Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

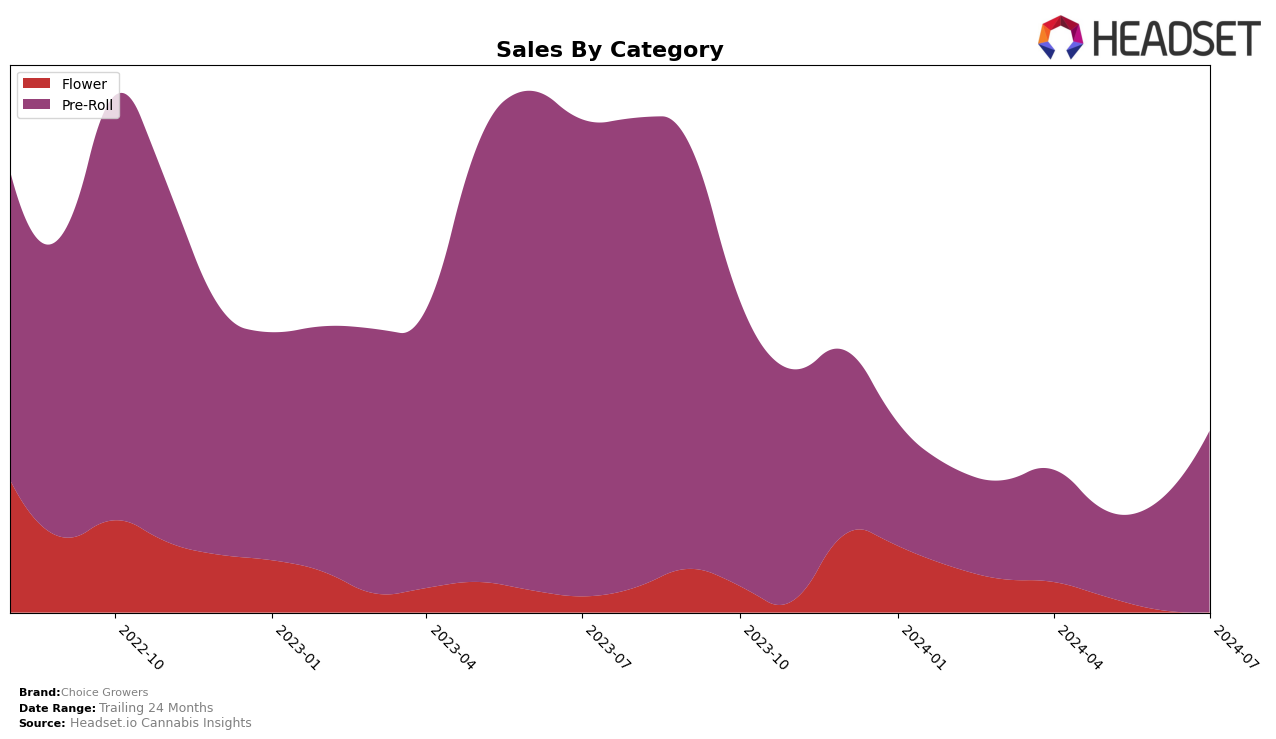

Choice Growers has shown a varied performance across different states and categories, with notable fluctuations in rankings and sales. In British Columbia, the brand's position in the Pre-Roll category has seen some ups and downs, starting at 78th place in April 2024 and dropping to 93rd in May and June before slightly improving to 84th in July. This movement indicates some recovery after a dip, with sales reflecting this trend as well. In Ontario, Choice Growers has maintained a more consistent performance in the Pre-Roll category, though it still faced challenges. The brand ranked 85th in April, dropped to 92nd in May and June, and then climbed to 81st in July, suggesting a positive trajectory towards the end of the period.

The performance in Saskatchewan has been more impressive, as Choice Growers entered the top 30 Pre-Roll brands in June 2024 at 26th place and significantly improved to 11th place by July. This sharp upward movement indicates a strong market presence and increasing consumer preference in the region. The absence of rankings for April and May suggests that the brand was not in the top 30 during those months, highlighting a remarkable turnaround. These trends across different states underscore the brand's dynamic market performance, showcasing both challenges and significant gains.

Competitive Landscape

In the Saskatchewan Pre-Roll category, Choice Growers has experienced notable fluctuations in its market rank and sales over recent months. After not appearing in the top 20 brands in April and May 2024, Choice Growers surged to 26th place in June and further climbed to an impressive 11th place in July. This upward trajectory indicates a significant boost in market presence and consumer demand. In comparison, Color Cannabis maintained a relatively stable position, ranging from 11th to 16th place, while Bold made a remarkable leap from 27th in April to 13th in July. Meanwhile, Sticky Greens consistently held a top 10 position, peaking at 4th place in June. Space Race Cannabis also showed strong performance, moving from 19th in April to 8th in July. The competitive landscape suggests that while Choice Growers is rapidly gaining ground, it faces stiff competition from established brands like Sticky Greens and emerging contenders like Bold.

Notable Products

In July 2024, the top-performing product for Choice Growers was The Jeffrey Pre-Roll (0.5g), maintaining its consistent first-place rank with sales of $16,593. Jeffrey Pre-Roll 10-Pack (3.5g) held steady in second place, showing significant growth from previous months. Blackberry Cheesecake Pre-Roll (0.5g) climbed to third place, continuing its upward trend in rankings. Pink Lemonade Pre-Roll (0.5g) re-entered the rankings in fourth place, while Tangerine Dream Pre-Roll (0.5g) secured the fifth position, both products showing improved performance compared to earlier months. Overall, Choice Growers' pre-rolls demonstrated strong sales momentum in July 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.