Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

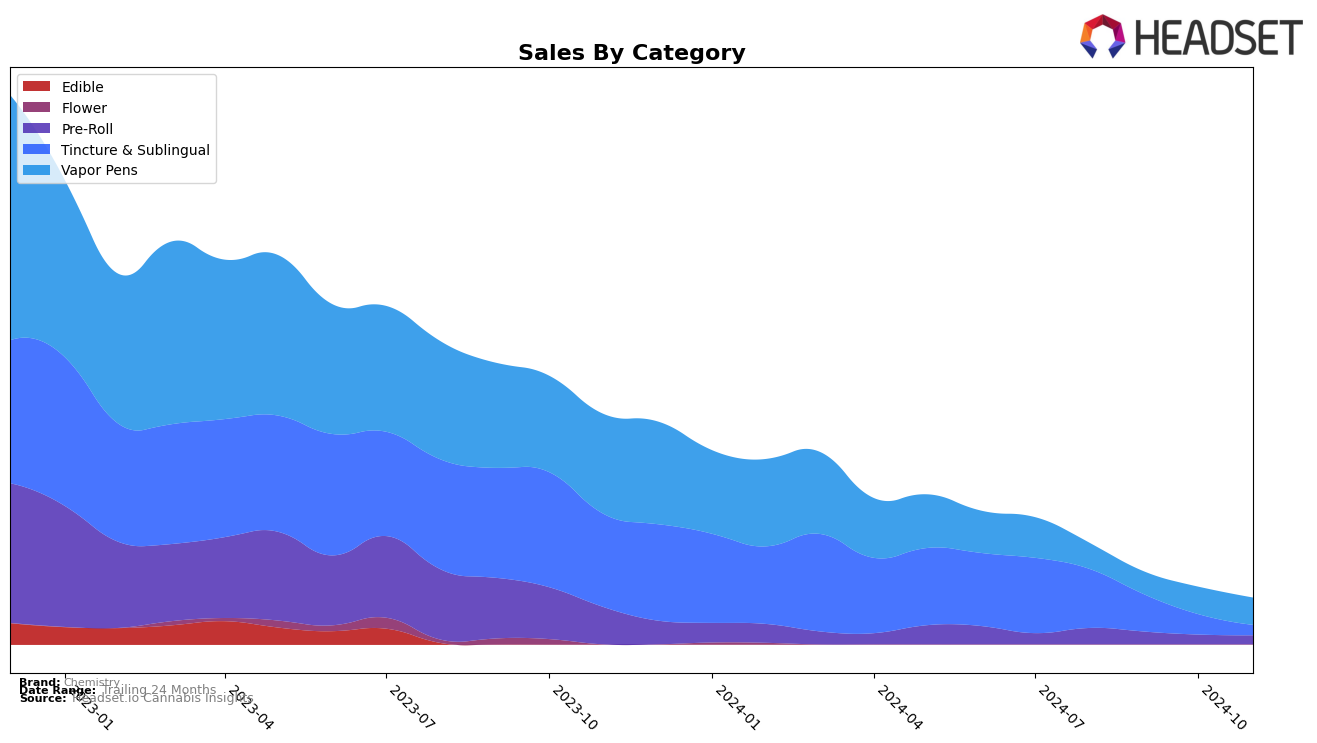

In the competitive landscape of cannabis brands, Chemistry has shown varying performance across different states and product categories. Notably, in the California market, Chemistry's presence in the Tincture & Sublingual category has seen a decline over the months. Starting at the 12th position in August 2024, the brand slipped to 14th in September, further dropped to 18th in October, and was absent from the top 30 by November. This downward trend in rankings suggests a challenging period for Chemistry in maintaining its competitive edge within this category. The decline in sales from $46,088 in August to $15,869 in October underscores the brand's struggle to capture consumer interest or retain its market share in California's dynamic cannabis industry.

The absence of Chemistry from the top 30 rankings in November within California's Tincture & Sublingual category could be seen as a significant concern, indicating potential issues in market strategy or consumer engagement. While the specific reasons behind this decline are not detailed here, it's clear that Chemistry faces stiff competition in this category. The brand's ability to innovate or adapt to changing consumer preferences will be crucial for its future performance. Observing Chemistry's strategies in response to these challenges could provide valuable insights into its resilience and potential recovery in the upcoming months.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Chemistry has experienced notable fluctuations in its rank and sales performance from August to November 2024. Initially ranked 12th in August, Chemistry saw a decline to 14th in September and further to 18th in October, before dropping out of the top 20 by November. This downward trend in rank is mirrored by a significant decrease in sales, from a high in August to less than half by October. In contrast, Breez maintained a stable presence in August, ranked 13th, but did not appear in the top 20 in subsequent months. Meanwhile, Kind Medicine re-entered the top 20 in October at 21st, showing a positive sales trajectory. High Power also dropped out of the top 20 after September, indicating a competitive and shifting market landscape. These dynamics suggest that Chemistry faces challenges in maintaining its market position amidst fluctuating consumer preferences and competitive pressures.

Notable Products

In November 2024, Pink Boost Goddess THCV Live Resin Infused Pre-Roll emerged as the top performer for Chemistry, maintaining its number one rank from September with a notable sales figure of 207 units. The CBD Harmony Rose Full Spectrum Oil Cartridge climbed to the second position, improving from its third-place ranking in October, with increased sales of 160 units. Moods - CBD/THC 18:1 Green Tincture dropped to the third rank, despite leading in August and October, showing a downward trend in sales to 151 units. THC/THCV 1:1 Pink Boost Goddess Distillate Cartridge held steady at fourth place, while Project Fusion - Hella Jelly Diamond Infused Pre-Roll 4-Pack fell to fifth, indicating a decline in its popularity. Overall, the rankings highlight a strong preference for pre-rolls and vapor pens in the current market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.