Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

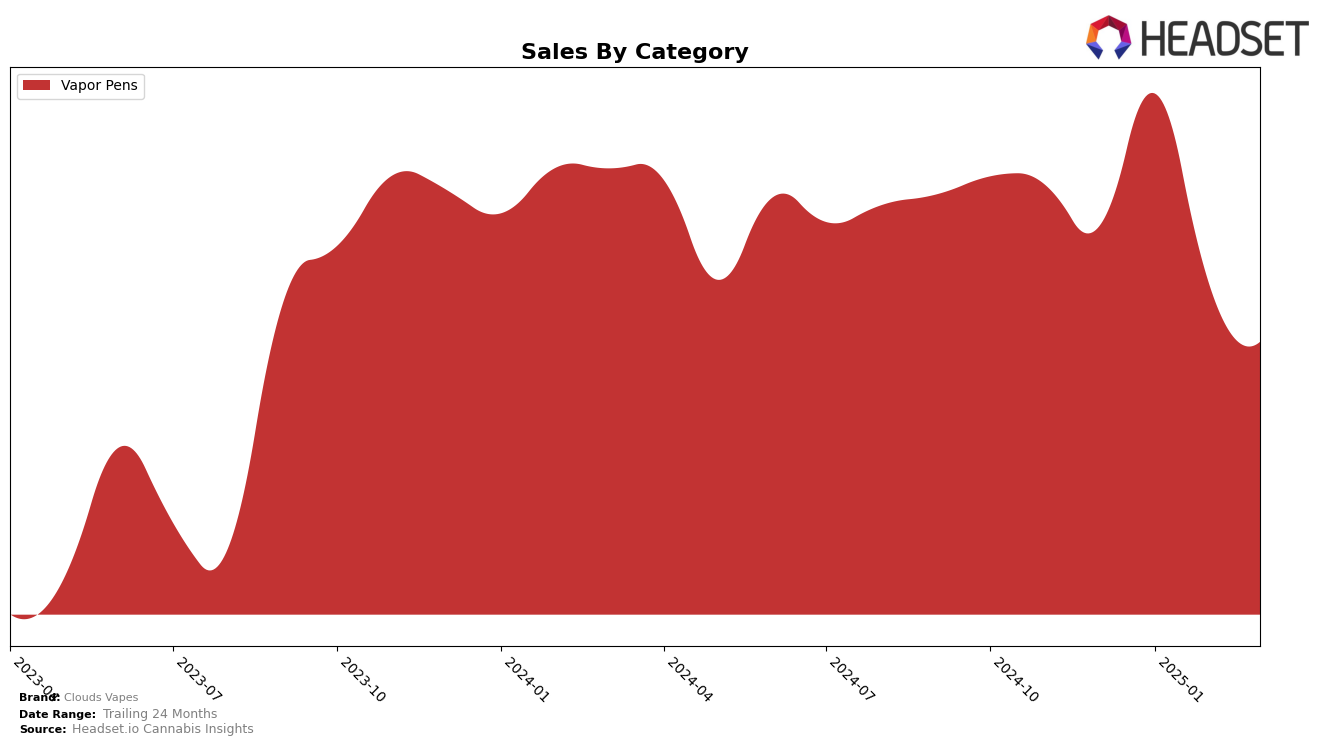

In the state of Missouri, Clouds Vapes has shown some fluctuations in its performance within the Vapor Pens category. Starting from a ranking of 20th in December 2024, the brand experienced a slight improvement in January 2025, moving up to 19th place. However, the following months saw a decline, with the brand slipping back to 23rd place in both February and March 2025. The sales figures reflect this trend, with a peak in January 2025 followed by a gradual decrease in the subsequent months. This suggests that while there was a momentary boost in sales and ranking, sustaining that momentum proved challenging for Clouds Vapes in Missouri.

It is worth noting that Clouds Vapes did not appear in the top 30 brands in some states and categories, indicating potential areas for growth and improvement. The absence of a ranking in such markets could signify either a lack of market penetration or competition from other brands. For Clouds Vapes, understanding these dynamics and identifying successful strategies in states like Missouri could be crucial for expanding their presence and improving their performance across different regions and product categories. This analysis highlights the importance of strategic planning and market adaptation for maintaining and enhancing brand standing in the competitive cannabis industry.

Competitive Landscape

In the Missouri Vapor Pens category, Clouds Vapes has experienced fluctuating rankings and sales over the past few months, indicating a competitive landscape. While Clouds Vapes held a rank of 20 in December 2024, it improved to 19 in January 2025, only to drop to 23 in February and March 2025. This volatility contrasts with brands like Safe Bet, which showed a notable rise to rank 12 in January before slipping to 22 by March. Meanwhile, Select maintained a relatively stable position around the 20th rank, although it experienced a sales decline over the months. Interestingly, Pinchy's showed a consistent presence in the mid-20s, suggesting steady performance. The entry of Acute into the top 25 by February highlights the dynamic nature of this market. For Clouds Vapes, these insights underscore the importance of strategic positioning and marketing efforts to regain and sustain higher rankings amidst robust competition.

Notable Products

In March 2025, the top-performing product for Clouds Vapes was the Wonka Bars Distillate Cartridge (1g) in the Vapor Pens category, securing the number one rank with sales of 891 units. Following closely was the Bacio Gelato Distillate Cartridge (1g) at rank two, while the Blueberry Cookies Distillate Disposable (1g) claimed the third spot. The White Gushers Distillate Cartridge (1g) dropped from third in January to fourth in March, showing a slight decline in its ranking. Purple Trainwreck Distillate Cartridge (1g) maintained a stable position, slipping just one rank from fourth in February to fifth in March. Overall, there was a noticeable shift in the rankings, with new entries dominating the top positions.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.