consistently ranking in the top 10. Despite these competitors, Canna-Lean's sales have shown a positive trend, culminating in a notable increase in January 2025, suggesting effective market strategies and growing consumer preference.

Notable Products

In January 2025, the top-performing product for Canna-Lean was Xtreme - Sugar Free Syrup (1000mg THC, 2oz, 60ml), maintaining its first-place rank for four consecutive months with sales of 3089 units. Xtreme - Grape Syrup (1000mg THC, 60ml, 2oz) held the second spot, consistent with its December 2024 ranking, showing a recovery from a dip in November. Xtreme - Watermelon Syrup (1000mg THC, 60ml, 2oz) climbed back to third place after slipping to fourth in December, indicating a positive trend in sales momentum. Meanwhile, Xtreme - OG Syrup (1000mg THC, 2oz, 60ml) dropped to fourth place, marking a slight decline from its consistent third-place position in the previous months. Overall, the beverage category continues to dominate Canna-Lean's sales, with each product showing distinct performance trends over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.