Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

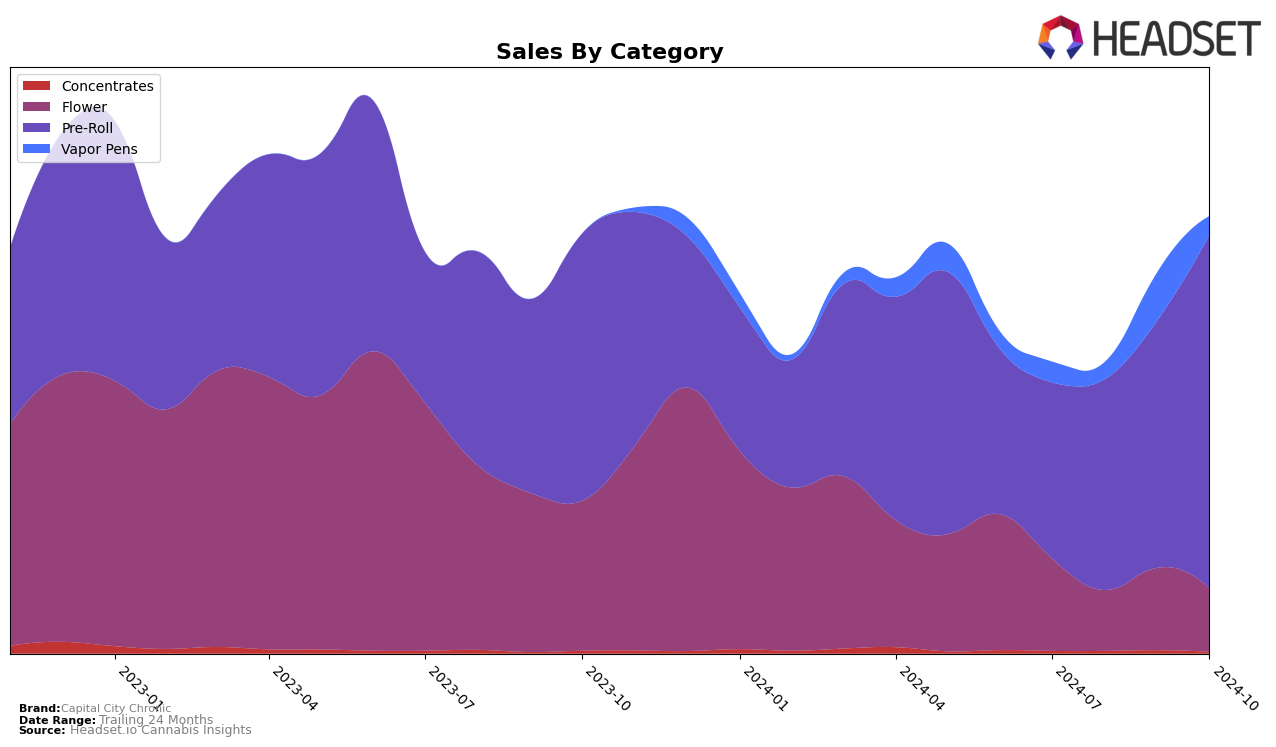

Capital City Chronic has demonstrated notable growth in the Pre-Roll category within the state of Washington. Starting from a rank of 51 in July 2024, the brand has climbed steadily, reaching the 26th position by October 2024. This upward trajectory is indicative of a strong market presence and increasing consumer preference for their products. Despite not being in the top 30 during July, their consistent improvement over the months highlights effective strategic initiatives or product enhancements that have resonated well with the audience in Washington.

While the brand's performance in the Pre-Roll category has been promising in Washington, it is important to note that Capital City Chronic did not appear in the top 30 rankings in other states or categories during the same period. This absence suggests potential areas for growth or market entry strategies that could be explored to expand their footprint beyond Washington. The sales figures, particularly the jump from $117,914 in September to $167,980 in October, further emphasize the brand's strengthening position in Washington, which could serve as a model for strategies in other markets.

Competitive Landscape

In the Washington pre-roll market, Capital City Chronic has shown a remarkable upward trajectory in recent months, climbing from a rank of 51 in July 2024 to an impressive 26 by October 2024. This significant improvement in rank is indicative of a robust increase in sales, positioning Capital City Chronic as a formidable competitor. In contrast, Green Haven experienced a decline, dropping from 23 to 27 over the same period, while Bacon Buds maintained a relatively stable position, hovering around the mid-20s. Meanwhile, Shatter J's by Seattle Marijuana Company and Rescue Cannabis Co. have seen slight fluctuations, with Shatter J's improving slightly and Rescue Cannabis Co. experiencing a minor decline. This dynamic shift in rankings suggests that Capital City Chronic's strategic initiatives are effectively capturing market share, potentially at the expense of some of its competitors.

Notable Products

In October 2024, the top-performing product from Capital City Chronic was Chi Chi Chong Infused Pre-Roll 2-Pack in the Pre-Roll category, securing the first position with sales of 2289 units. Following closely was Twin Peaks Infused Pre-Roll 2-Pack, which ranked second with notable sales figures. Peach OG Pre-Roll, which had previously held the top spot in July and August, dropped to third place, indicating a shift in consumer preference. Gelato Pre-Roll, previously ranked first in September, fell to fourth place in October, showing a slight decline in its sales momentum. The Milkyway Infused Pre-Roll 2-Pack debuted in the rankings at fifth place, suggesting a positive reception in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.